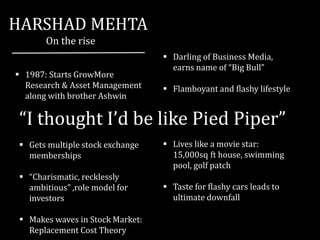

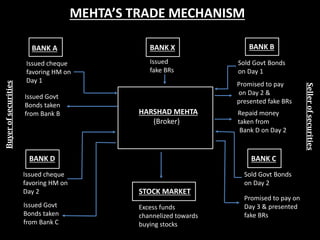

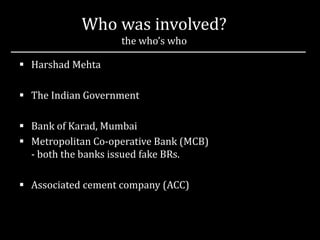

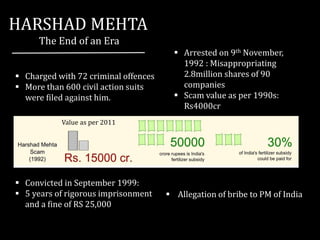

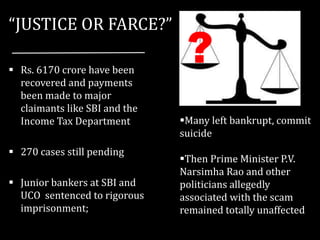

Harshad Mehta, known as the 'Big Bull,' rose from modest beginnings to become a prominent figure in the Indian stock market, only to orchestrate the 'technology security stock scam' that led to his arrest for misappropriating shares worth INR 4,000 crore. His scandal involved fake bank receipts and resulted in his conviction in 1999, alongside significant losses for investors and ongoing legal repercussions. The aftermath of the scam raised serious questions about government policy and financial regulations in India.