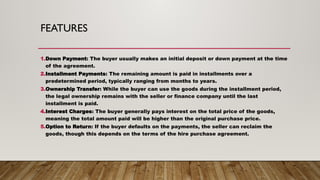

The hire purchase system allows buyers to acquire goods through an initial down payment followed by installment payments, giving immediate use of the items without full ownership until all installments are paid. Key features include affordability through flexible payments, improved cash flow for businesses, and the opportunity to build credit history, while drawbacks involve higher total costs and risks of repossession. This system benefits both consumers and businesses by facilitating access to expensive items and stimulating economic growth.