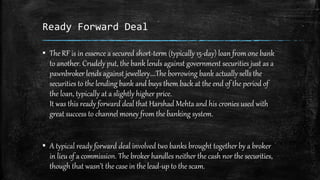

Harshad Mehta used ready forward deals between banks to illegally divert funds into the stock market in the early 1990s, inflating share prices. Known as the "Big Bull", Mehta took prices of stocks like ACC from Rs. 200 to Rs. 9,000 before the market crashed when he had to book profits. The scam was exposed by journalist Sucheta Dalal and led to a sharp fall in indices and Rs. 100,000 crores loss in market capitalization. While total claims were over Rs. 20,000 crores, some banks recovered portions of their dues after Mehta's death. The scam led to reforms by SEBI including greater powers to regulate markets and penalize violations.