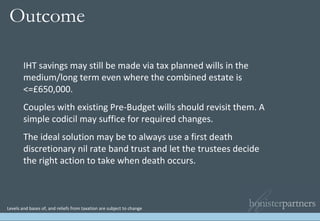

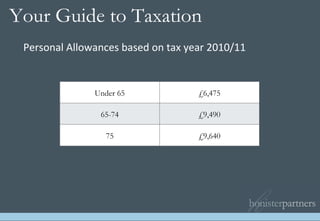

The document offers a comprehensive guide to pre-retirement financial planning, covering key topics such as money management, taxation, investments, and inheritance tax. It stresses the importance of evaluating personal financial situations to maintain living expenses in retirement and outlines strategies for managing income and capital effectively. Additionally, it highlights the significance of wills and estate planning to ensure proper distribution of assets and minimize tax liabilities upon death.

![Levels and bases of, and reliefs from taxation are subject to change. Inheritance Tax Solution Mr Smith’s Estate £325,000 Mrs Smith’s Estate £325,000 Mr Smith leaves the £325,000 in a Discretionary Will Trust. Total Estate = £325,000 Taxable Estate = Nil Nil Rate Band £325,000 (As of April 2010) If the potential growth in value of an asset is likely to outstrip future increases in the Nil Rate Band, tax planned Wills on first death leaving an amount up to £325,000 [2010/11] to a trust should still be considered. TAX DUE @ 40% NIL TAX DUE @ 40% = NIL Year 2010 value of trust - £390,000 (available NRB - £325,000 had asset passed to surviving spouse on first death.)](https://image.slidesharecdn.com/slides-preretirement-110412061344-phpapp01/85/Slides-Pre-Retirement-37-320.jpg)