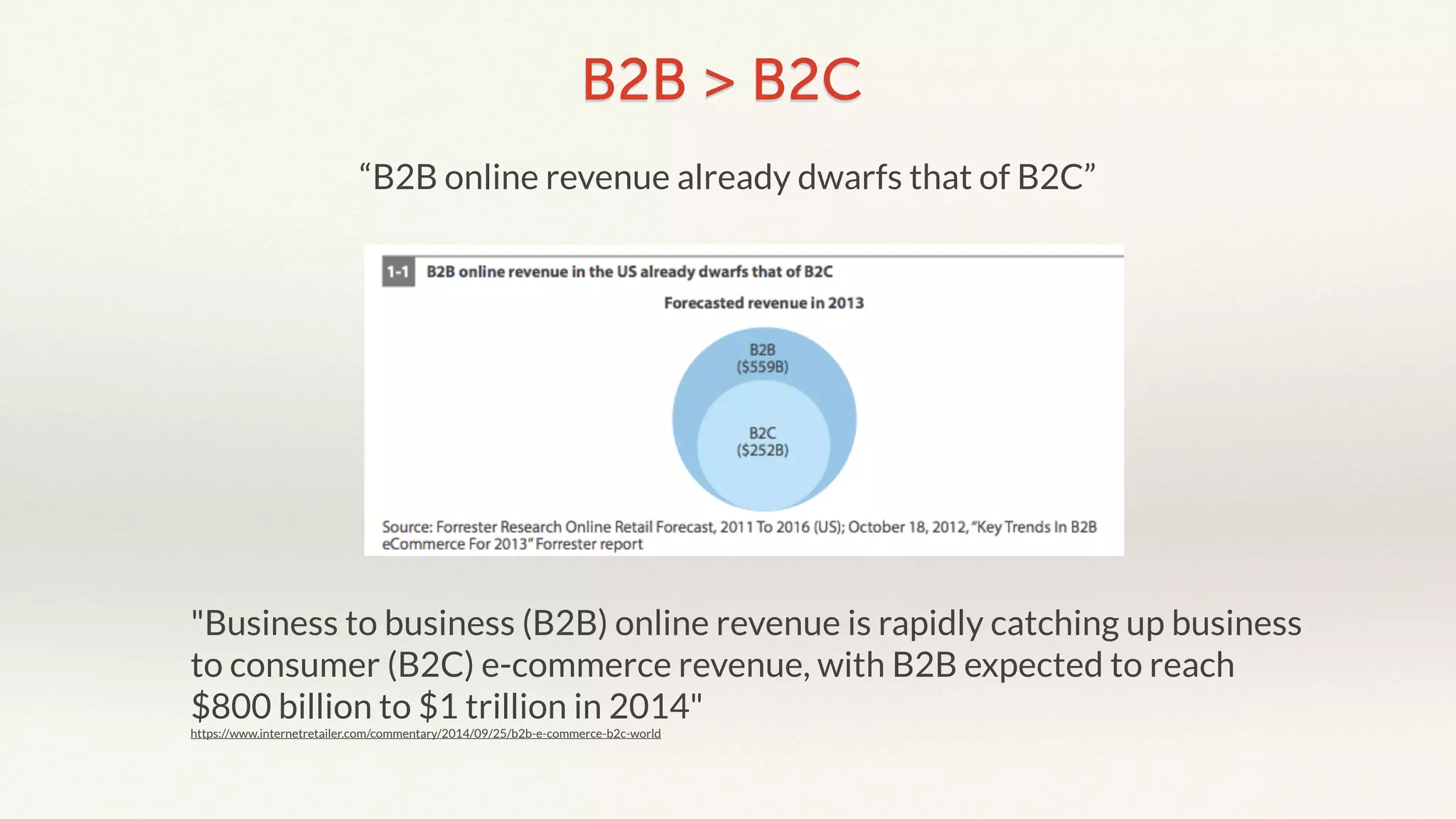

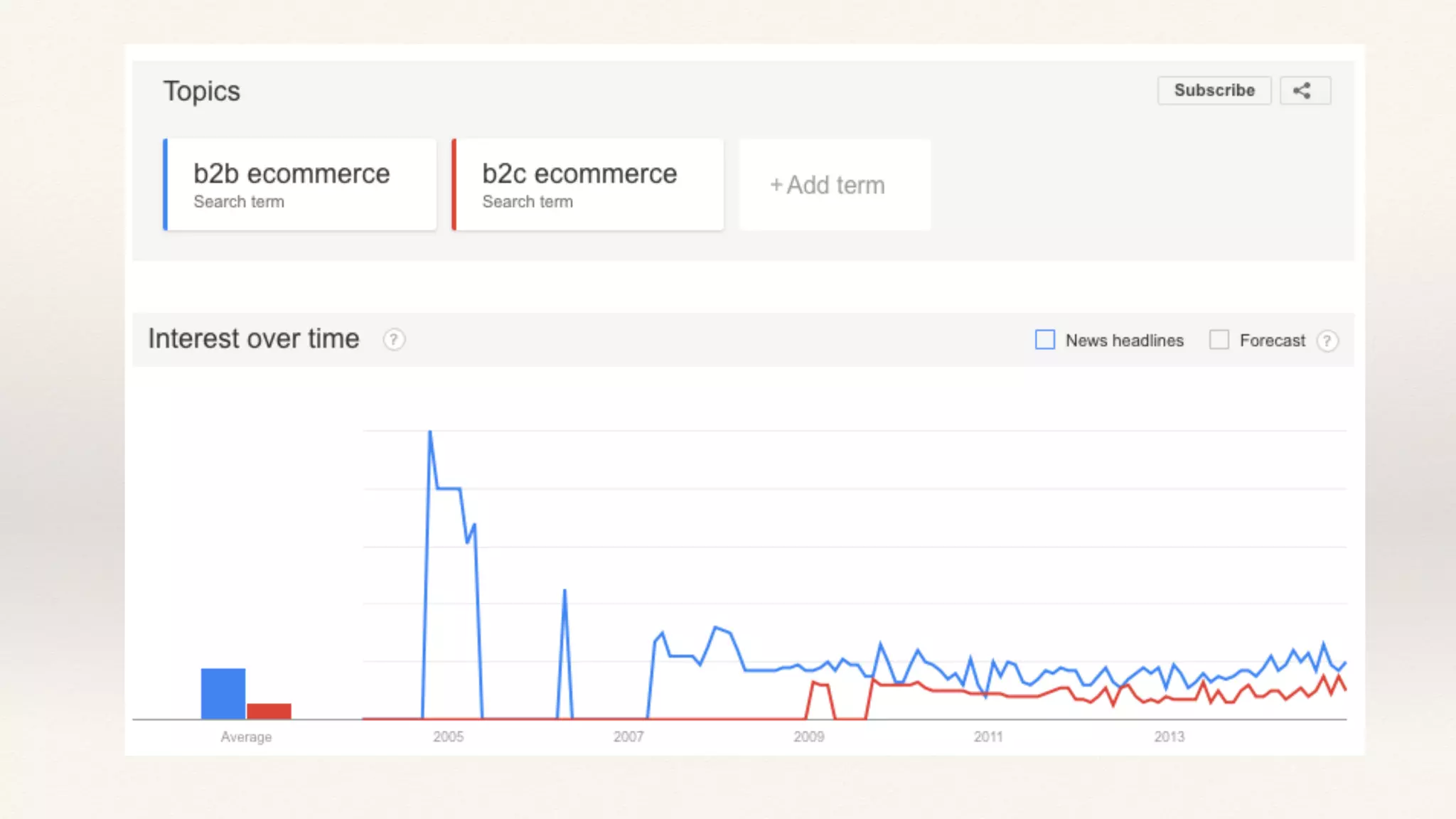

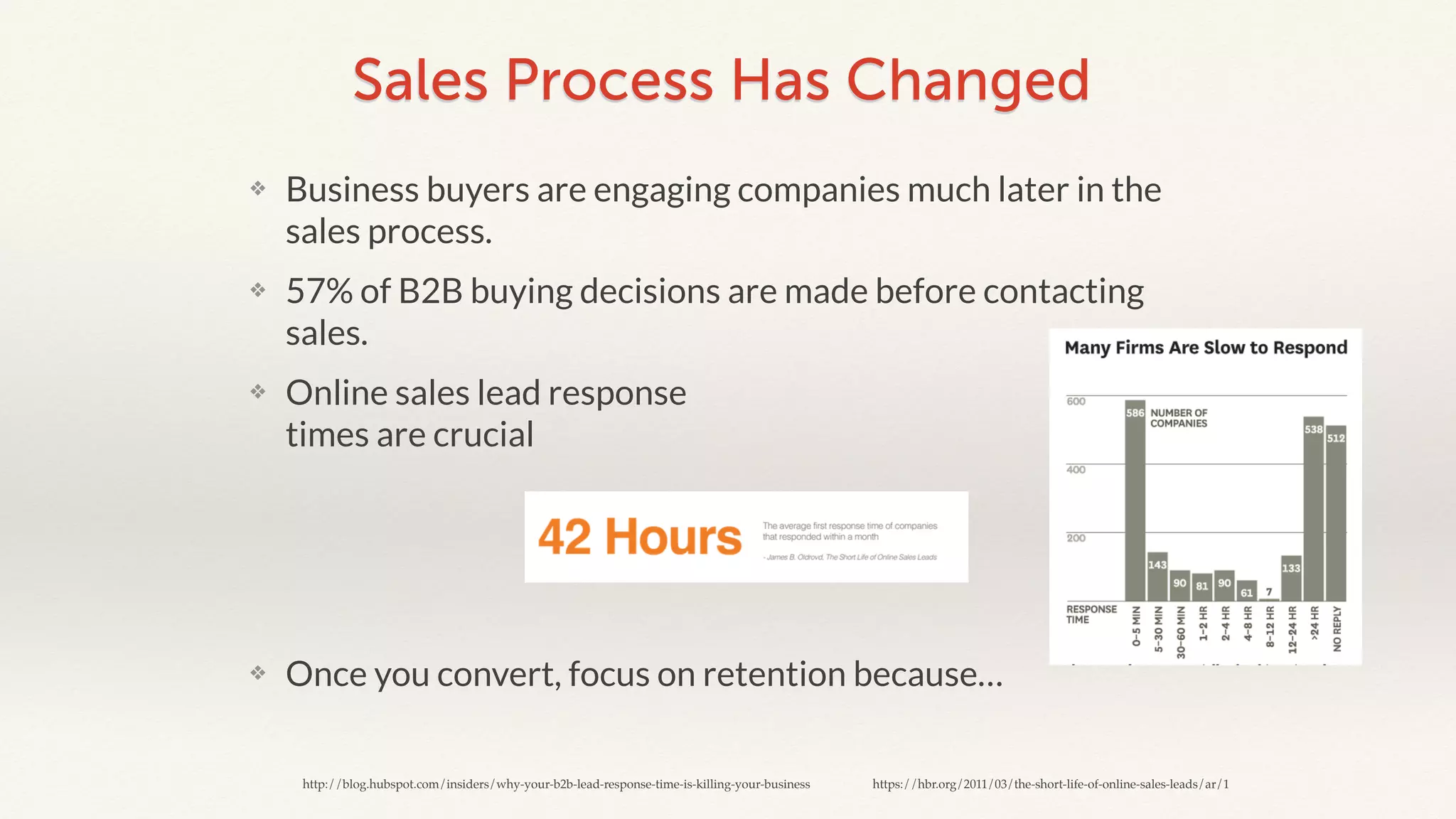

This document discusses key aspects of business-to-business (B2B) e-commerce. It notes that B2B online revenue exceeds business-to-consumer revenue and is projected to reach $12 trillion by 2020. Unlike B2C, B2B purchasers prioritize efficiency and need robust product information over user experience features. Successful B2B e-commerce requires understanding customer workflows, integrating with business systems, and providing self-service options rather than relying on sales. While still early, B2B e-commerce presents major opportunities for companies that can address the distinct needs of business purchasers.