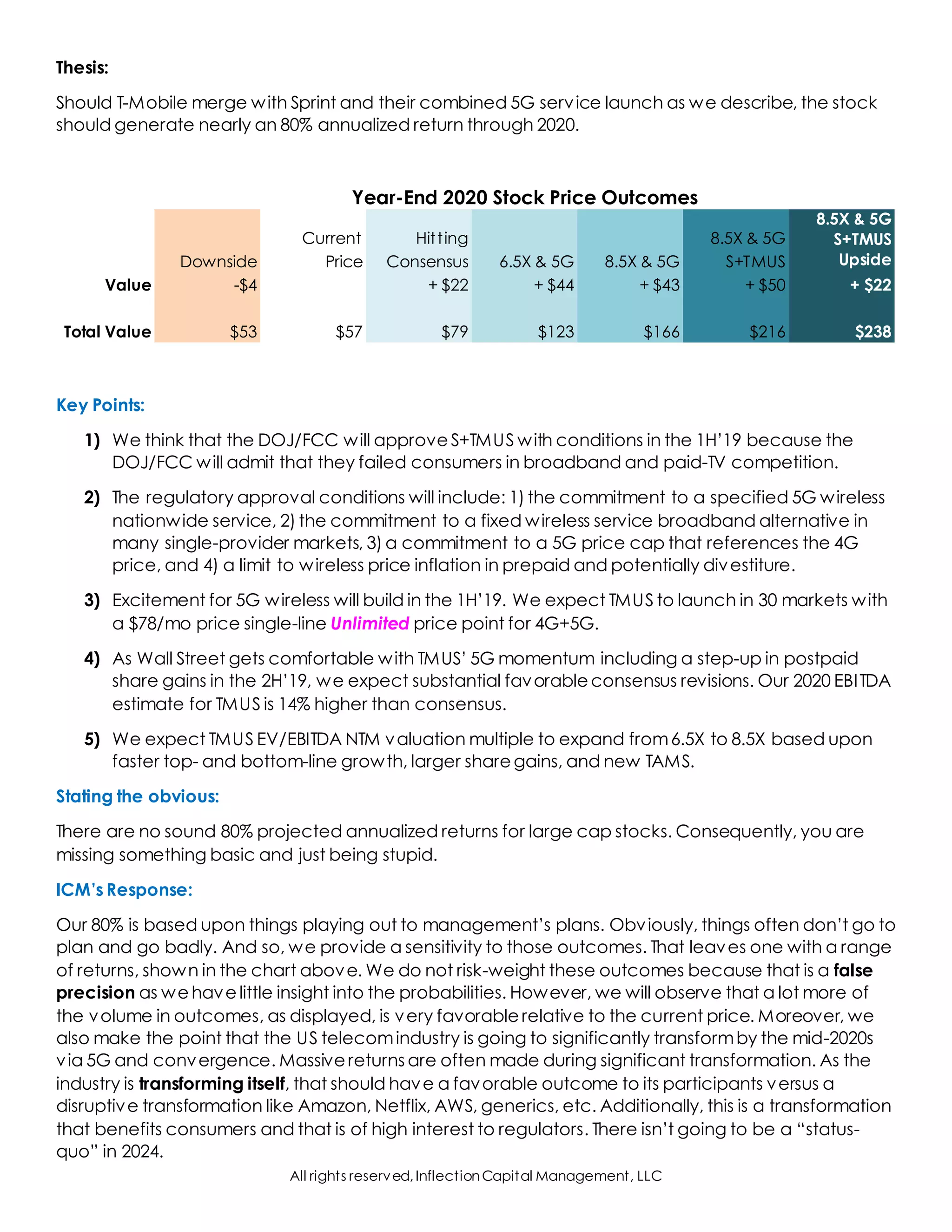

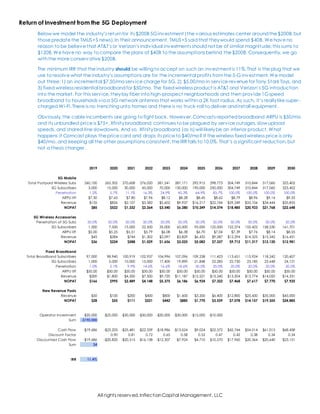

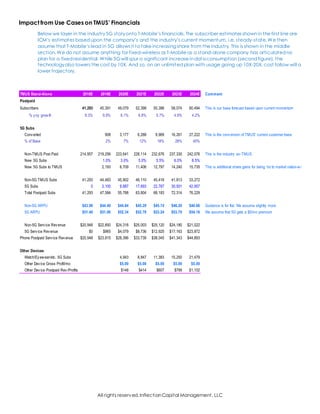

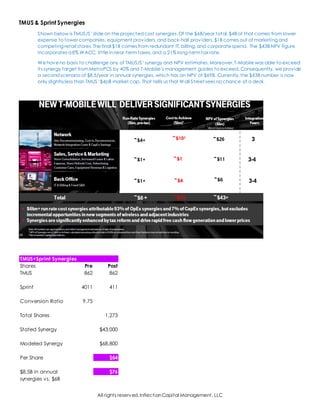

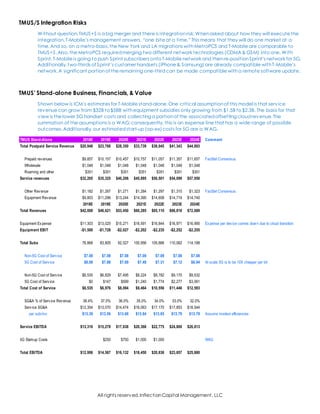

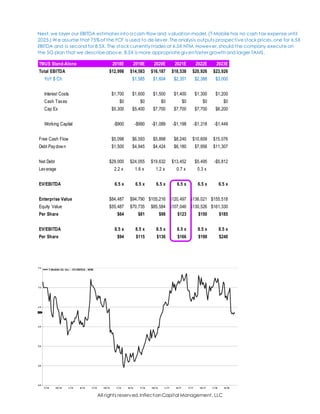

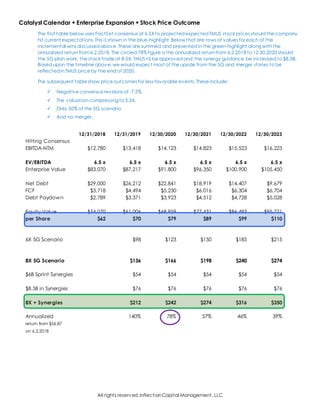

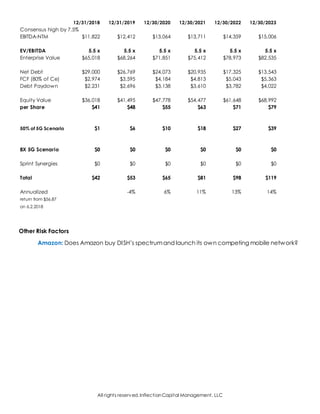

The document discusses a thesis that if T-Mobile and Sprint merge and successfully launch their combined 5G network service as described, T-Mobile's stock should generate an annualized return of nearly 80% through 2020. It outlines key points supporting this, including that regulators will likely approve the merger in early 2019 due to failures in broadband and pay-TV competition, and conditions will be set around 5G service commitments and pricing caps. It also predicts excitement and adoption of 5G will build in early 2019, leading to consensus earnings revisions and multiple expansion, driving the projected stock returns. However, it acknowledges there are no guaranteed 80% returns for large caps and provides sensitivity analysis around potential outcomes.