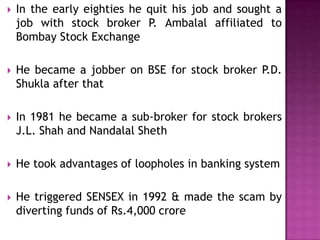

Harshad Mehta was an Indian stockbroker born in 1953 who triggered a securities scam in 1992 by diverting Rs. 4,000 crore from banks to inflate stock prices. He took advantage of loopholes in the banking system to siphoned money and bought shares, artificially raising prices. His actions were later exposed, causing the stock market to crash and devastating many investors. Mehta was charged with 72 criminal offenses and banned from trading, and his actions highlighted issues with regulation and oversight in the financial system.