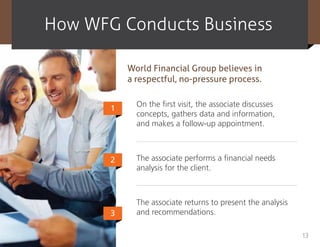

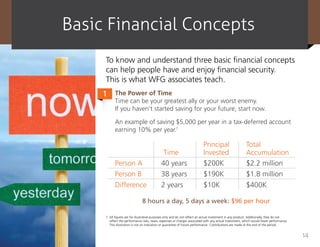

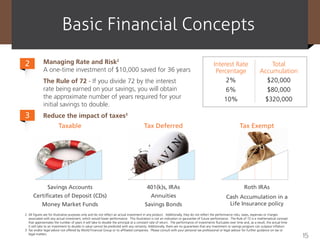

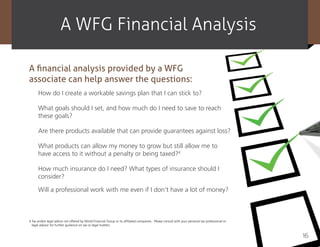

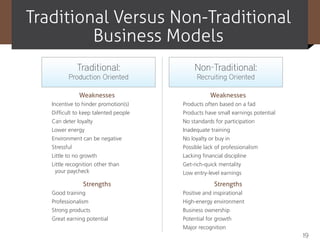

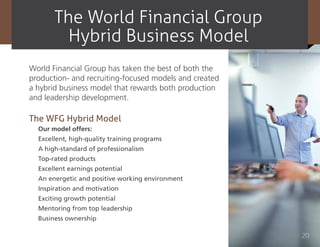

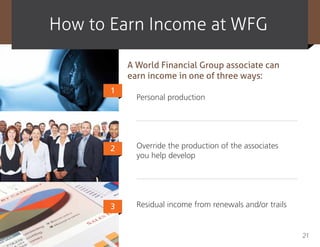

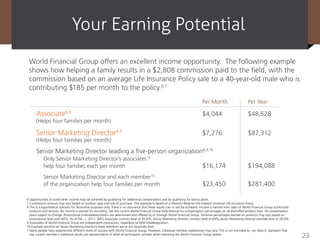

World Financial Group provides financial services and products to help people achieve better financial futures. It uses a hybrid business model that rewards associates for both sales production and leadership in developing other associates. The opportunity allows associates to earn income through their own sales, overrides on other associates' sales, and residuals. World Financial Group focuses on serving middle-income individuals and families and provides training and support to help associates be successful.