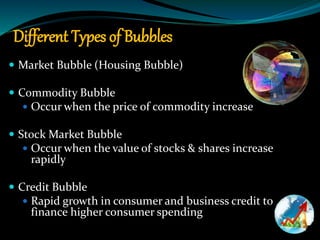

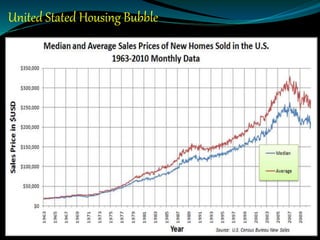

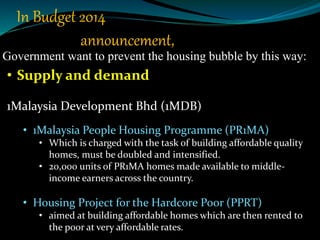

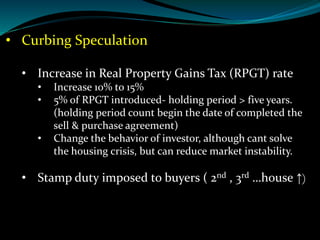

This document discusses economic bubbles, providing examples and theories. It focuses on the United States and Malaysian housing bubbles. Different types of bubbles are defined, including market, commodity, stock, and credit bubbles. The document outlines the history of bubbles like the tulip mania and dot-com bubble. Social psychology theories for bubbles are explained, and the effects of bubbles discussed. The US housing bubble and its causes are analyzed, along with the impact on employment. Malaysia's housing bubble is also examined, outlining factors like foreign investment and government efforts to manage supply and demand.