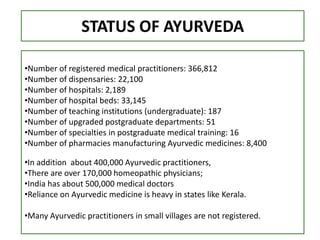

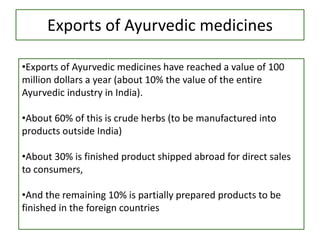

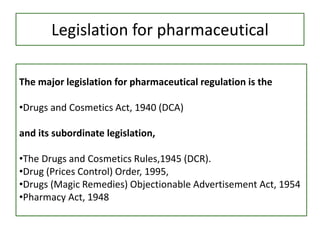

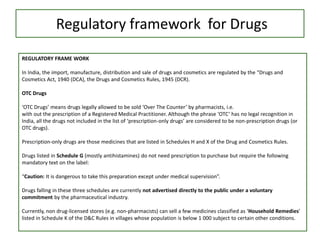

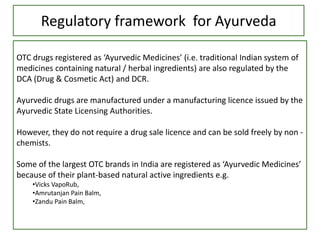

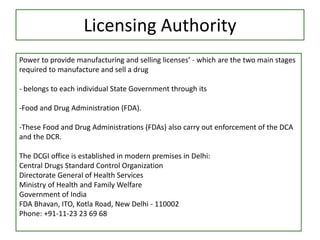

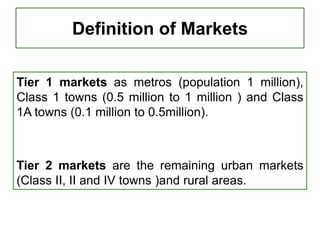

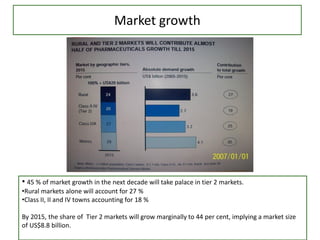

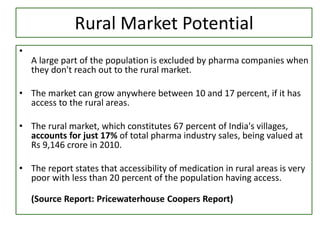

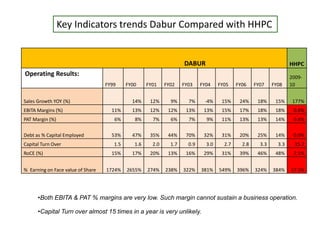

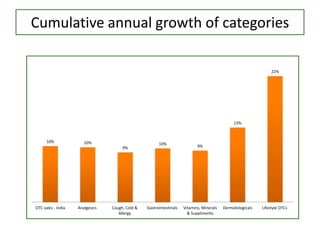

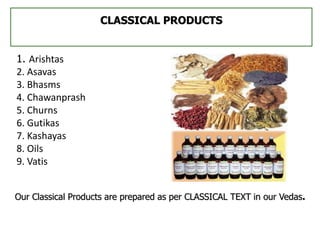

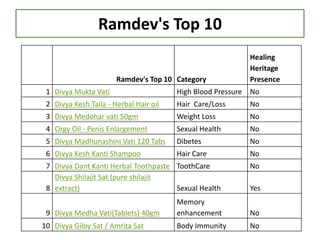

This document provides information on the status and prospects of the Ayurveda industry in India. It notes that there are over 366,000 registered Ayurvedic medical practitioners and over 8,400 pharmacies manufacturing Ayurvedic medicines in India. Exports of Ayurvedic medicines have reached $100 million annually, with herbs, finished products, and partially prepared products being exported. The document also discusses regulations governing Ayurvedic drugs and over-the-counter medicines under the Drugs and Cosmetics Act and emerging trends in the rural market potential and growth drivers of the Ayurvedic industry in India.