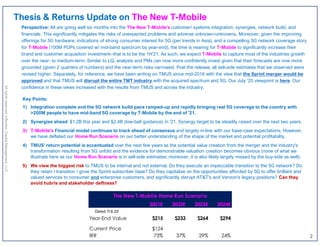

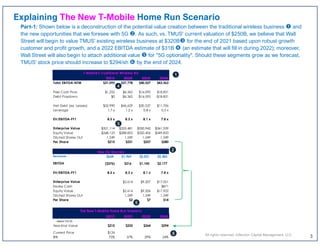

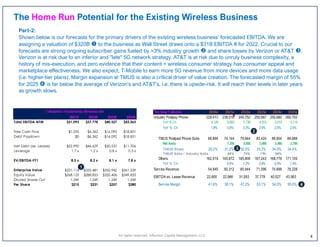

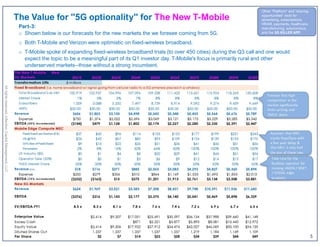

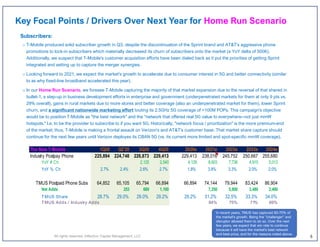

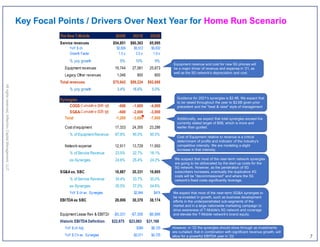

This document discusses T-Mobile's path forward and potential returns. It provides forecasts for T-Mobile's value, subscribers, revenue, EBITDA and other financial metrics from 2020-2024. It sees potential for T-Mobile to capture more industry growth through its 5G network buildout and disrupt competitors. Key risks include successful integration of Sprint and capitalizing on 5G opportunities through new services and avoiding complacency.