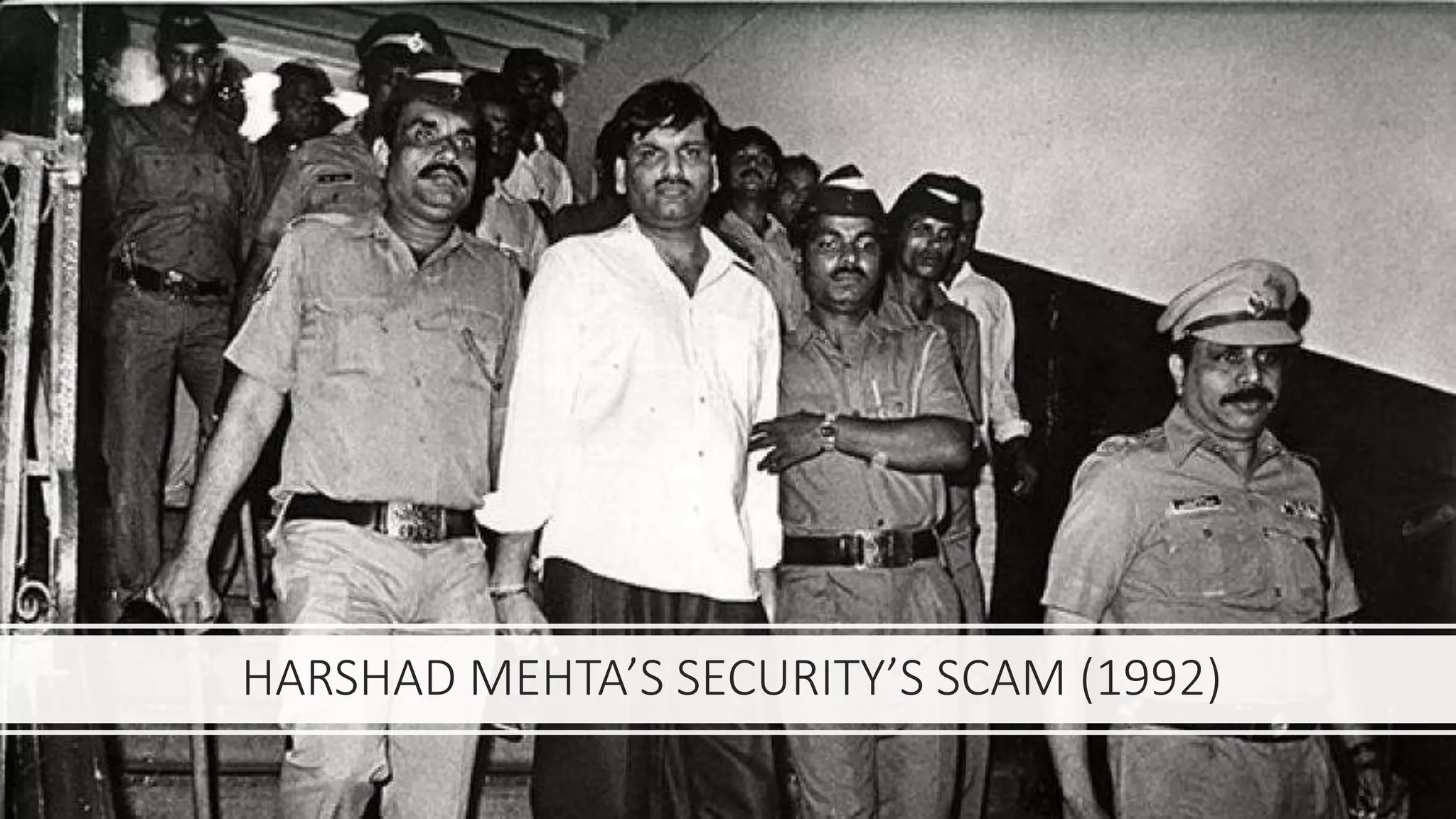

Harshad Mehta, a prominent stock broker, orchestrated a massive securities scam in 1992 by manipulating the stock market through fraudulent bank receipts, borrowing almost Rs 4000 crores. His actions led to 72 criminal charges and approximately 600 civil actions after the scam was exposed by journalist Sucheta Dalal, revealing the unethical practices that inflated stock prices. The aftermath saw significant impacts on various banks and the loss of public trust, culminating in Mehta's arrest and eventual death in 2001.