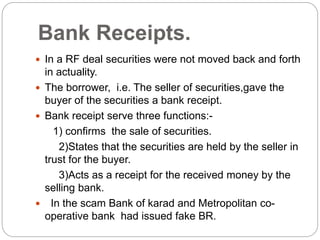

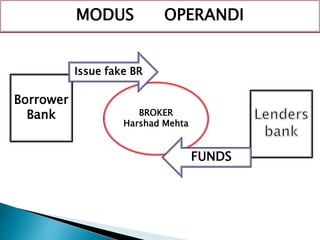

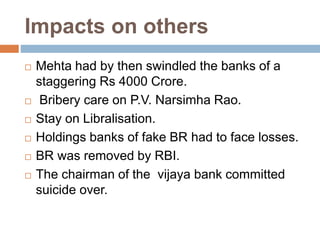

Harshad Mehta used loopholes in the banking system in the early 1990s to divert Rs 4000 crore and manipulate stock prices in what became known as the Harshad Mehta securities scam. He used instruments like ready forward deals and fake bank receipts to carry out the fraud. The scam had major impacts, including stalling economic reforms and causing losses for banks. Mehta was later arrested and banned from stock trading, facing over 600 lawsuits. The scam exposed weaknesses in the financial system and led to regulatory changes to strengthen oversight of markets.