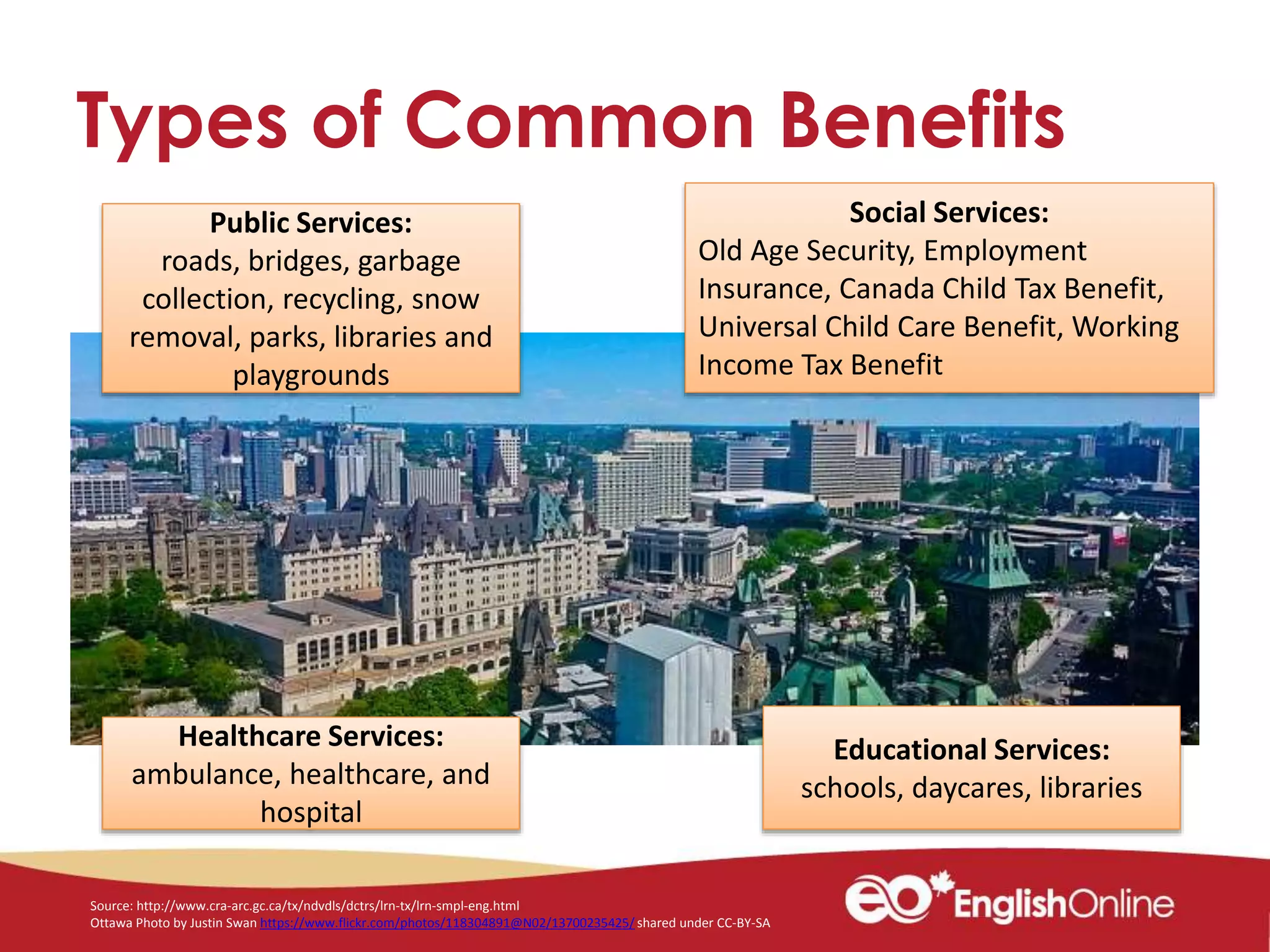

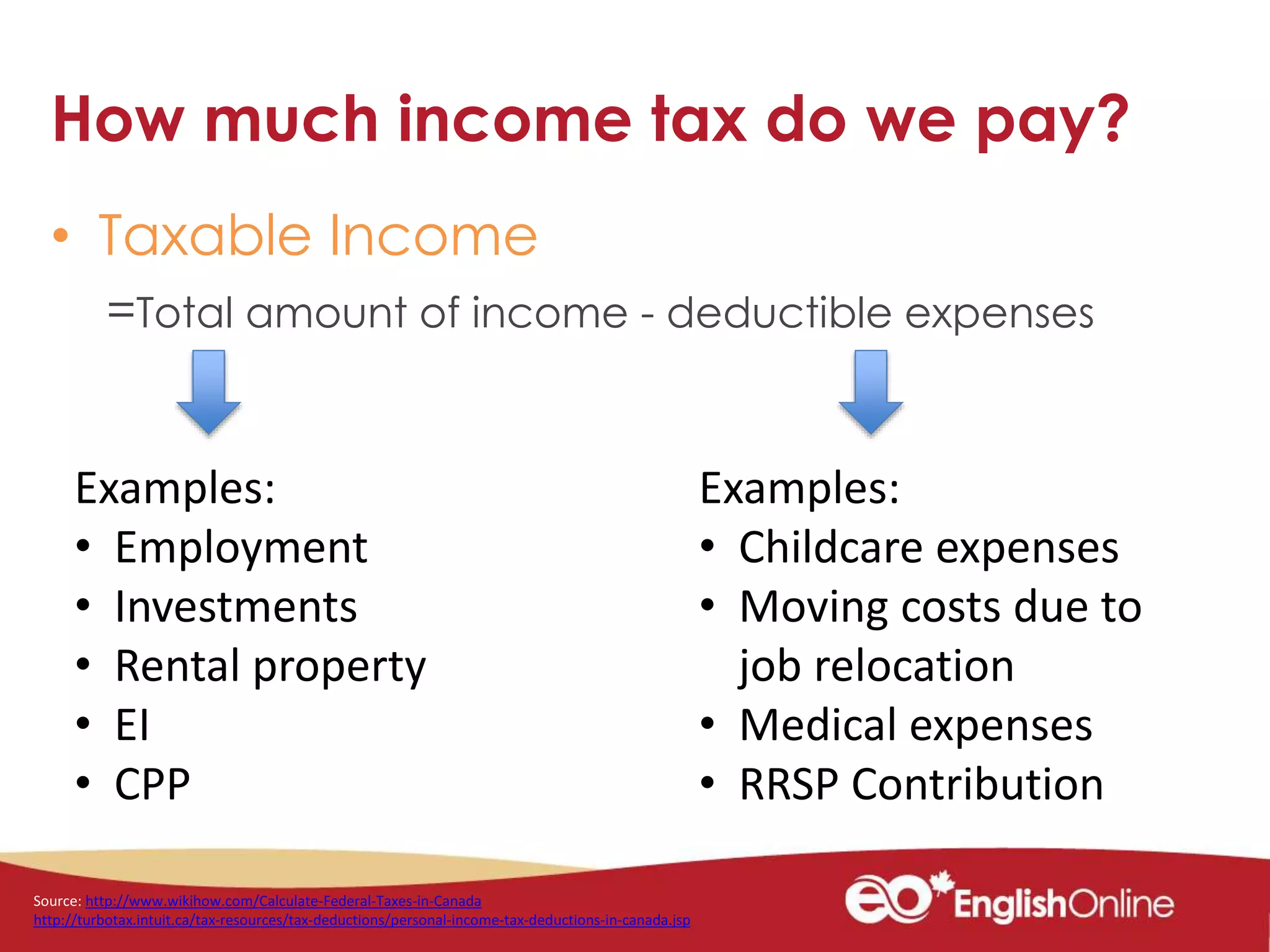

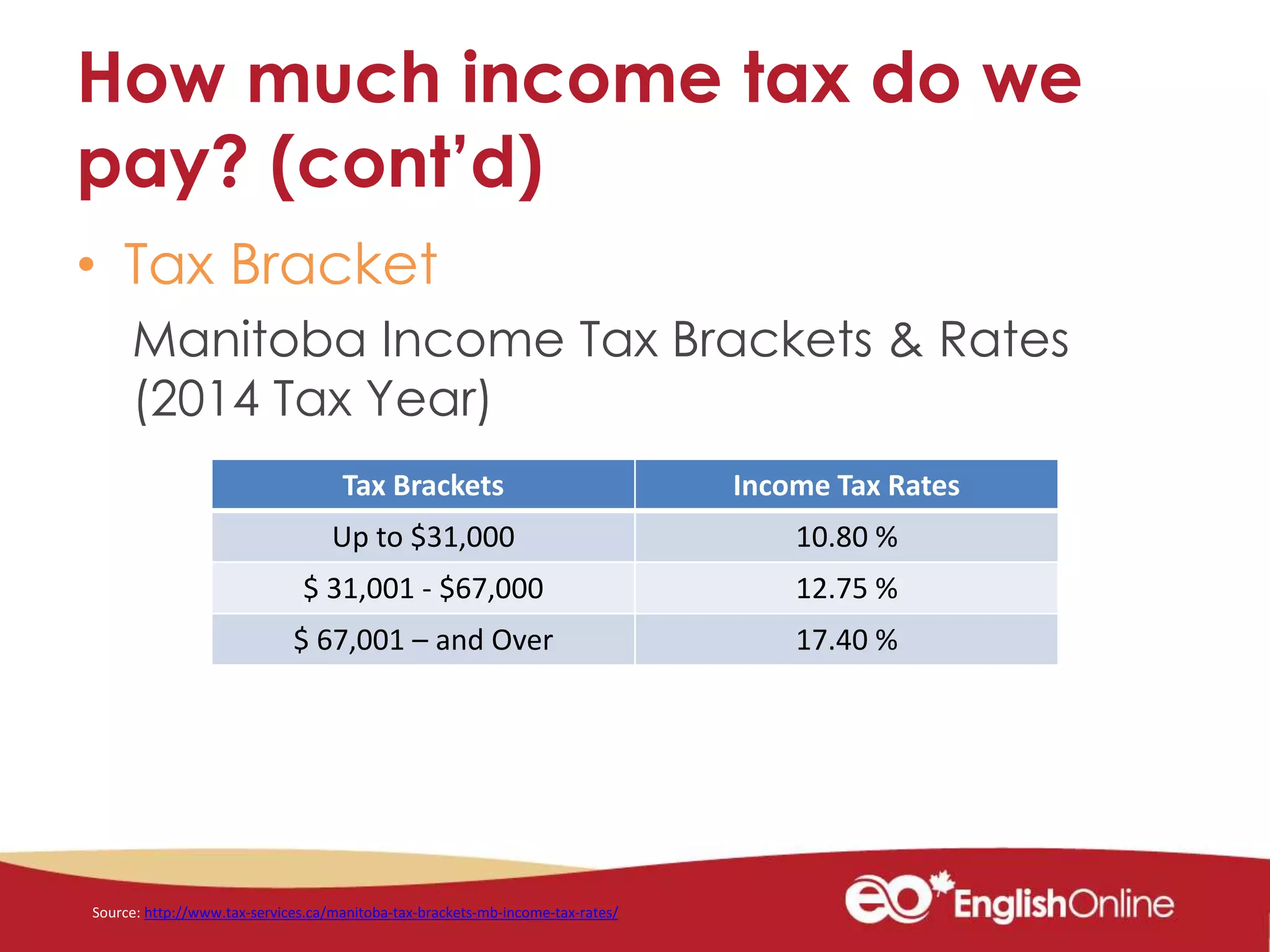

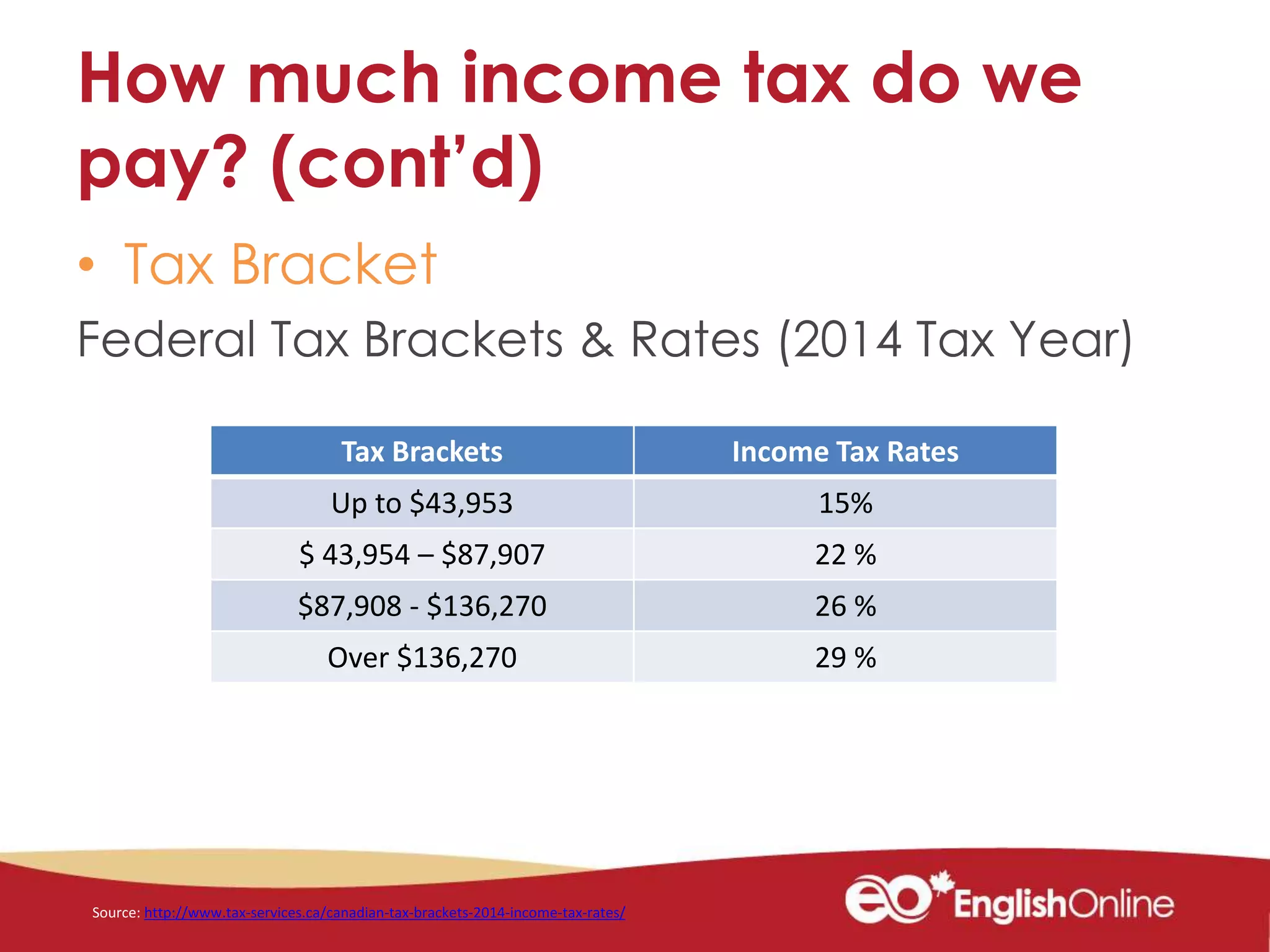

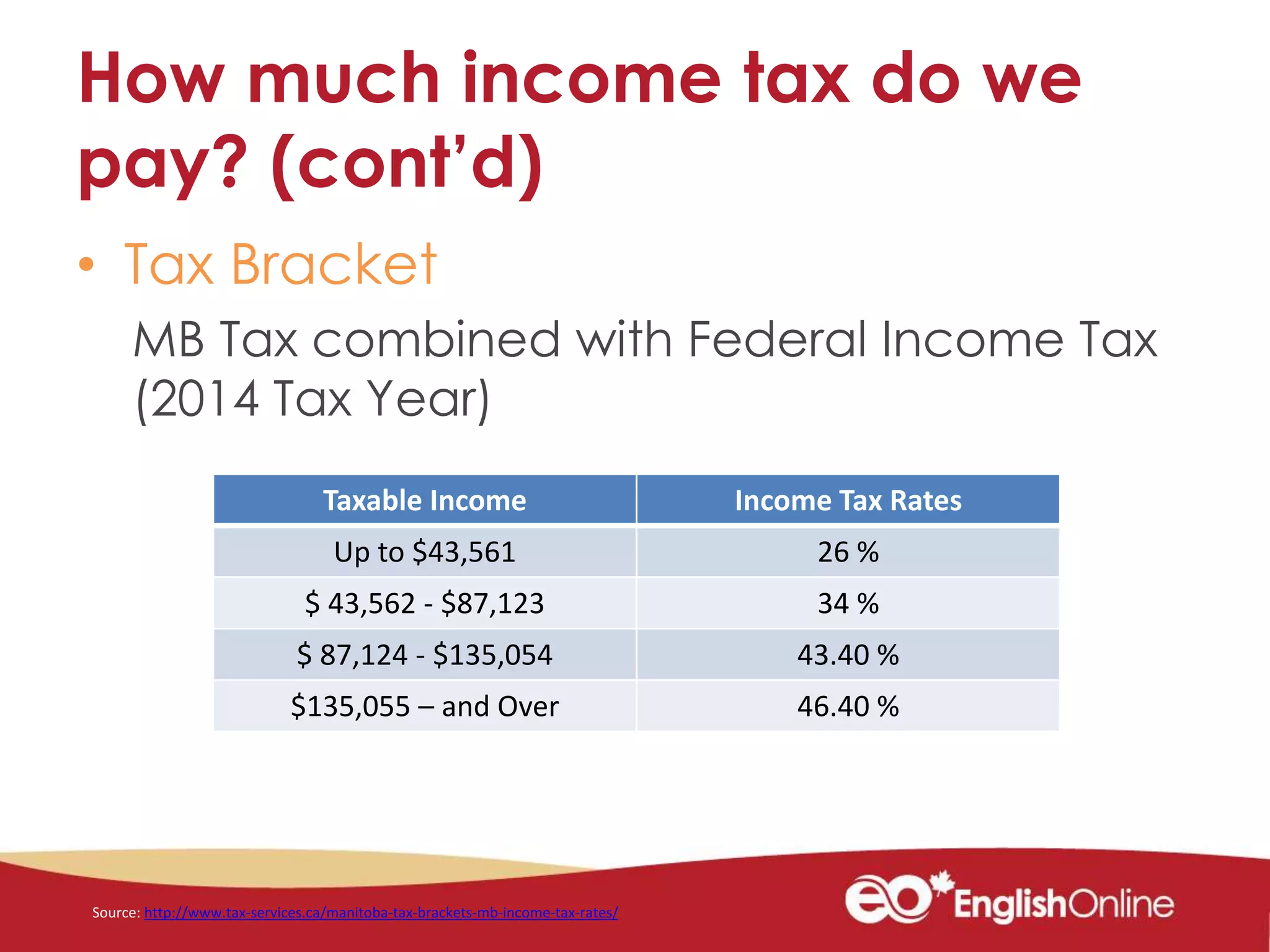

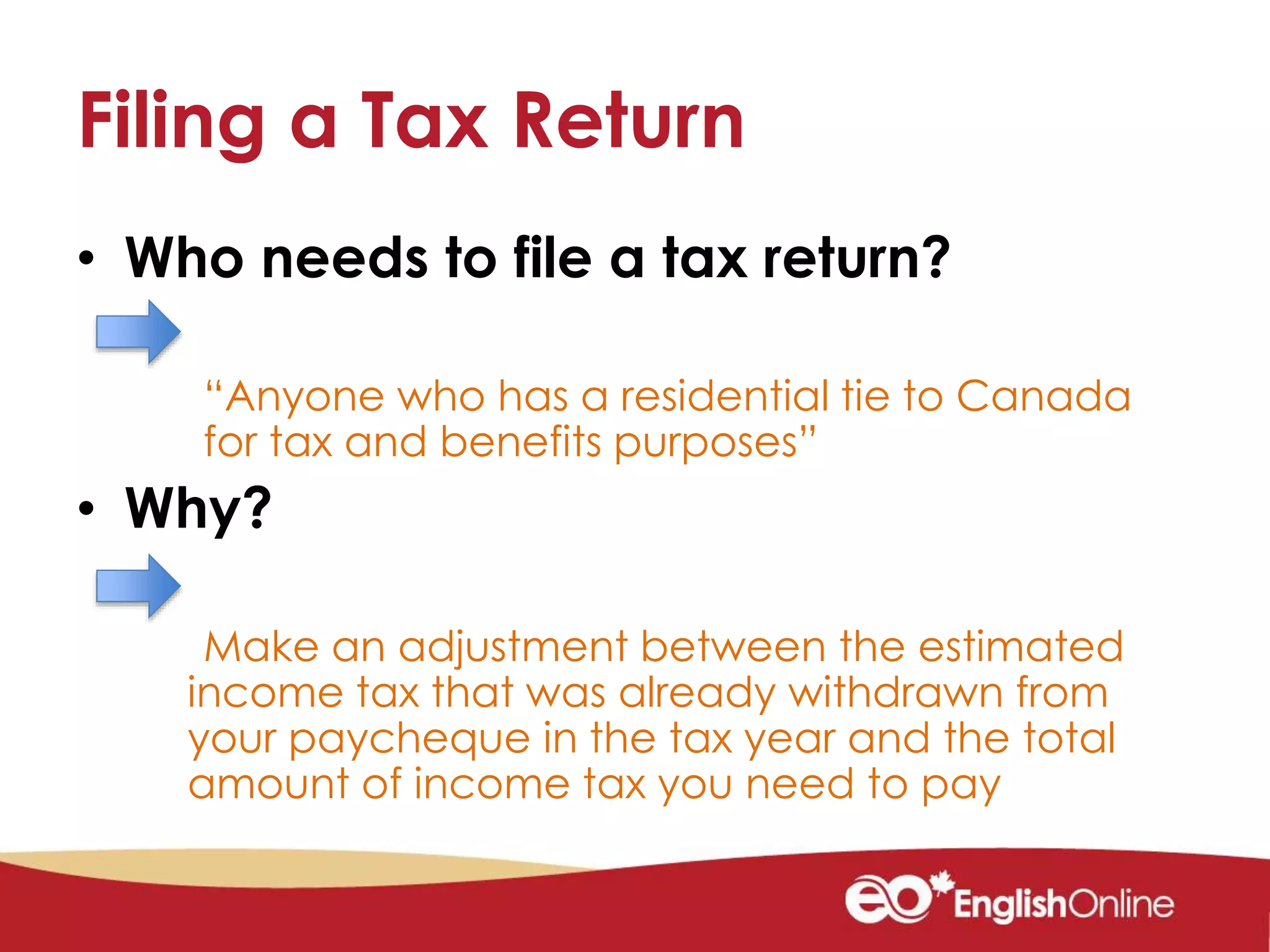

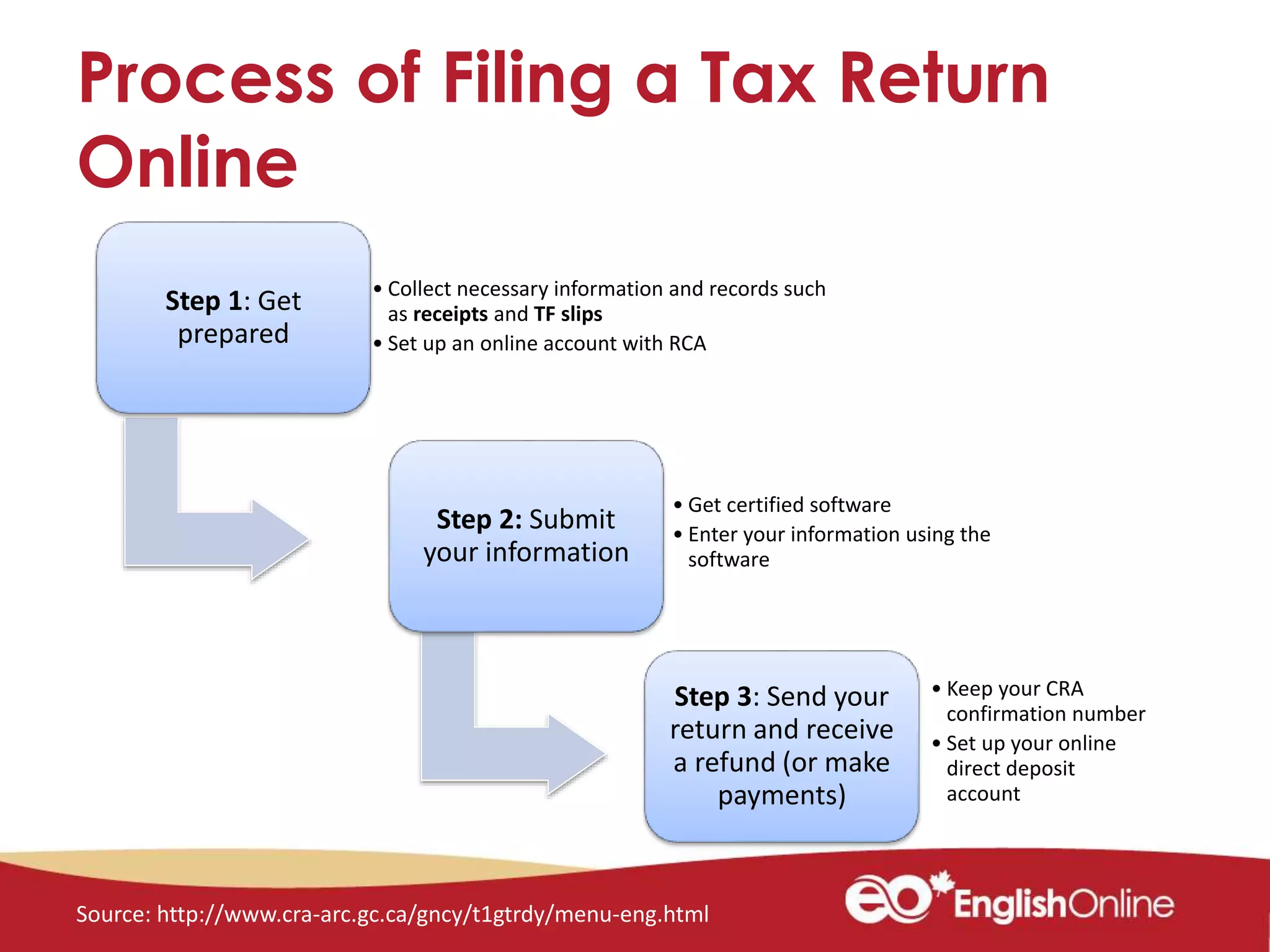

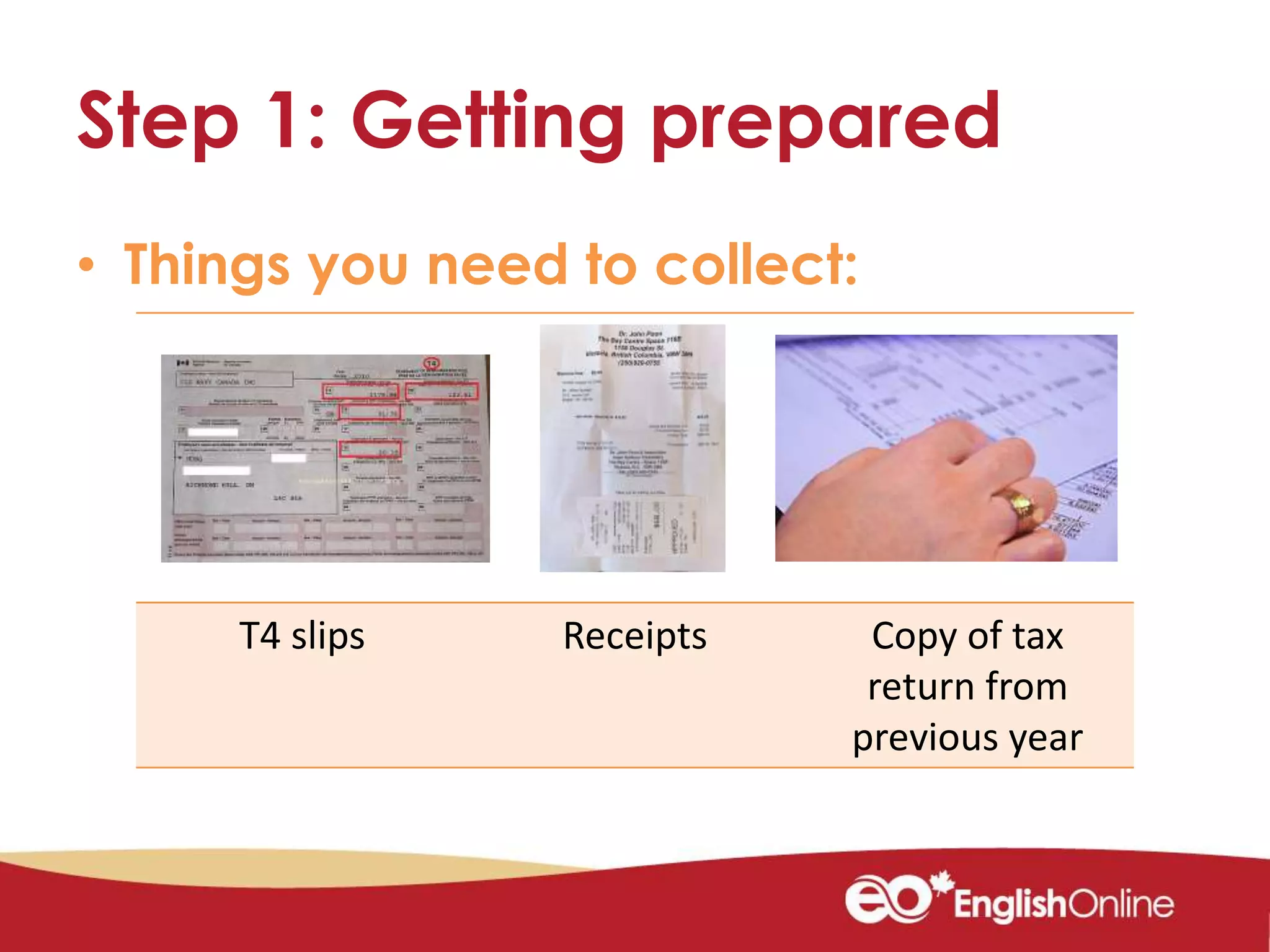

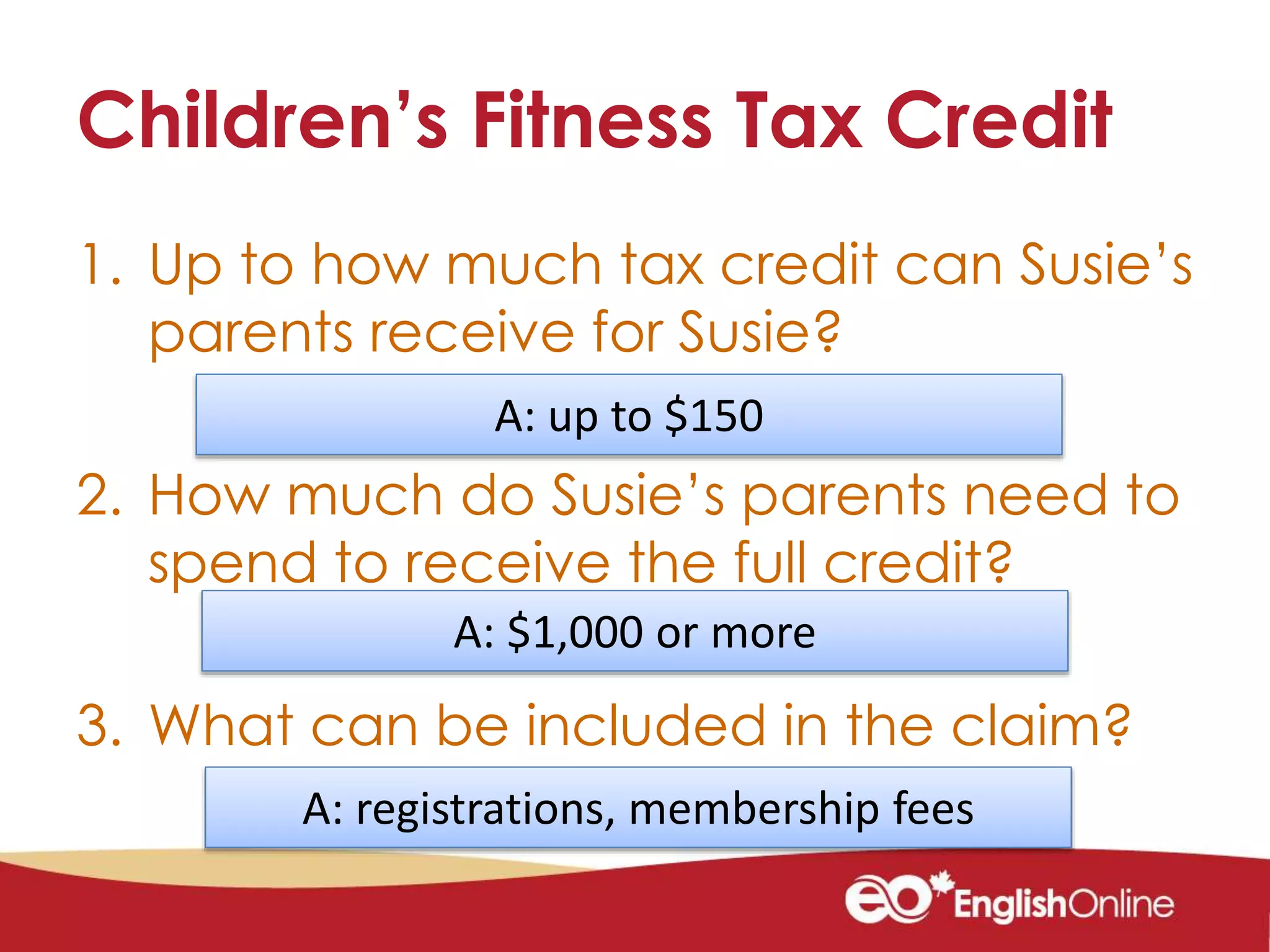

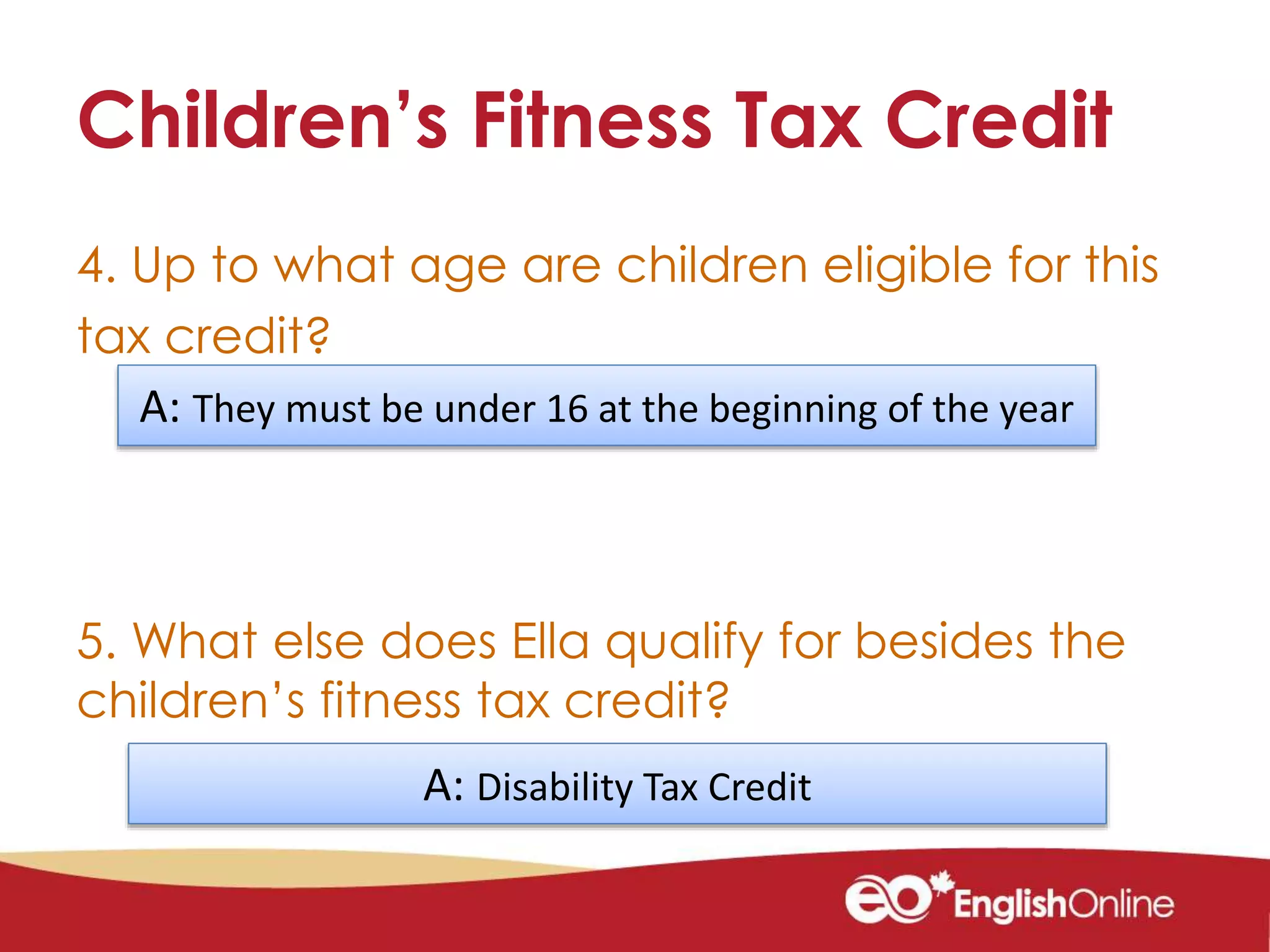

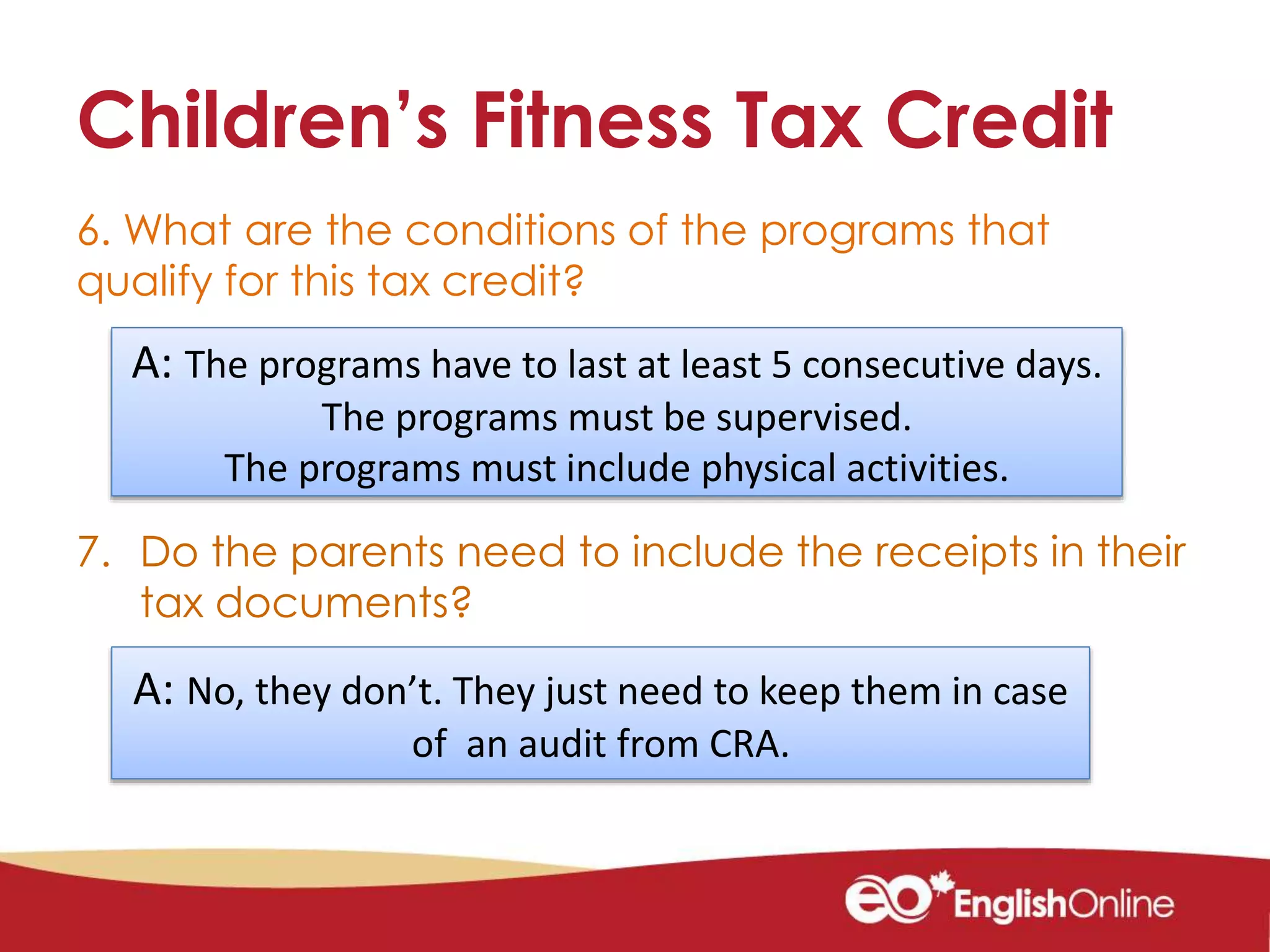

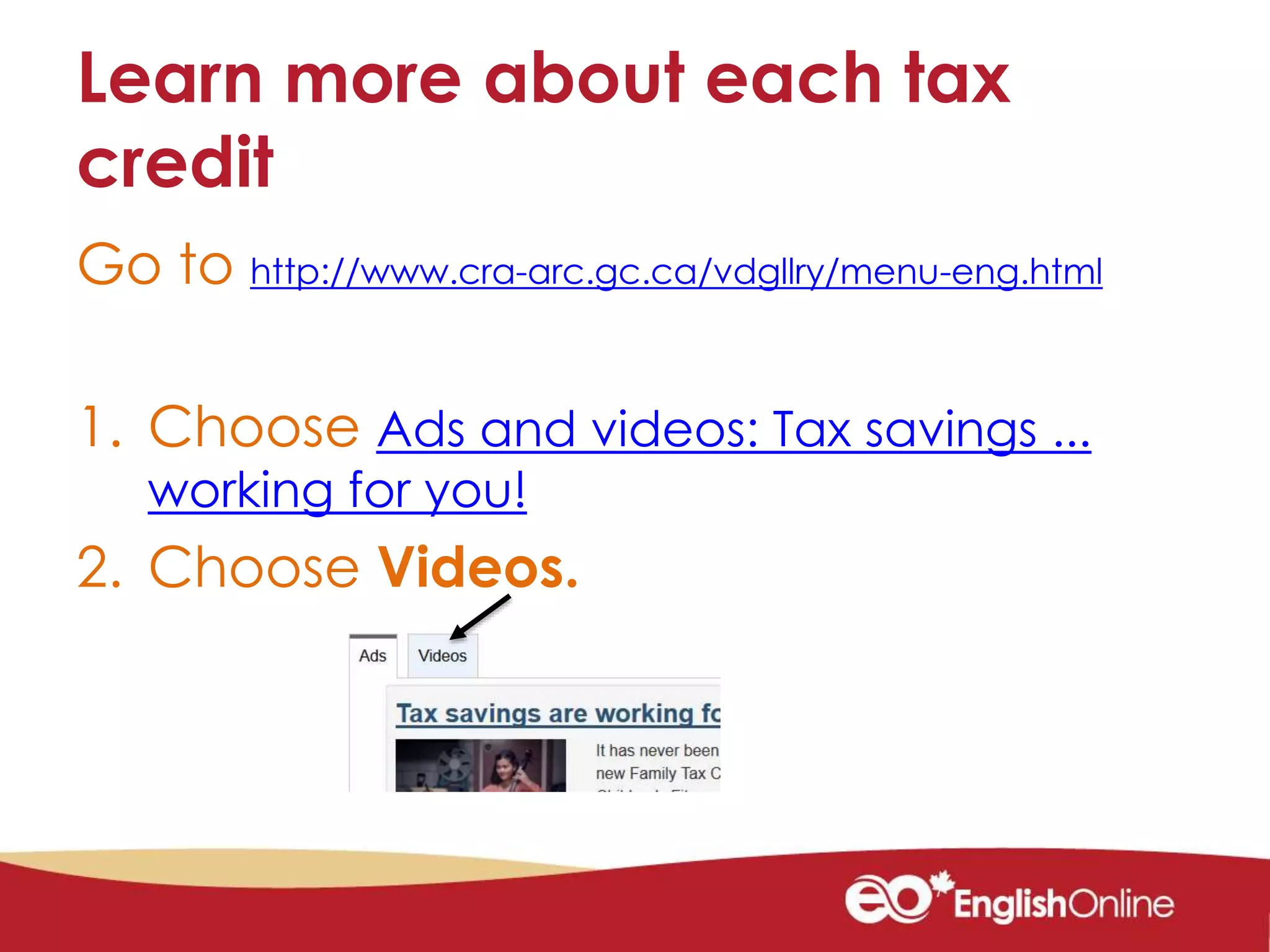

This document provides information about filing taxes in Canada. It begins with introducing the workshop objectives, which are to learn about the Canadian tax system, the tax filing process, and how to get help with taxes. Various tax-related terms are defined. The document then discusses the different types of taxes Canadians pay, including income, sales, and property taxes. It explains why taxes are paid and what common benefits are funded by taxes, such as social services, healthcare, education, and public services. The document outlines the tax filing process and how to determine your taxable income and tax bracket. It provides details on getting tax forms, filing options, deadlines, and setting up direct deposit. Tax credits are described and information given on where