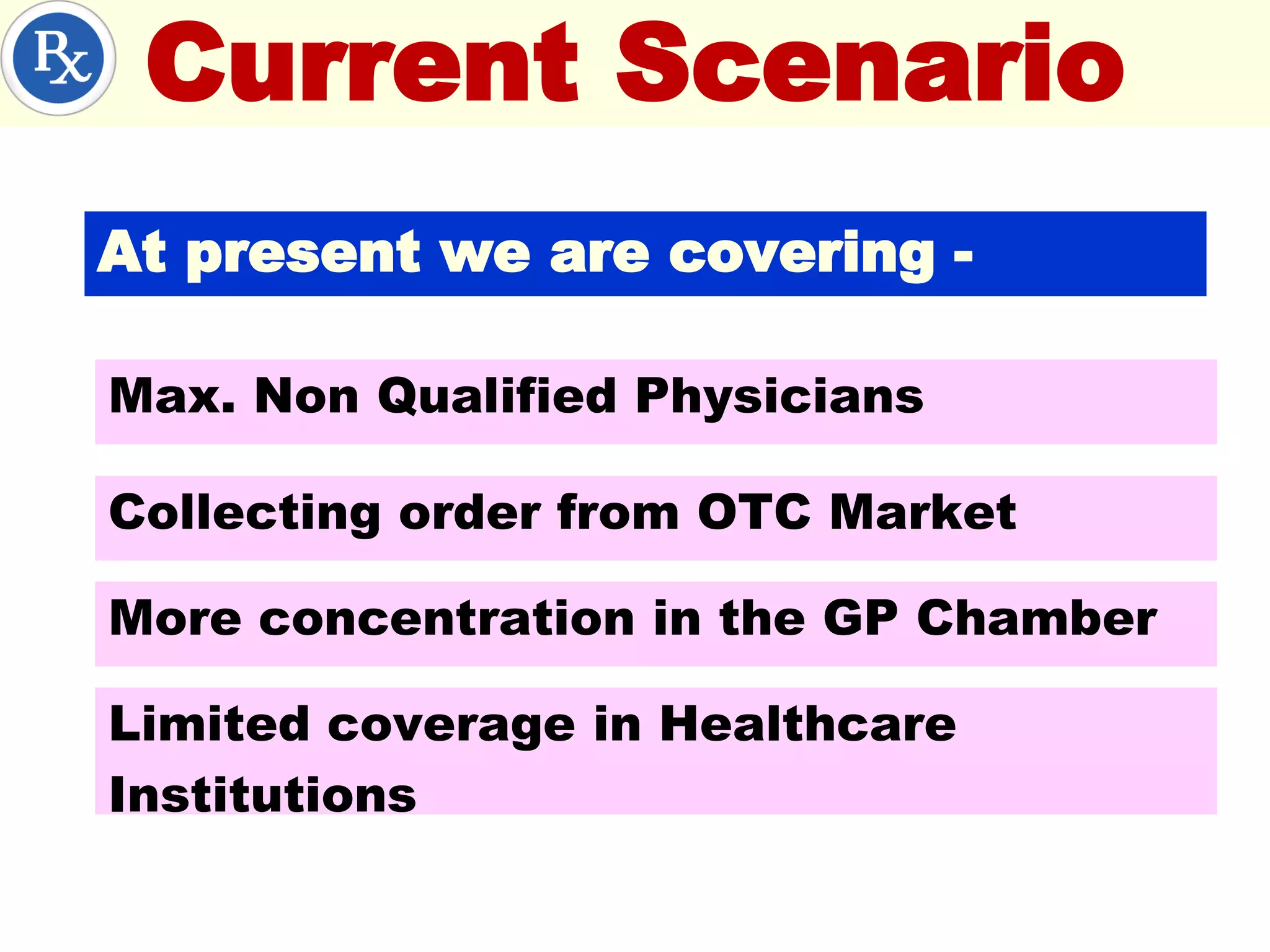

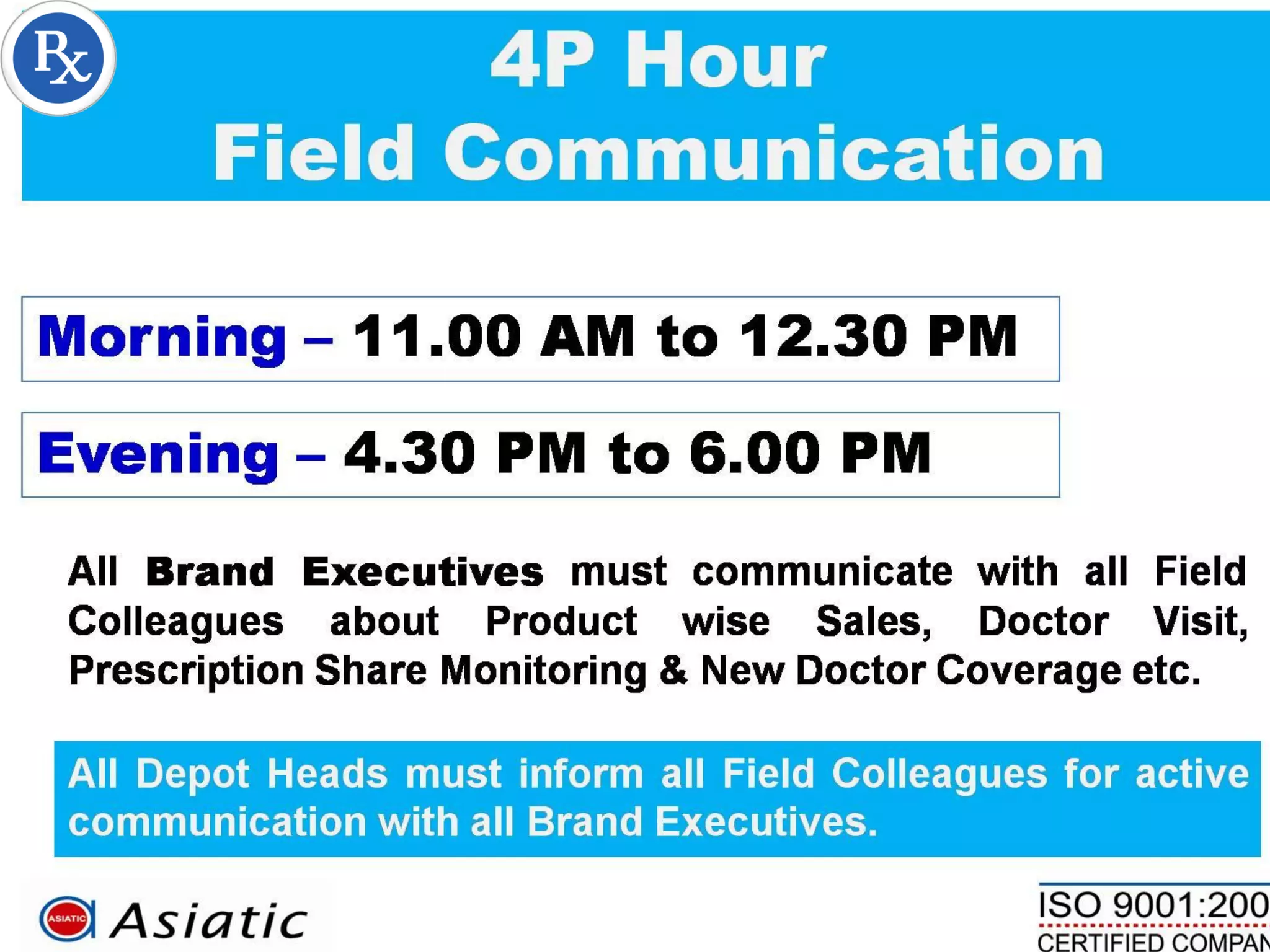

Maximize your business by analyzing Rx share reports, which can help:

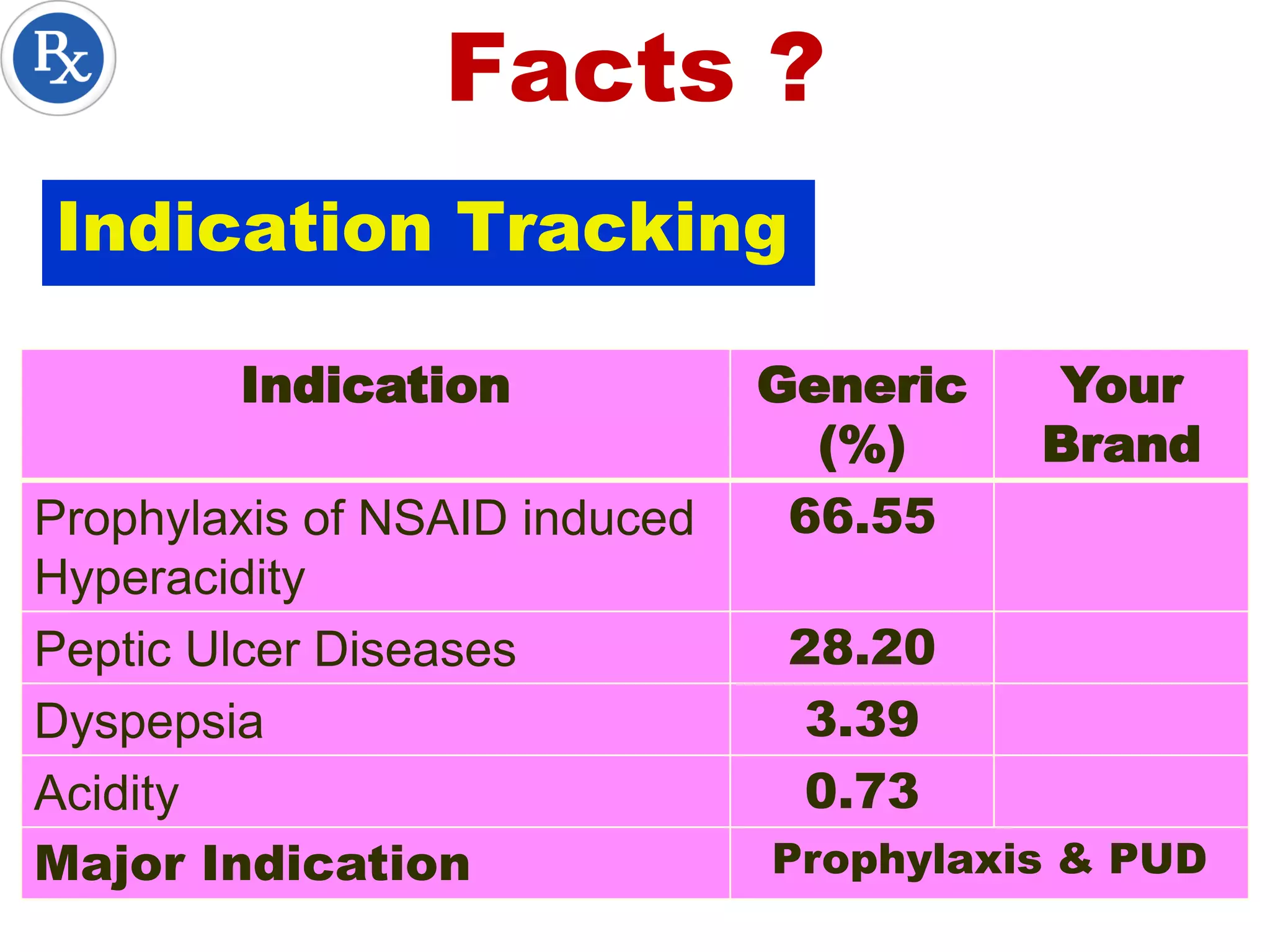

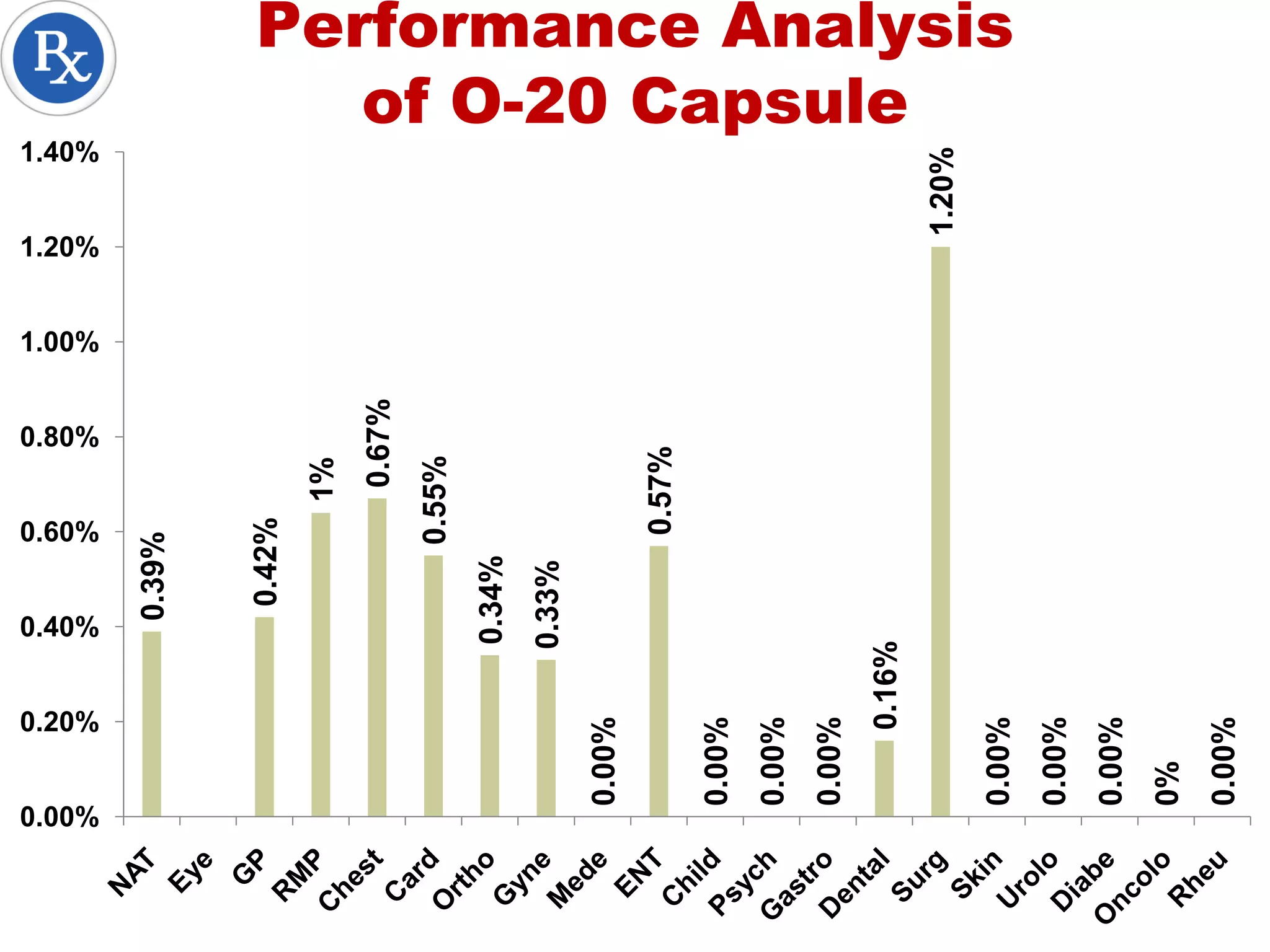

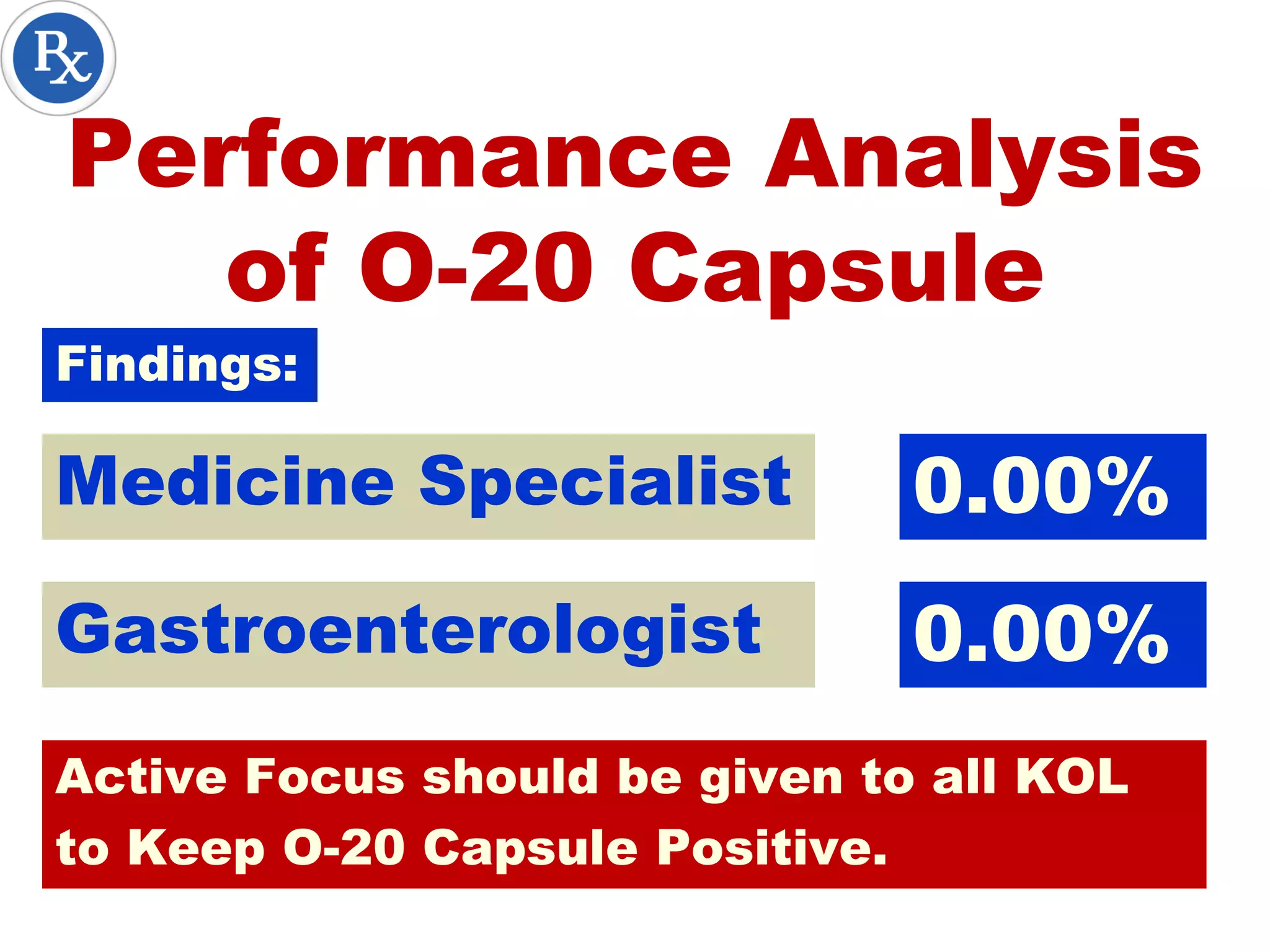

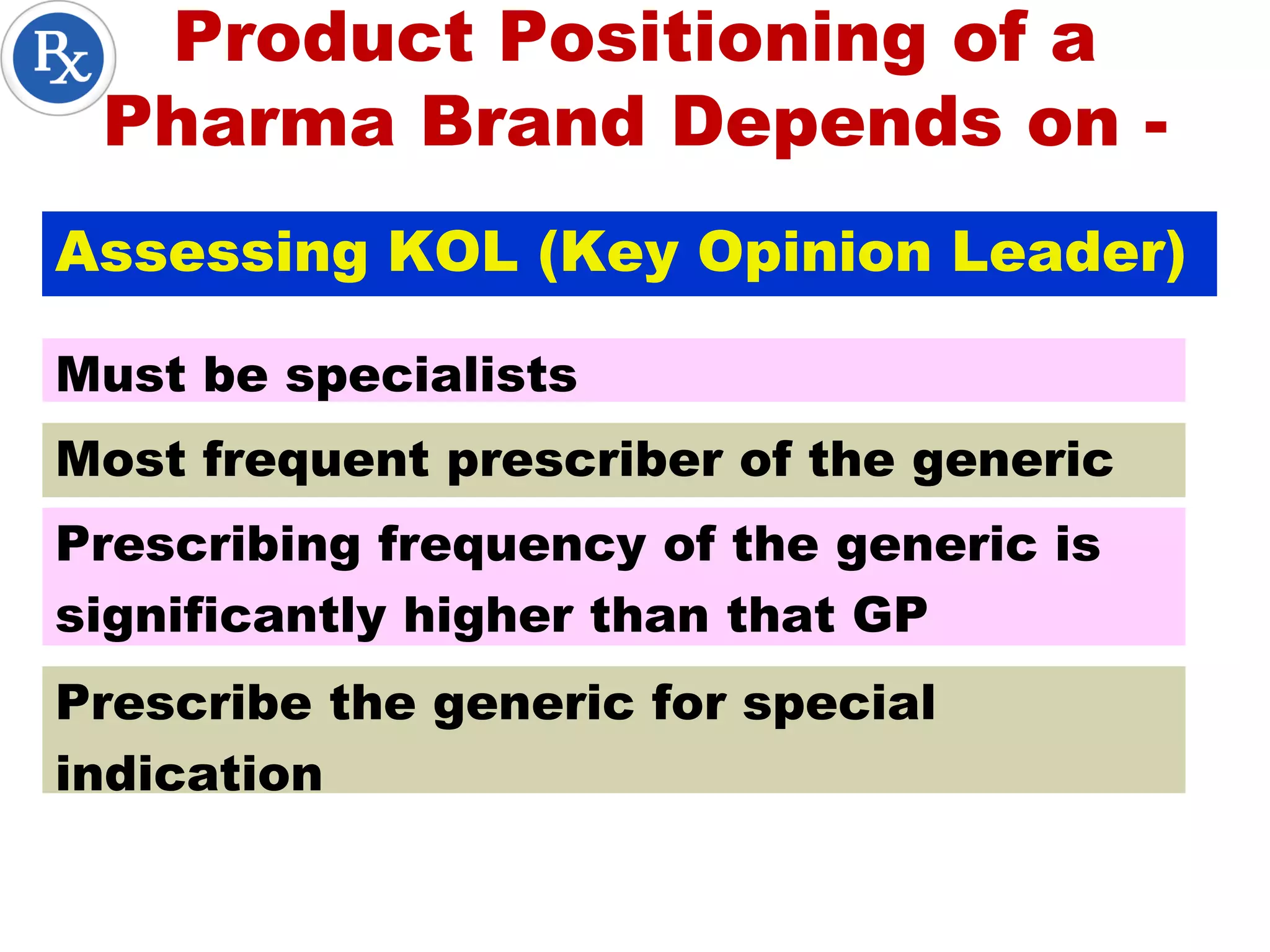

1. Understand physicians' prescription habits to better target brands and position products based on indication.

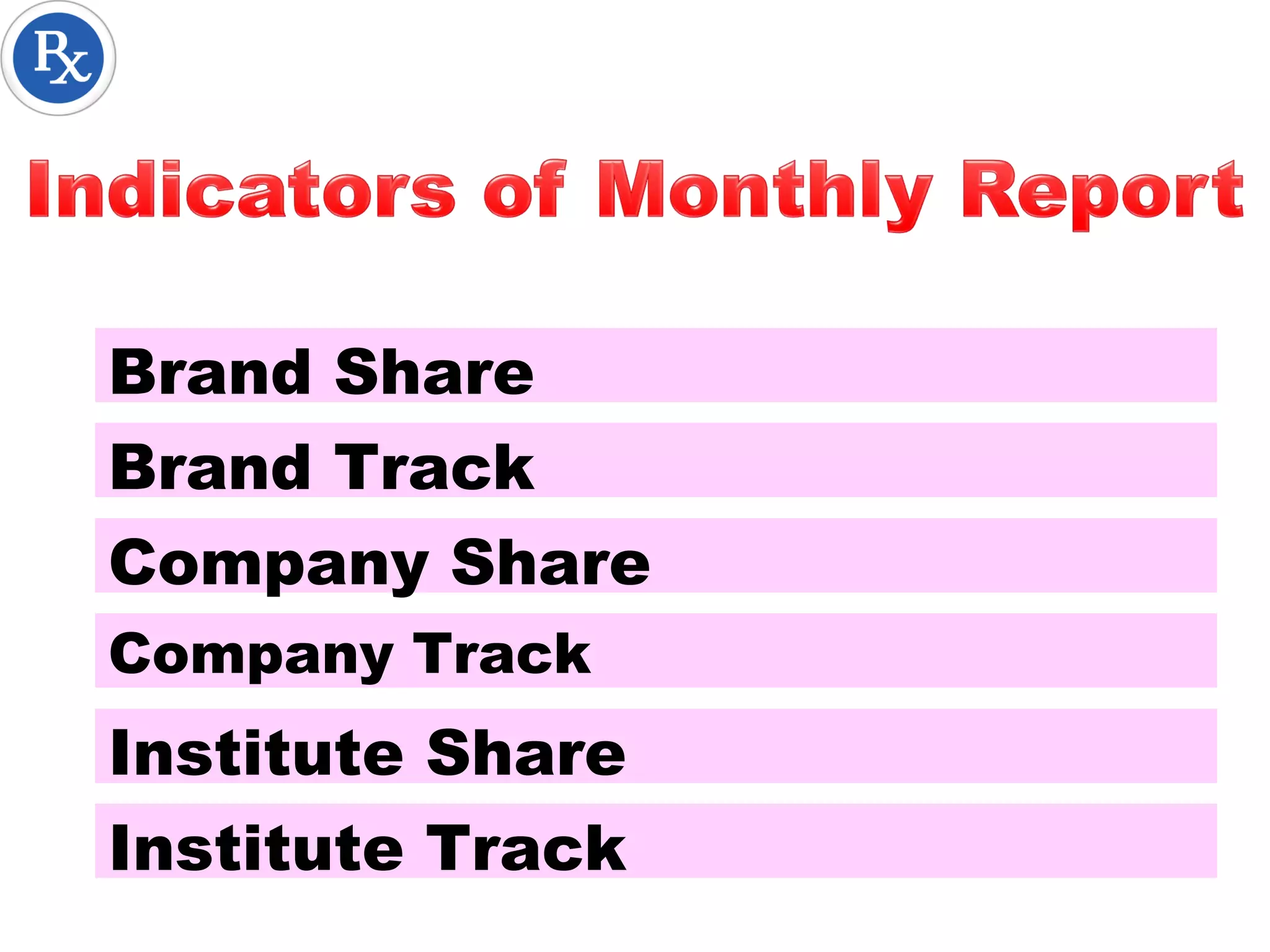

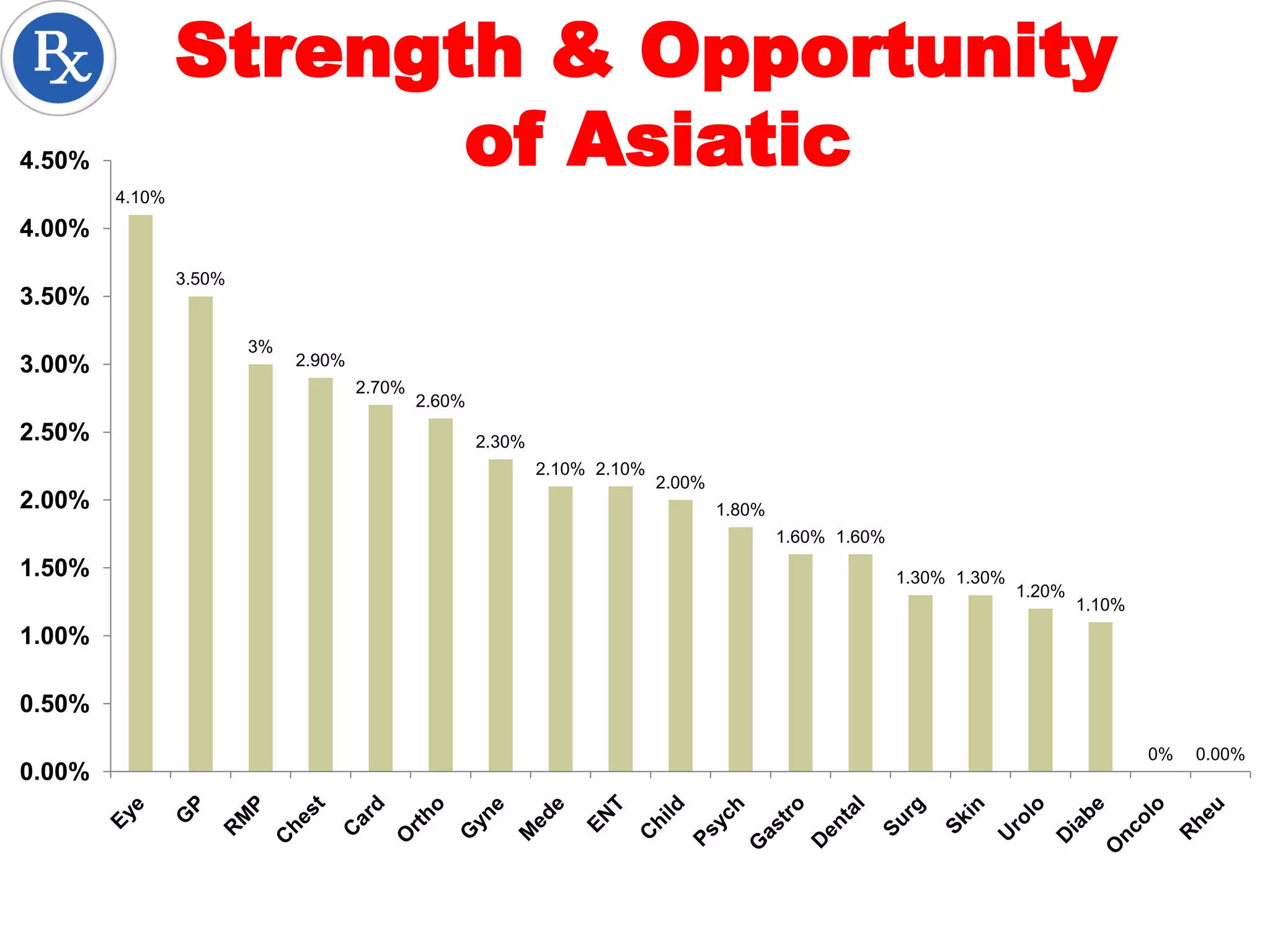

2. Monitor marketing program performance by assessing brand, company, and institutional shares.

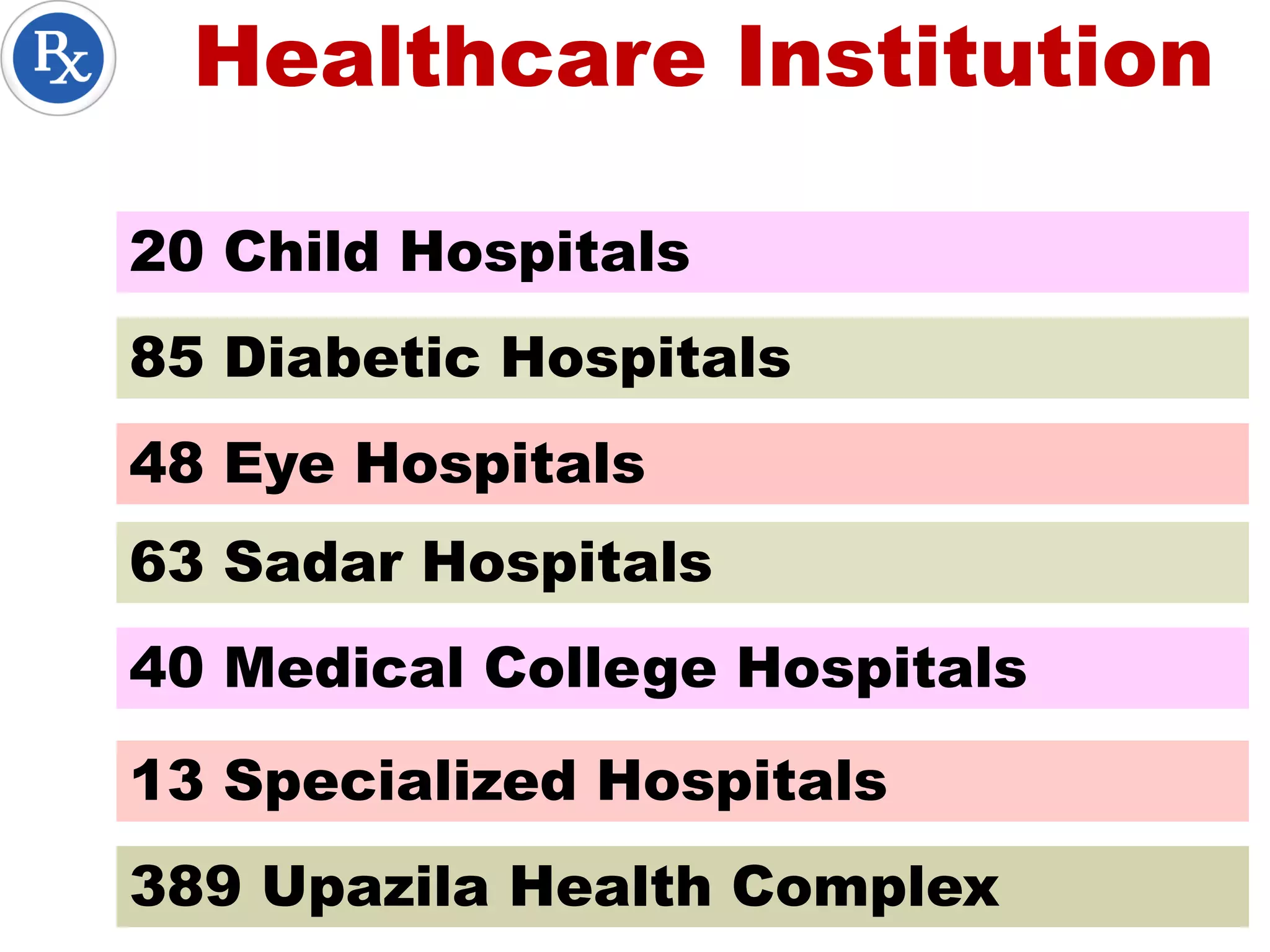

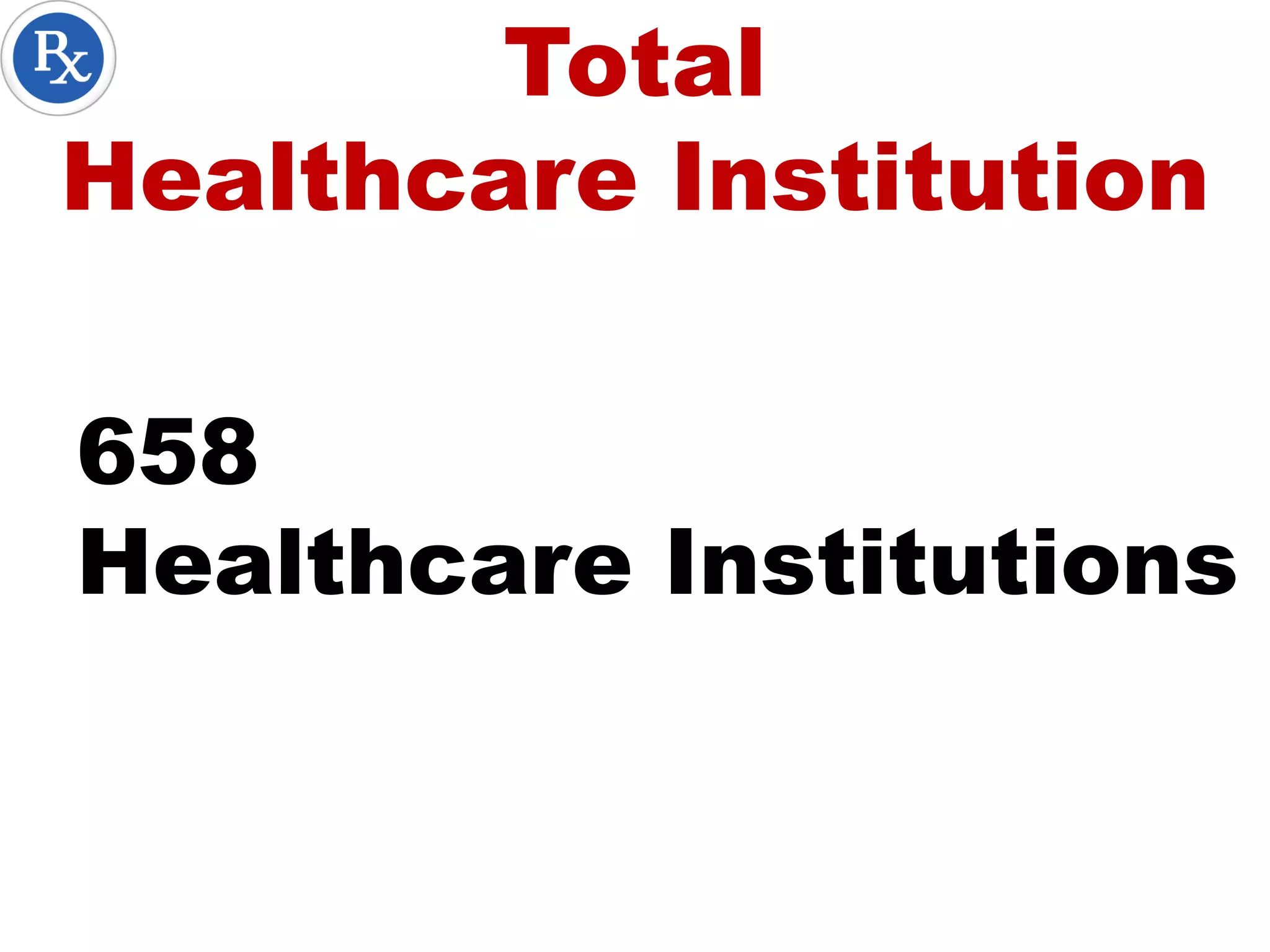

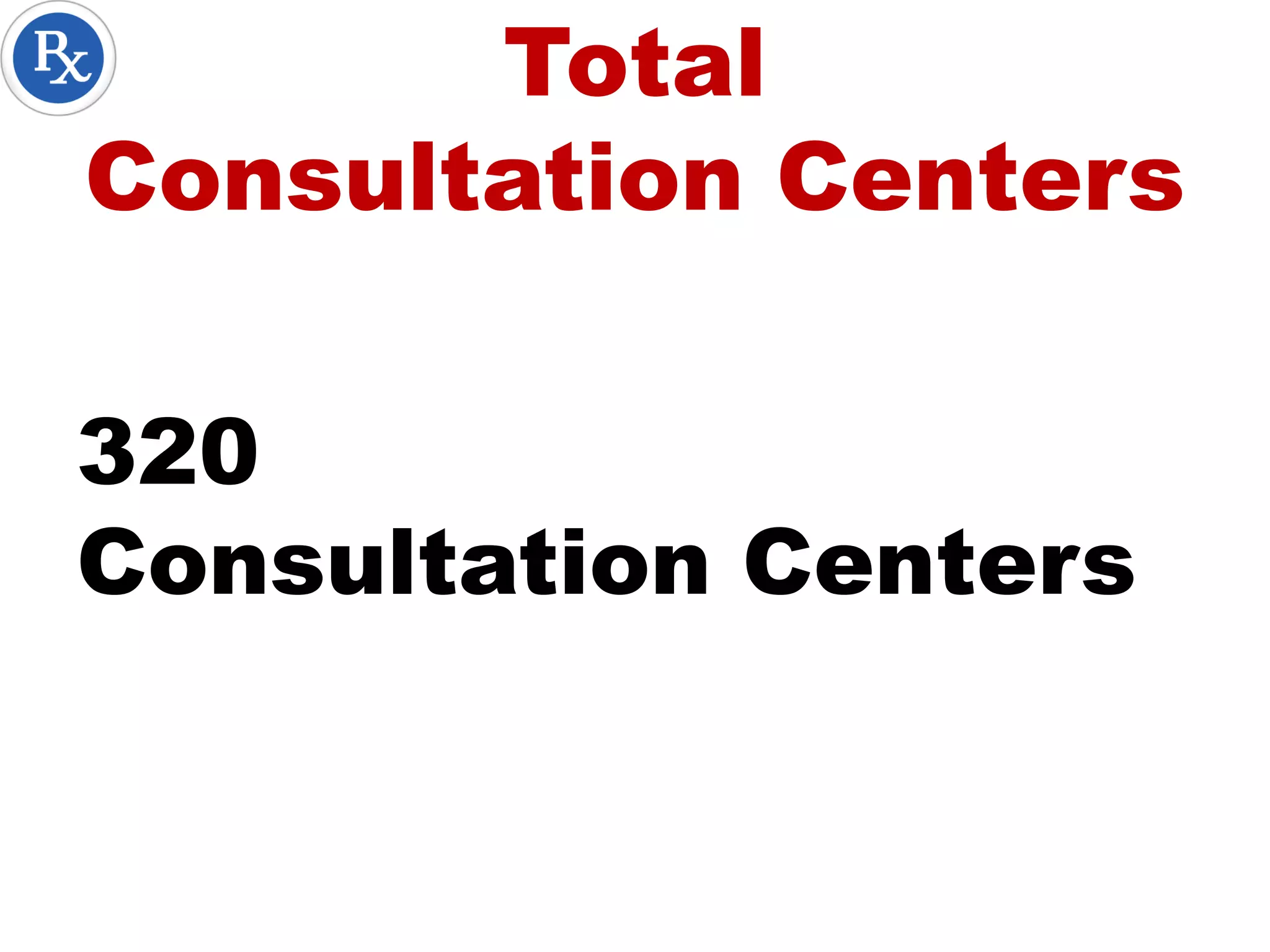

3. Identify uncovered potential customers and markets through analysis of prescription data.