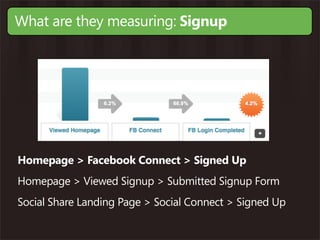

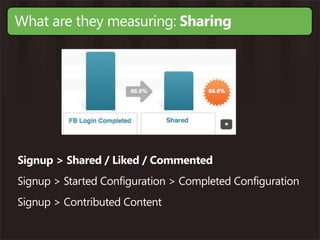

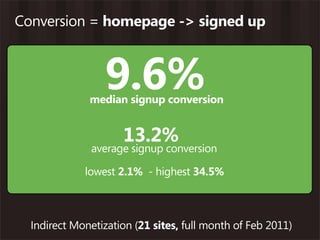

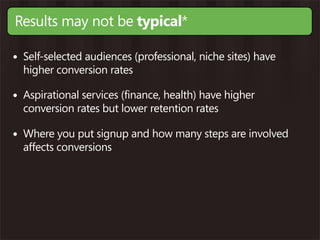

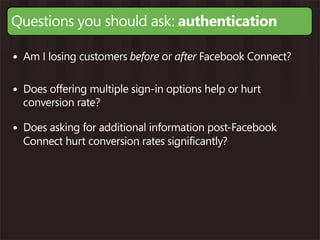

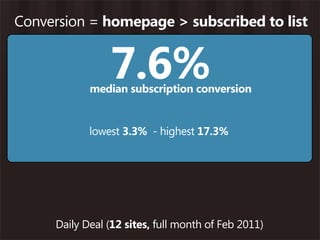

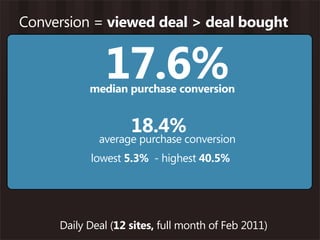

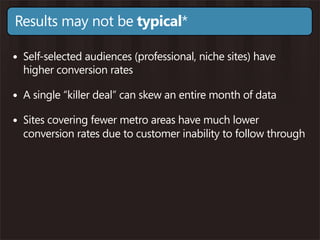

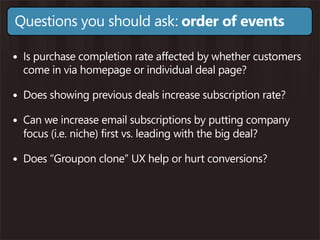

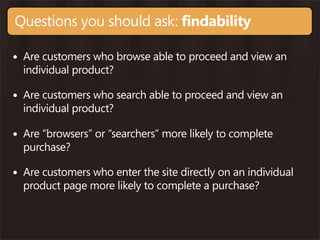

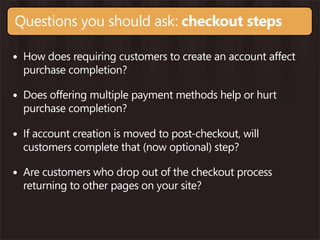

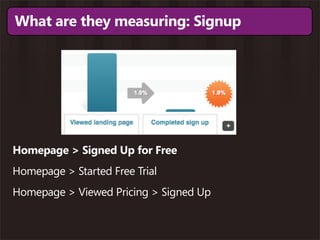

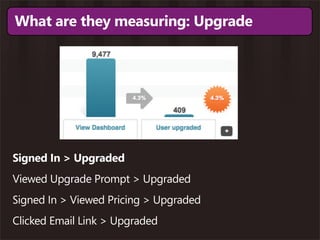

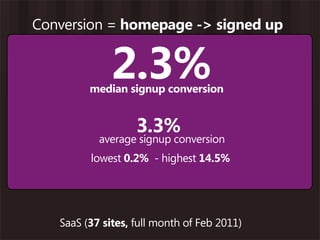

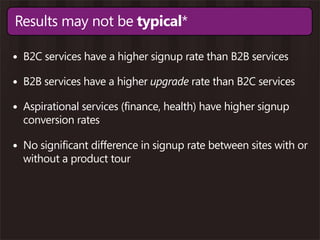

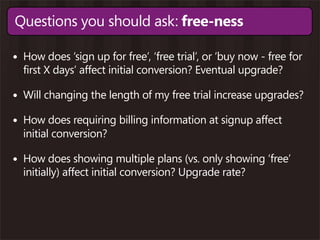

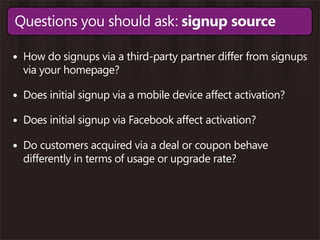

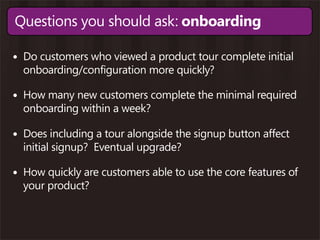

The document presents insights from Kissmetrics on customer conversion rates across various online business models, such as e-commerce, SaaS, and daily deals, based on data collected from over 300 web businesses. Key observations include the impact of signup processes, the role of friction in conversions, and differences in behavior across business types. It emphasizes that results vary widely and encourages businesses to ask specific questions to improve their conversion strategies.