This document discusses various financial concepts including life insurance, taxes, savings, and investing. It emphasizes the importance of financial knowledge and planning for the future. Some key points include:

- There are two main types of life insurance: term life (which has lower monthly costs when younger but expires after a set time period) and permanent life (which lasts a lifetime but has higher monthly costs).

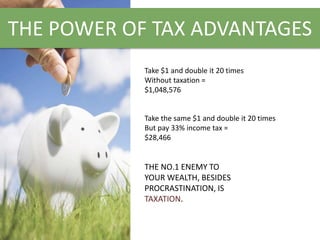

- Taxes can significantly impact investment returns over time. Strategies like tax-advantaged accounts can help maximize savings.

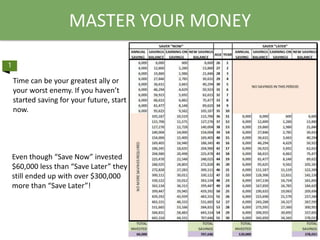

- Starting to save early allows time to be an ally rather than an enemy due to compound interest. Waiting longer to save can result in hundreds of thousands of dollars less at retirement.

-