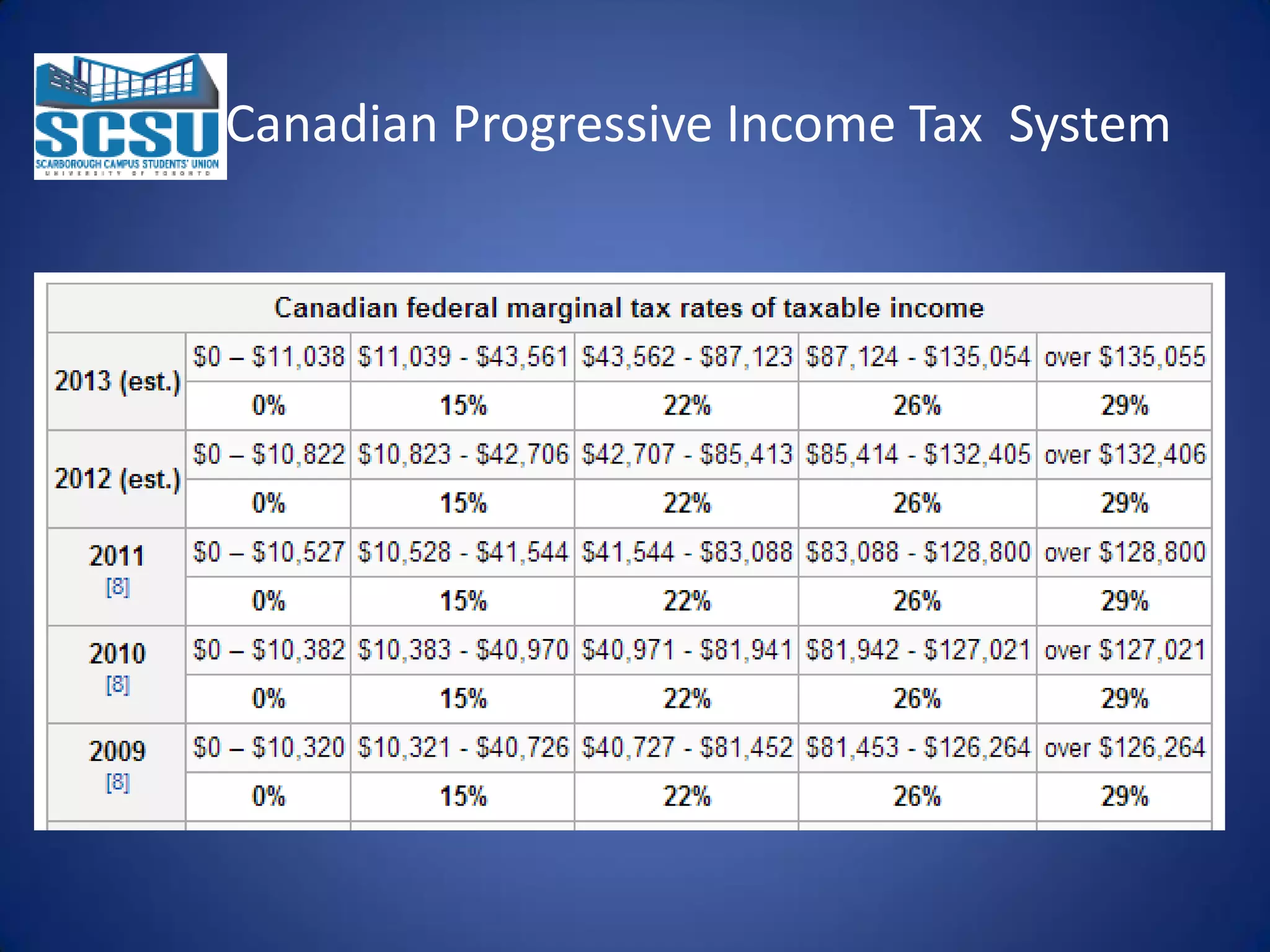

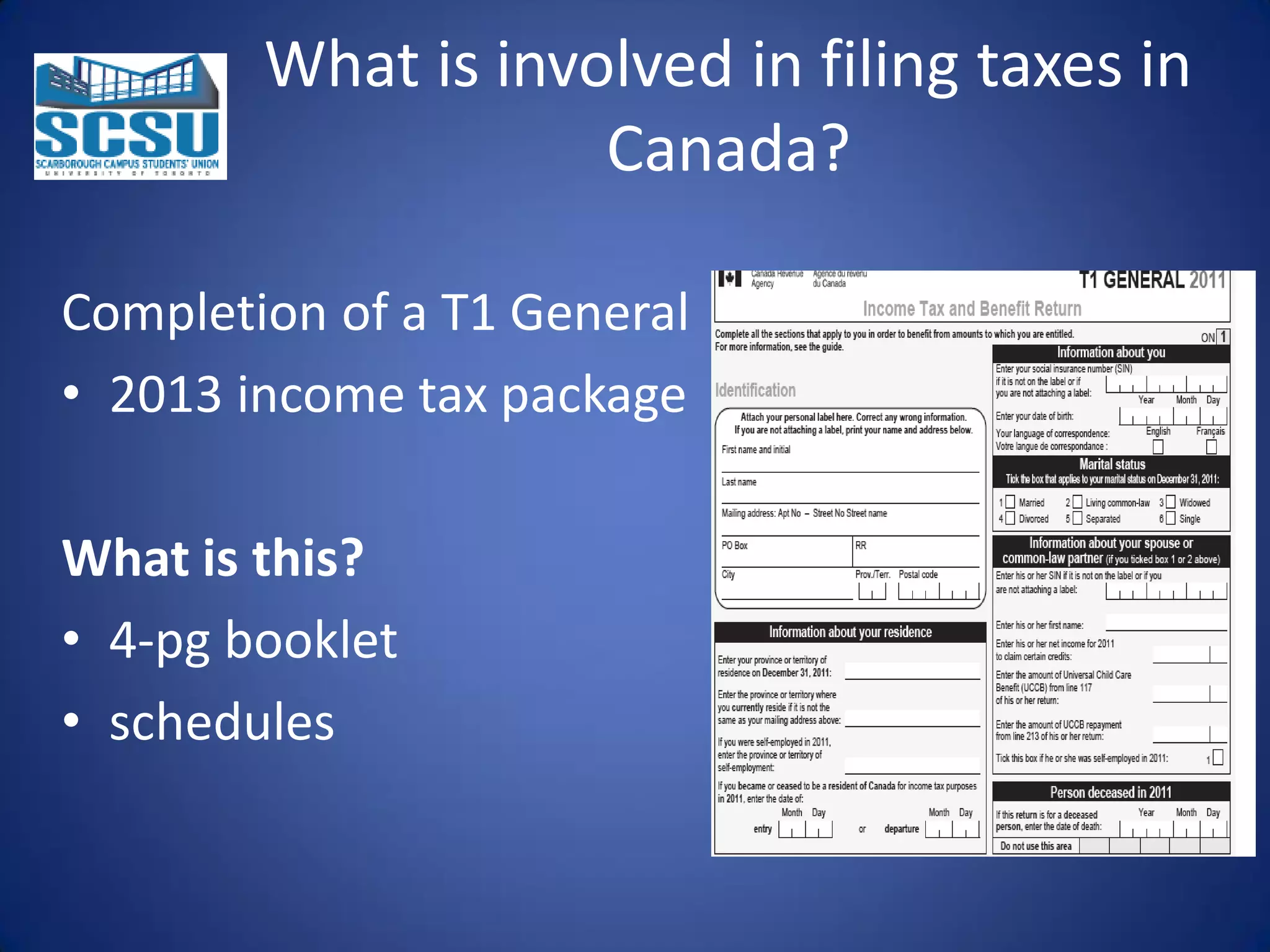

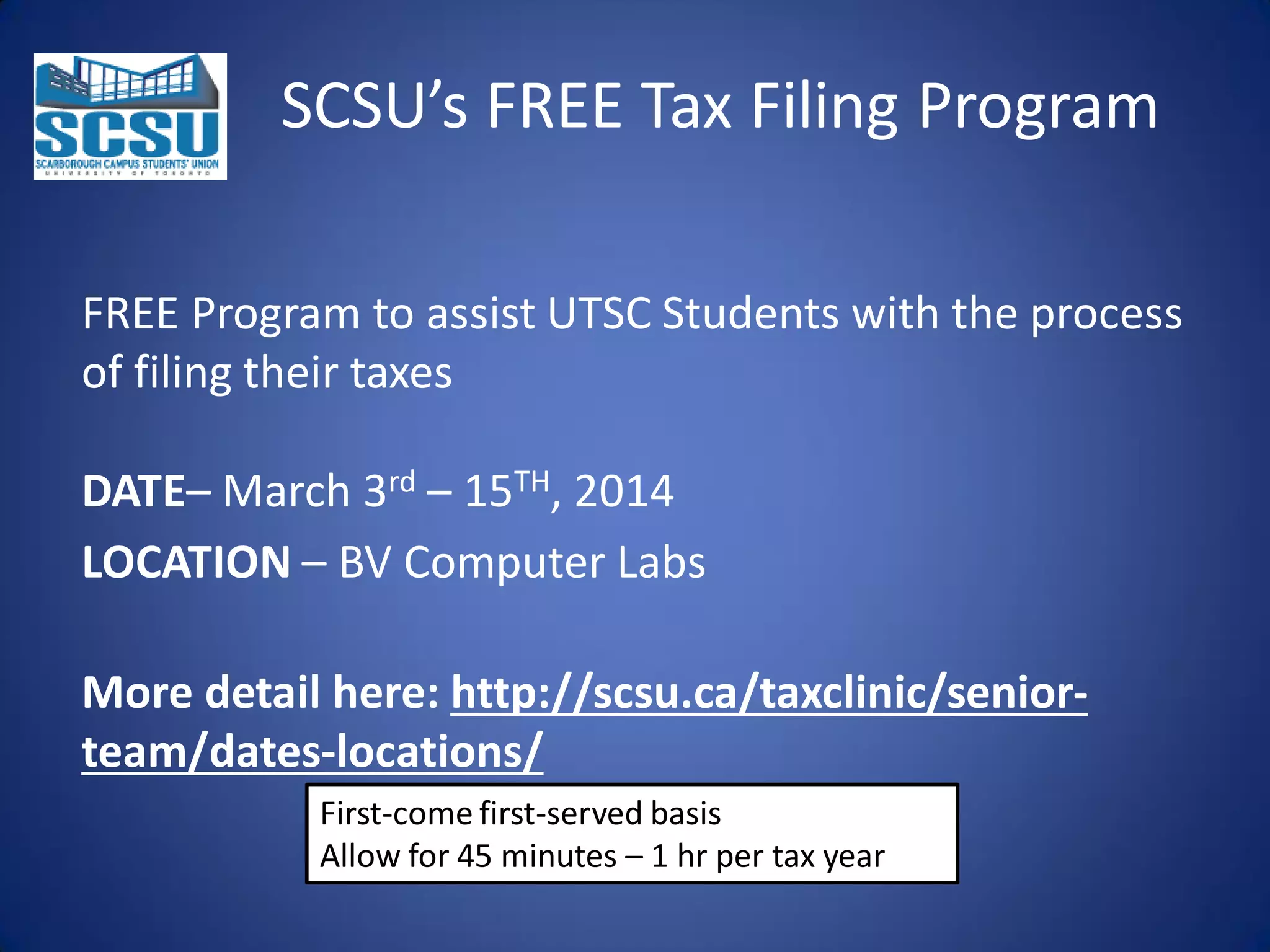

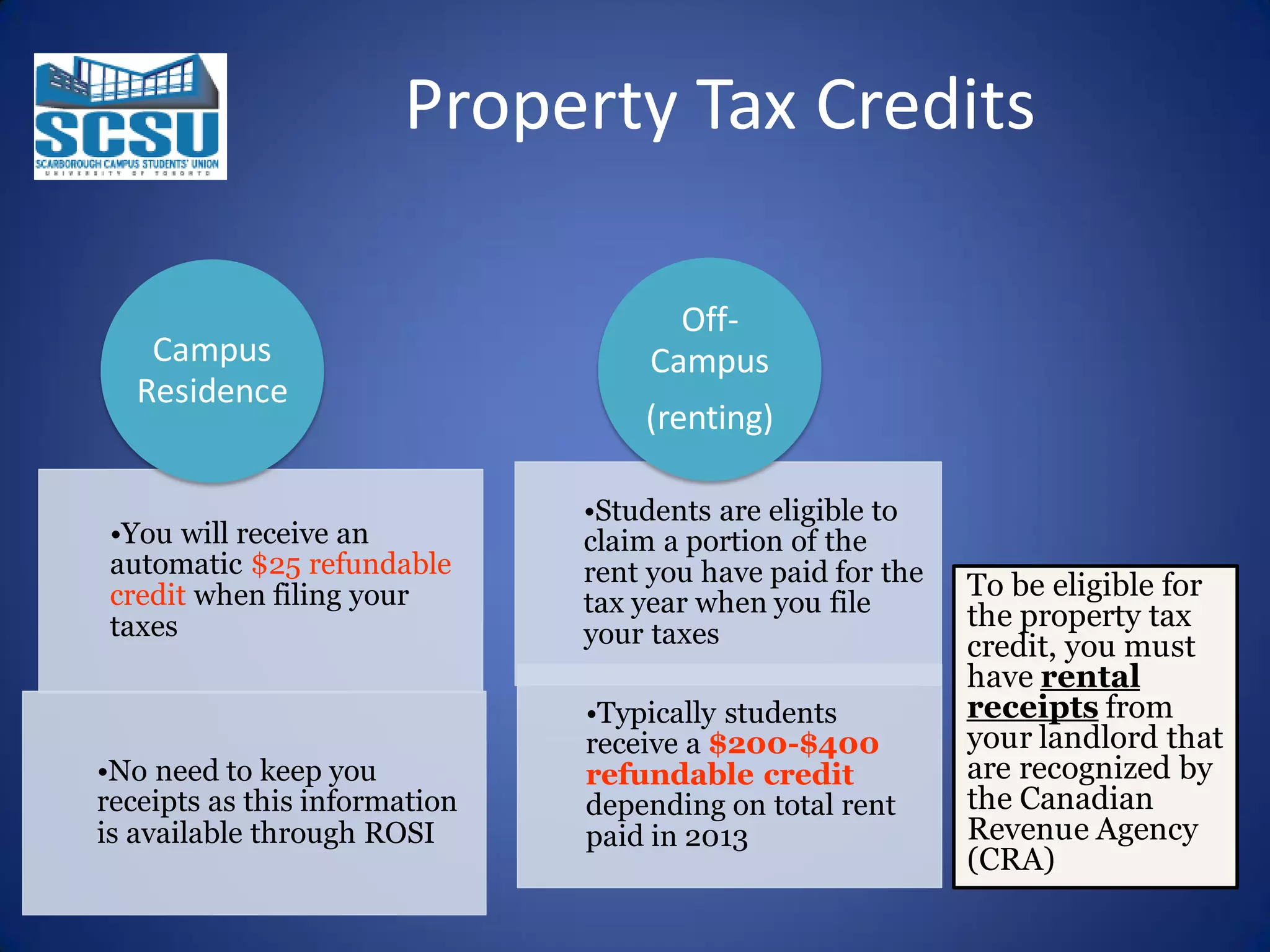

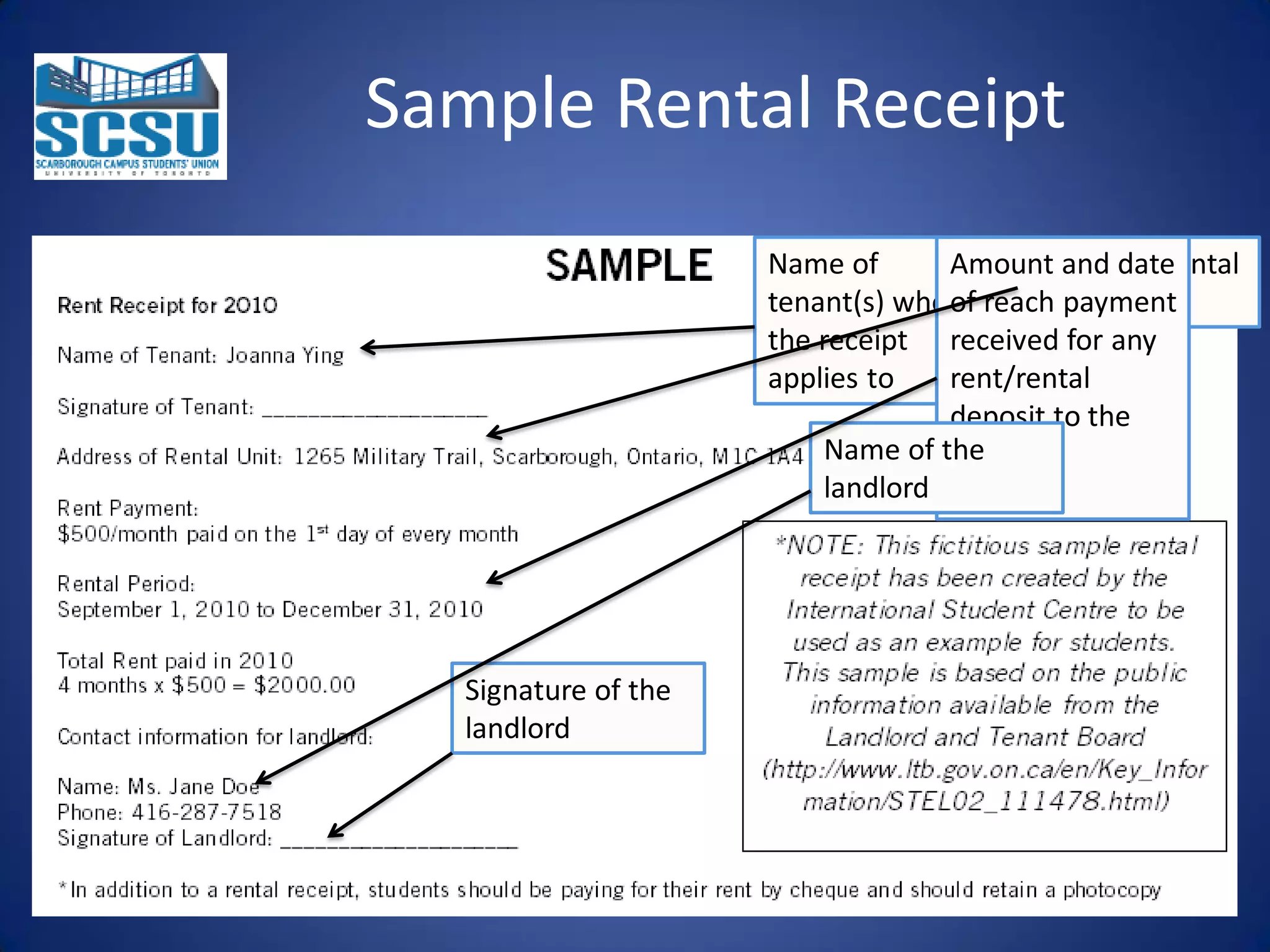

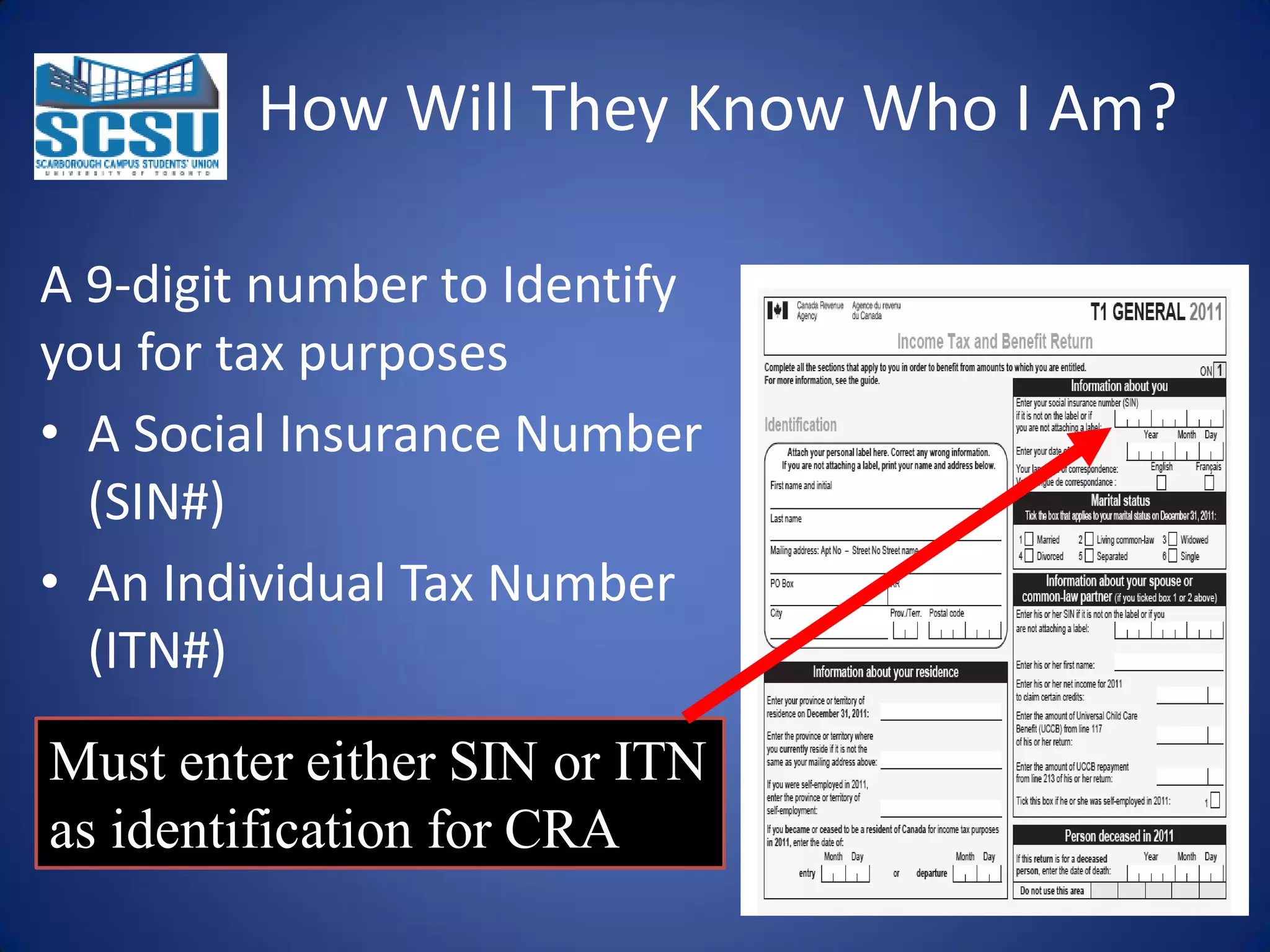

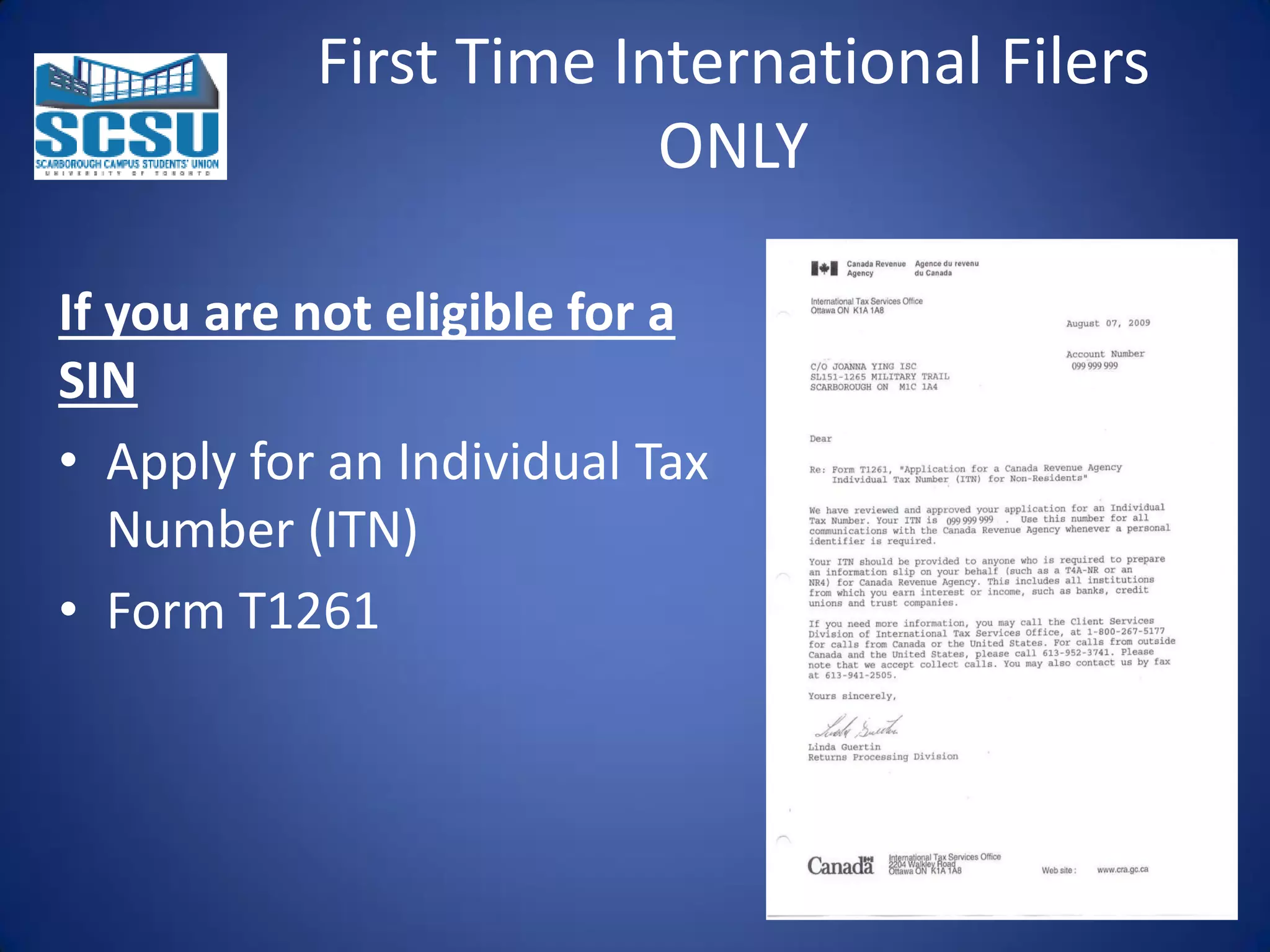

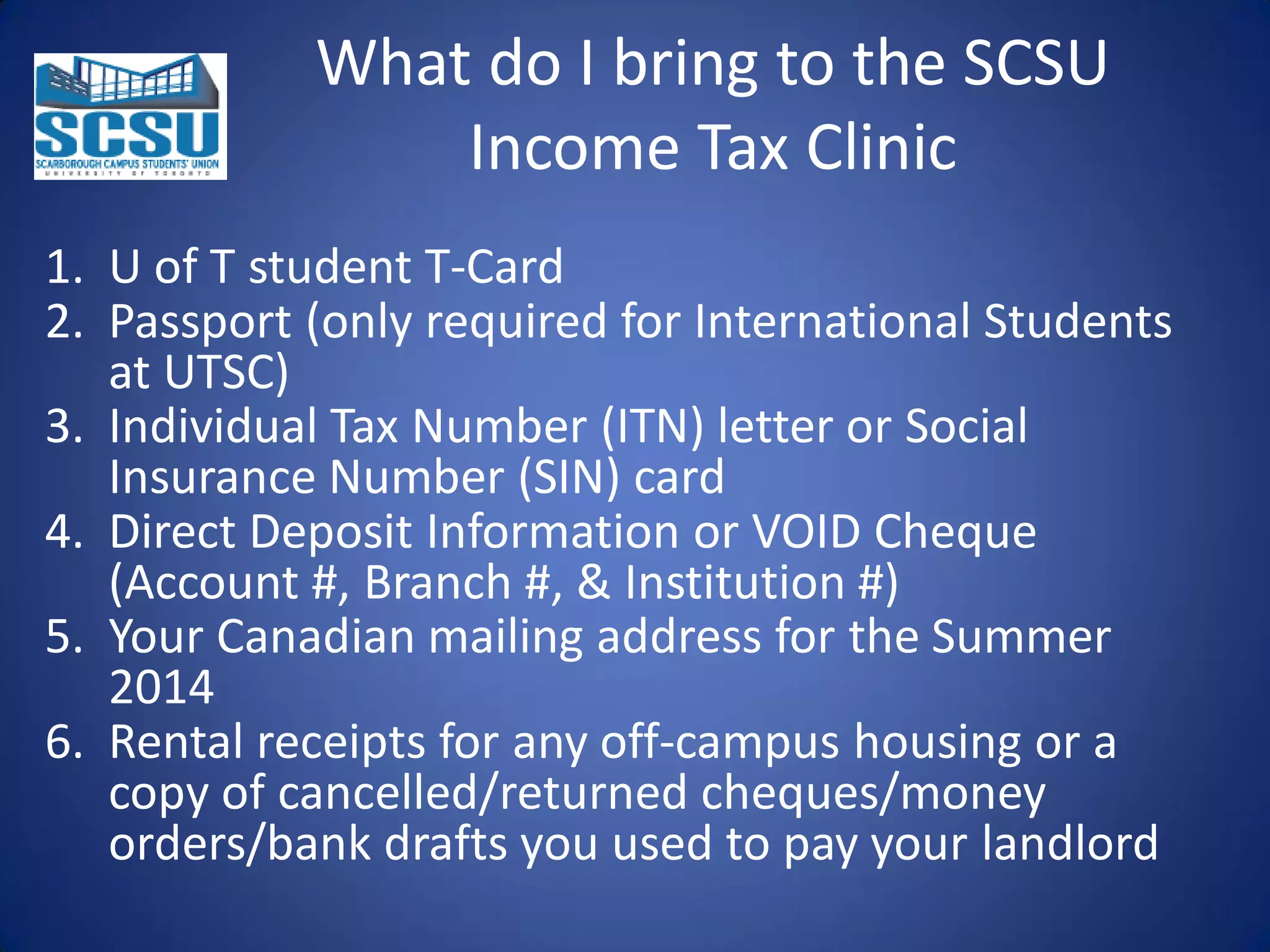

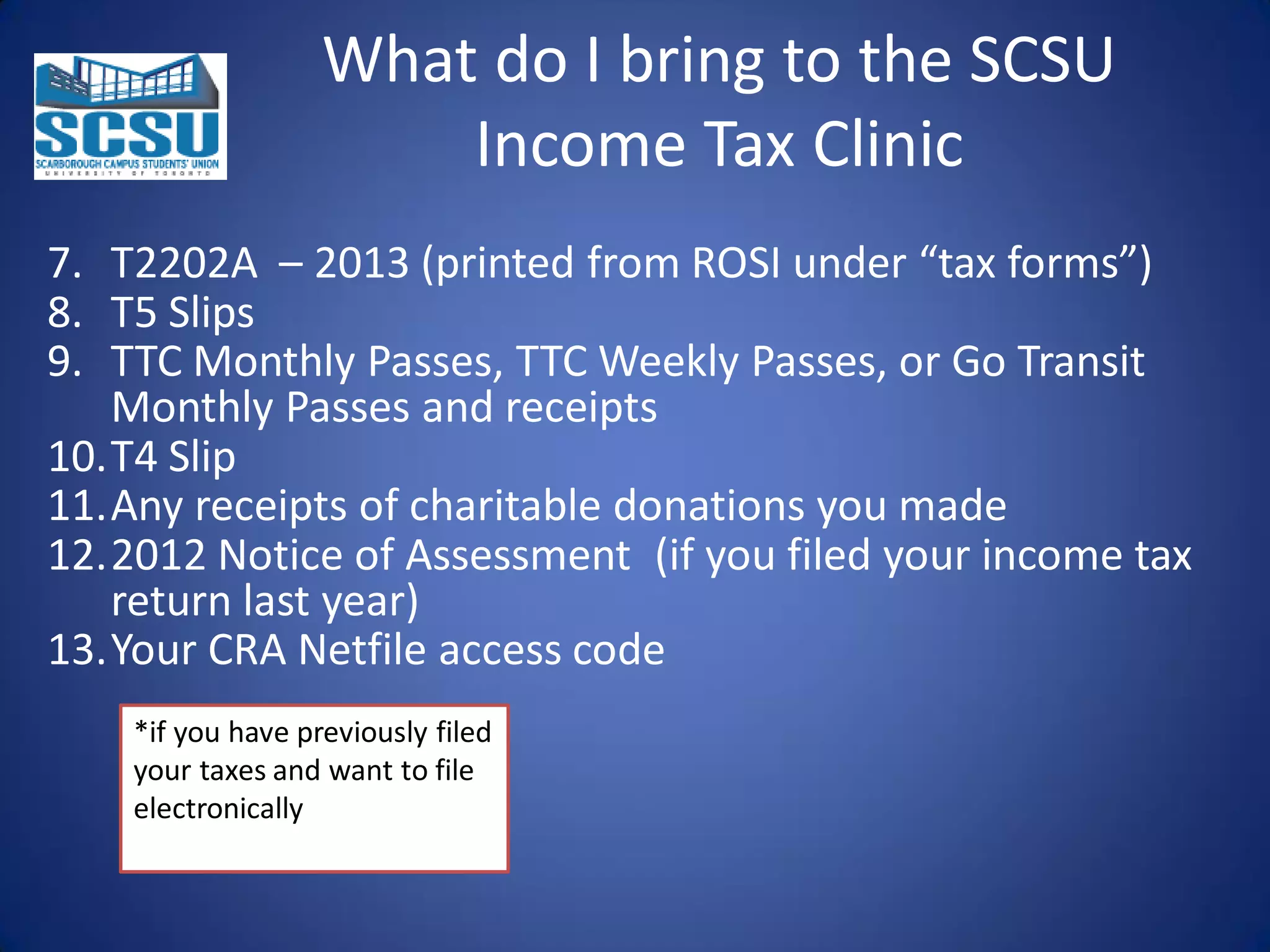

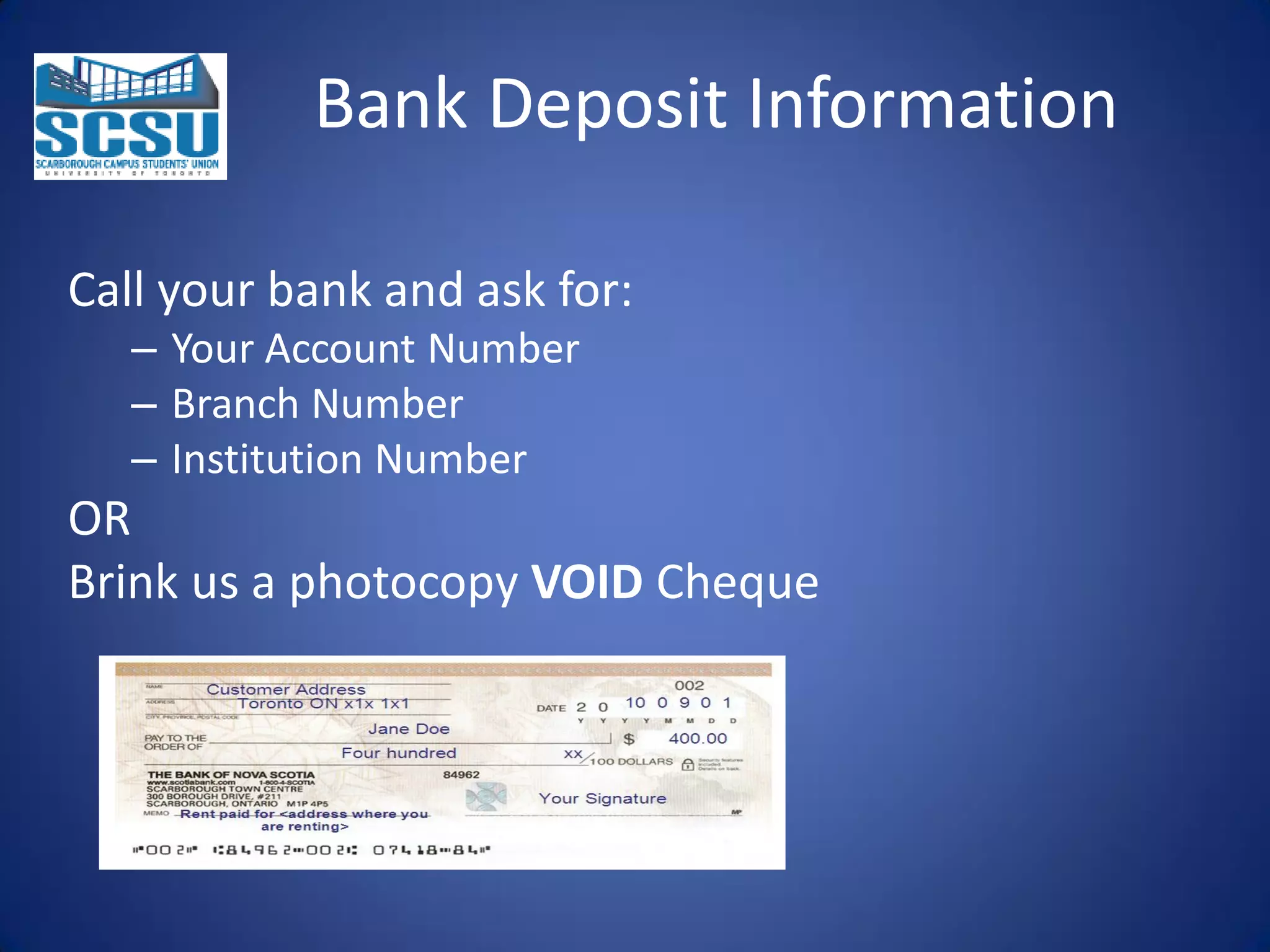

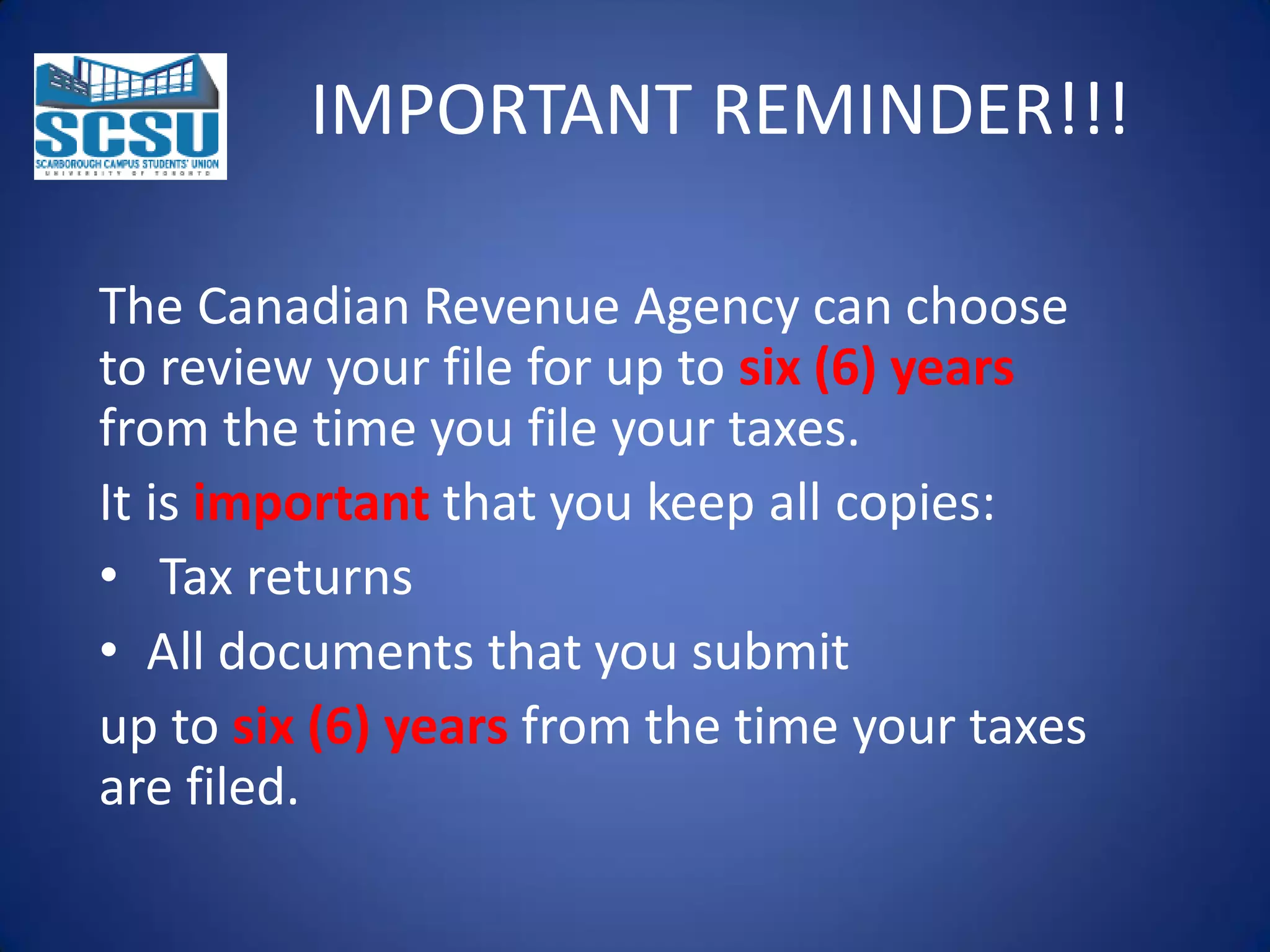

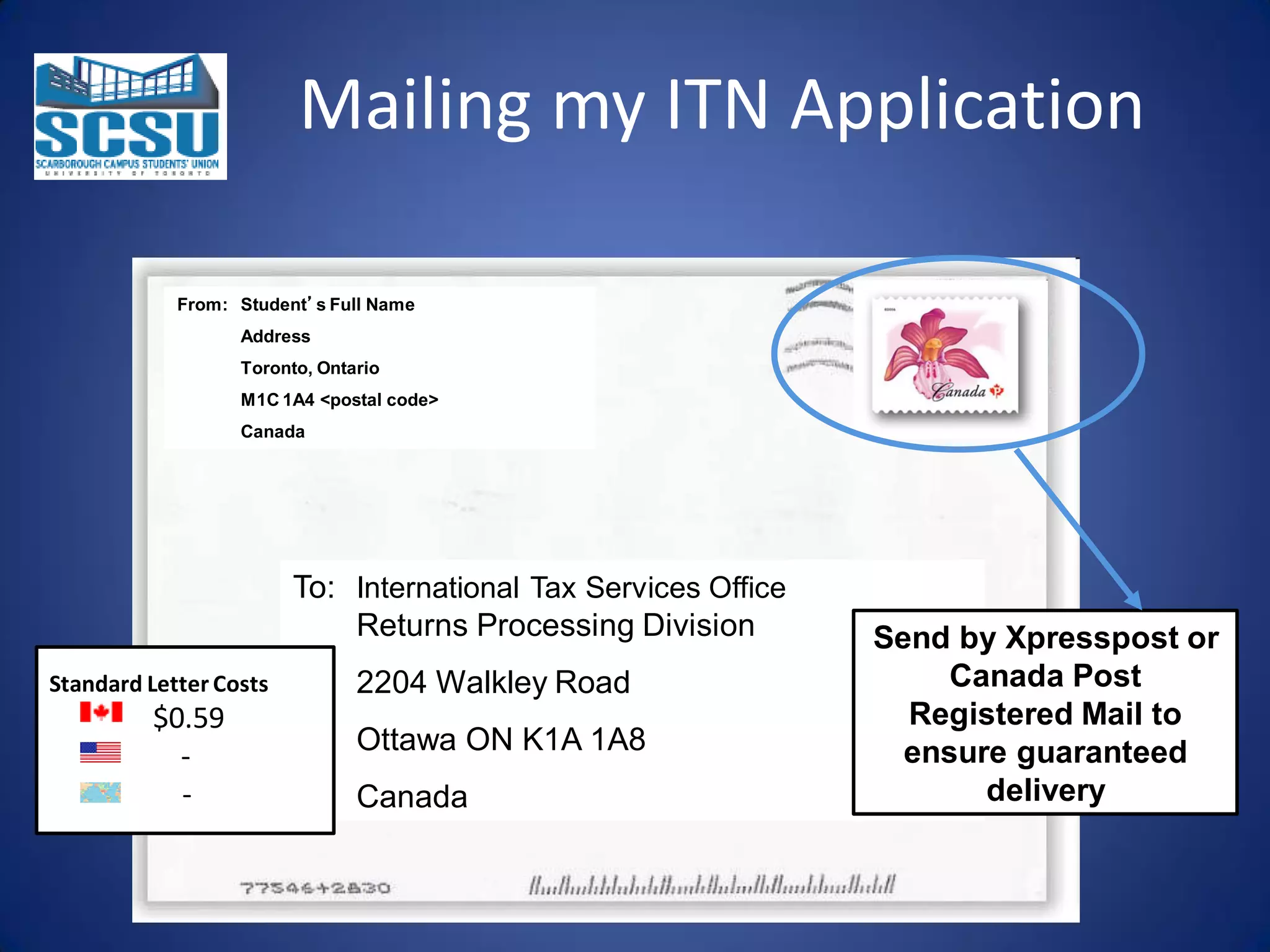

This document provides information about an income tax filing session for first time and returning filers. It discusses what is involved in filing taxes in Canada, including completing a T1 General tax return. It outlines the Scarborough Campus Students' Union's free tax filing program and the benefits of filing taxes such as tax credits. The presentation covers important dates, required documents, and identification numbers. It provides tips for international students applying for an Individual Tax Number and explains the auditor process.