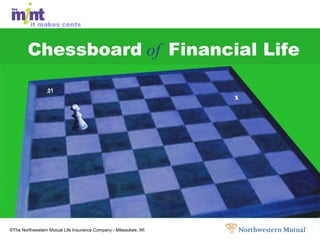

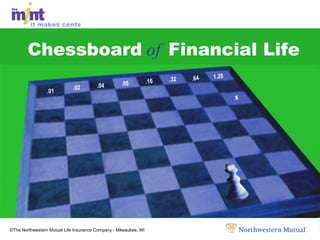

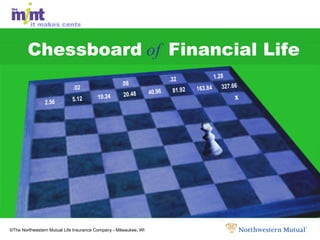

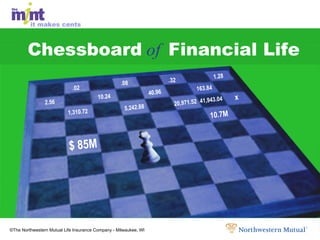

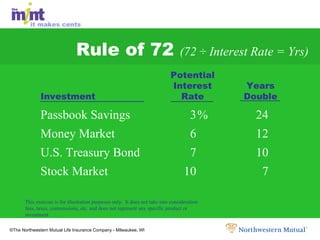

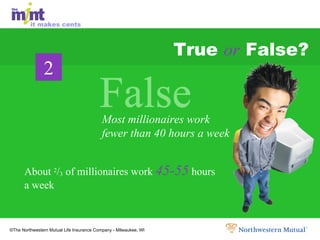

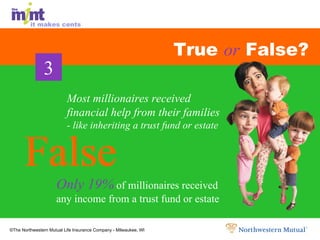

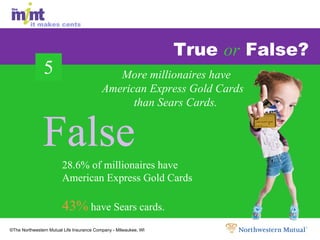

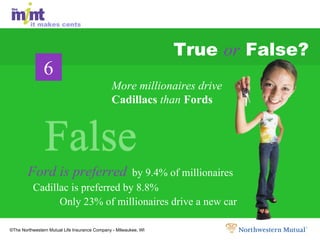

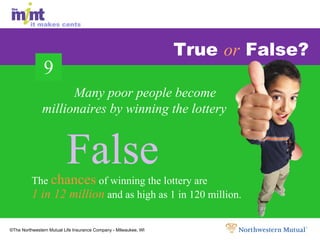

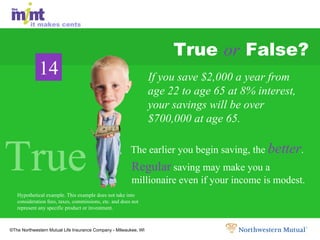

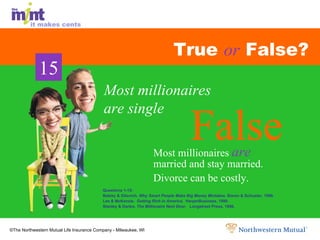

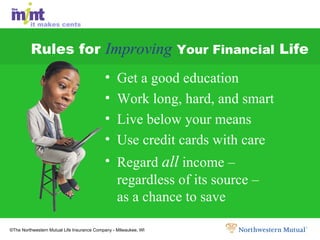

This document provides financial fitness exercises and tips for money management. It discusses compound interest and how small regular savings can grow significantly over time. It also summarizes findings about the characteristics of millionaires, including that most have college degrees, work regular hours, and received little financial help from family. True or false questions reveal that things like lottery wins and expensive cars are not typical paths to becoming a millionaire.