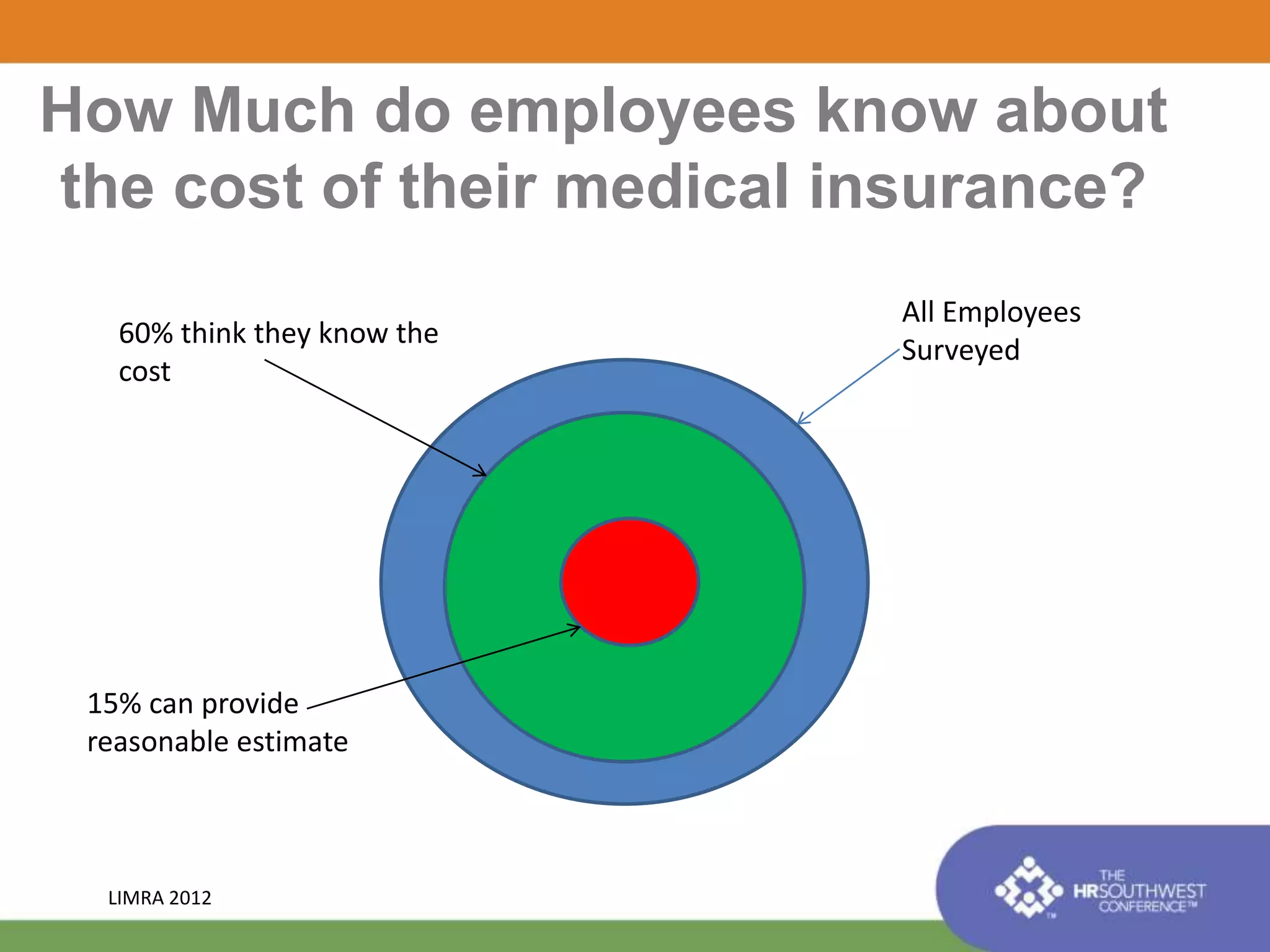

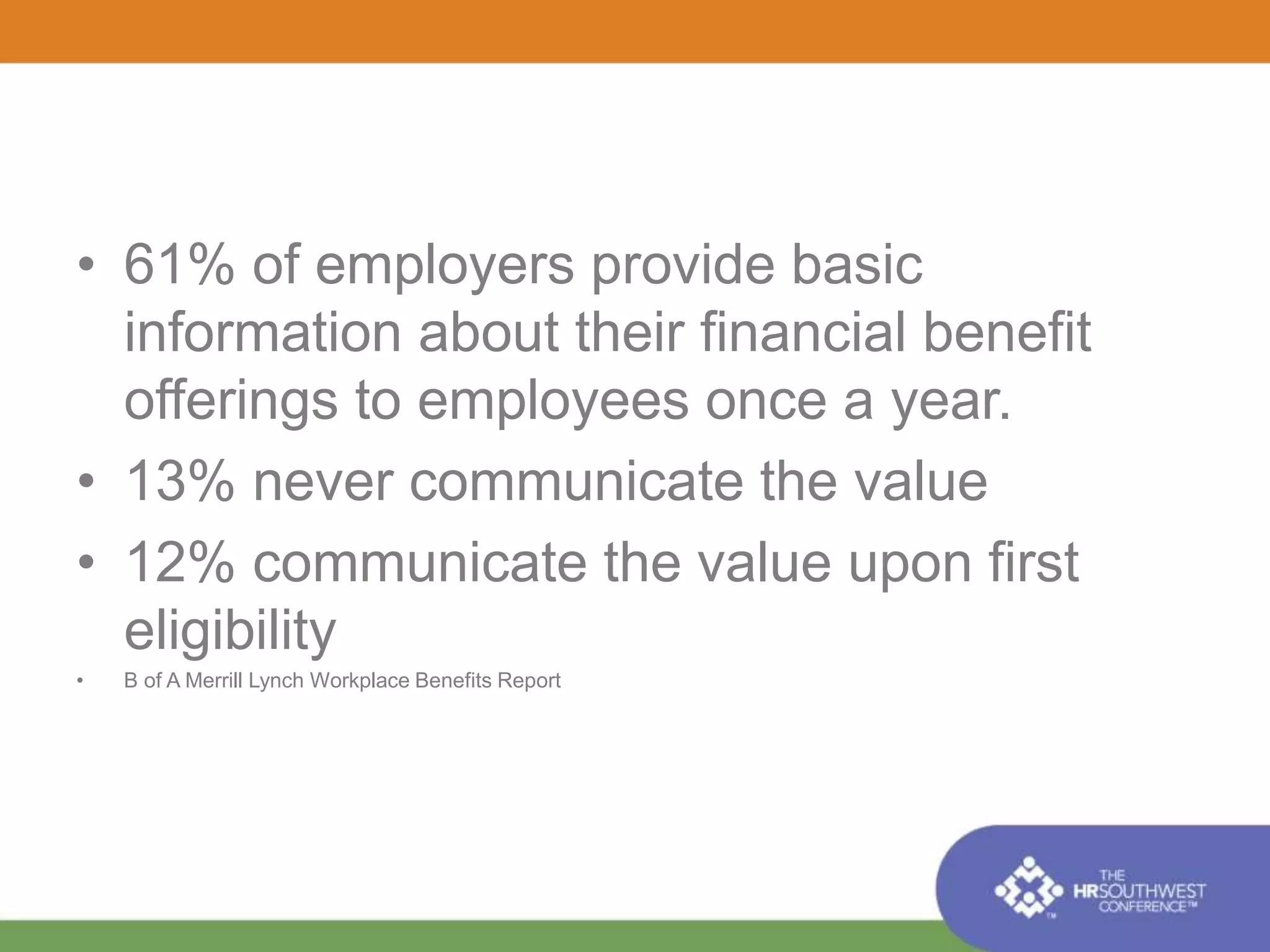

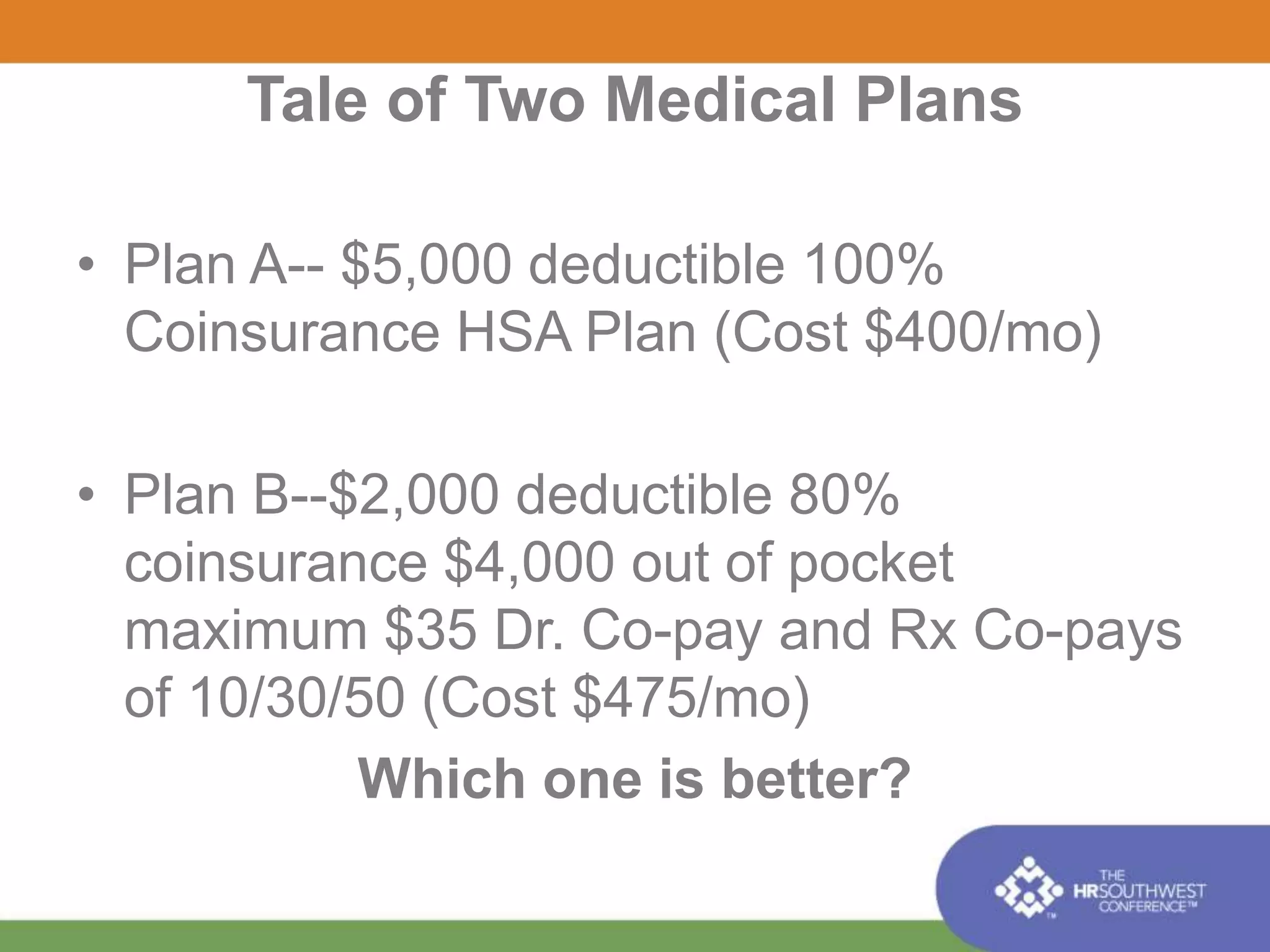

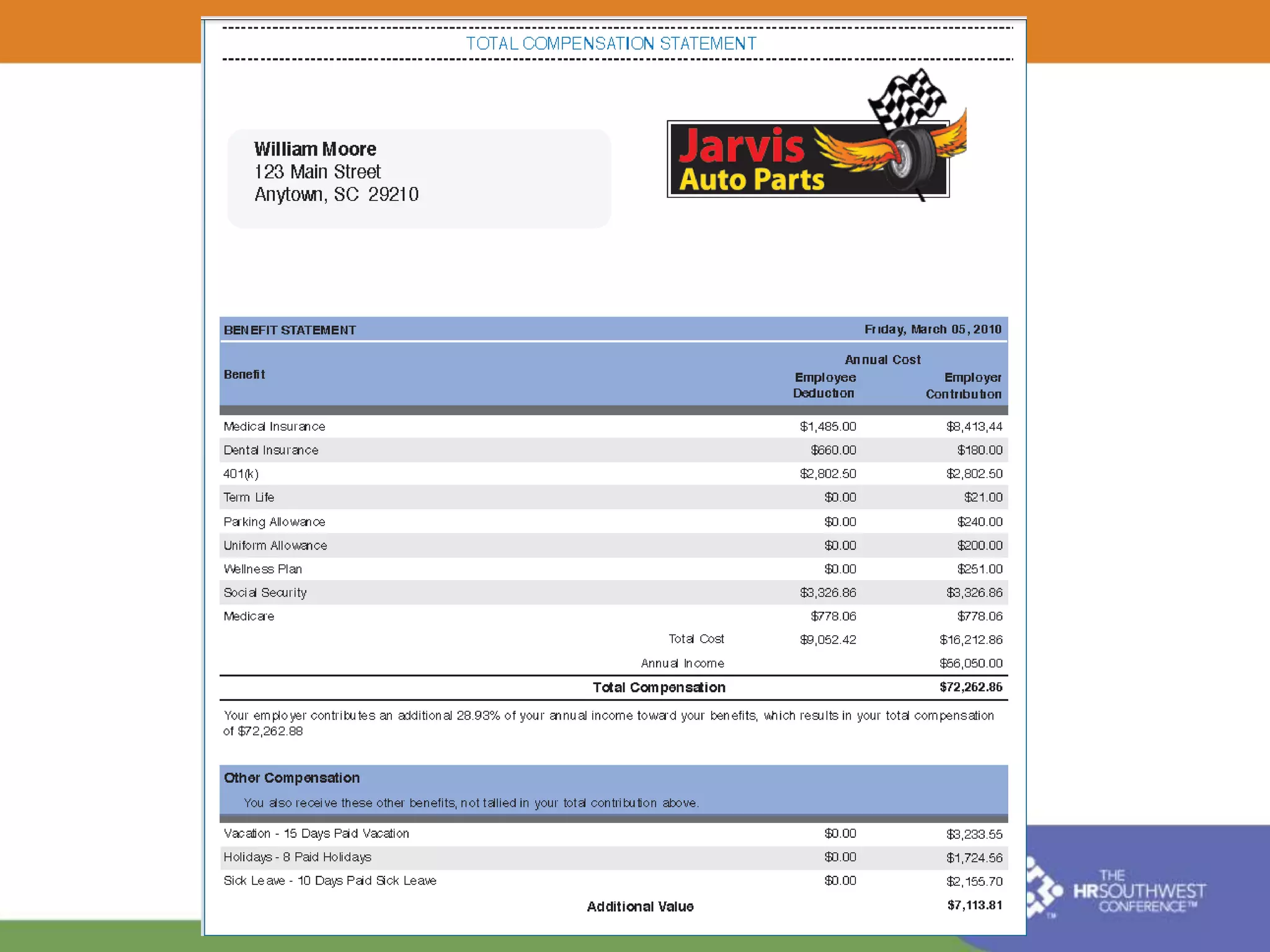

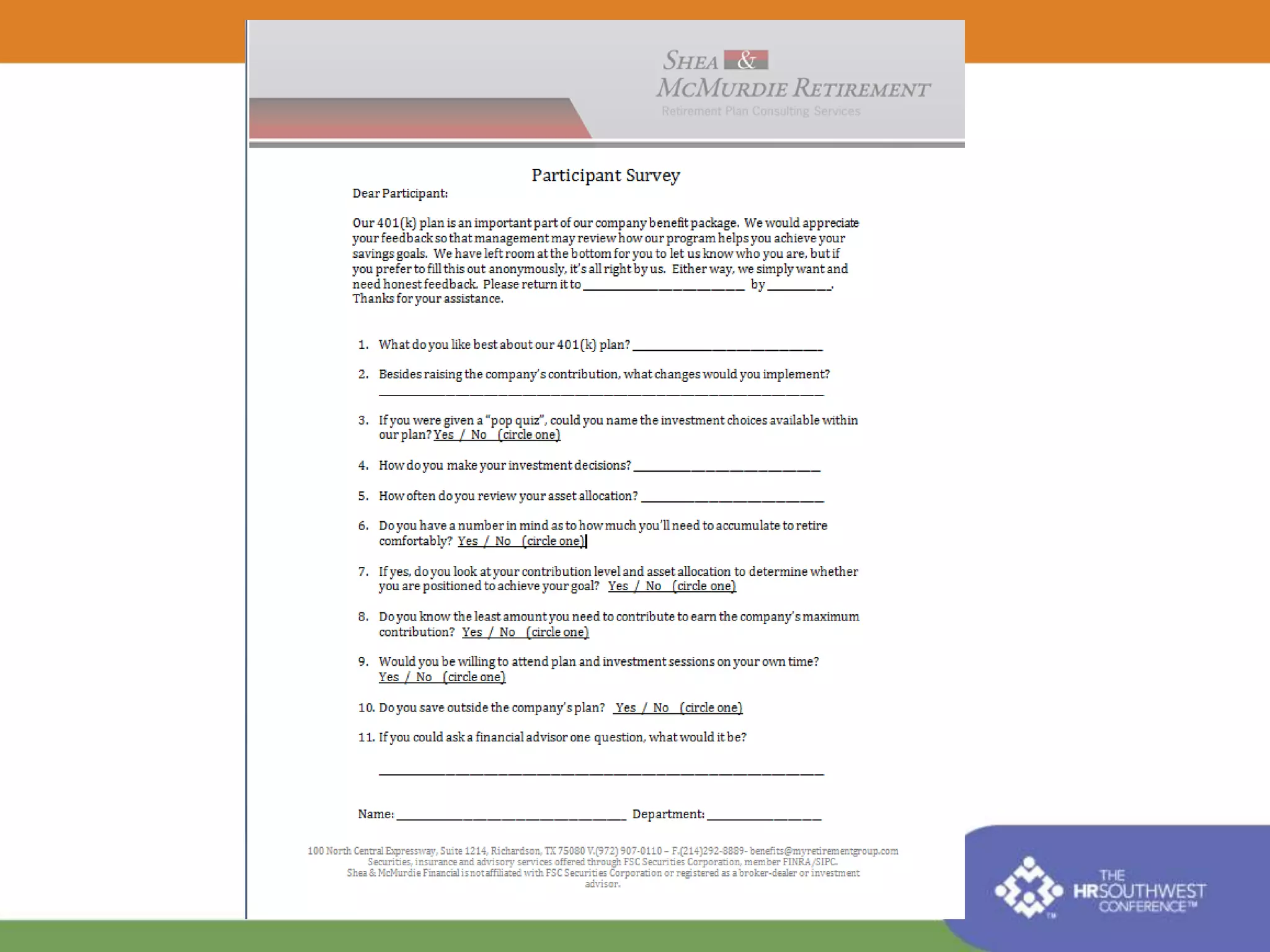

The document discusses common misconceptions about employee benefit plans and the importance of effective communication regarding these benefits. It highlights signs of education problems, barriers to improvement, and suggests five ideas for enhancing benefits communication. A well-structured education program can lead to decreased turnover, improved engagement, and better overall employee satisfaction.