Embed presentation

Downloaded 154 times

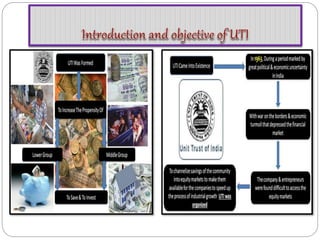

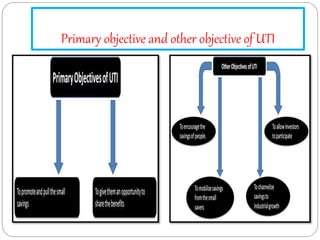

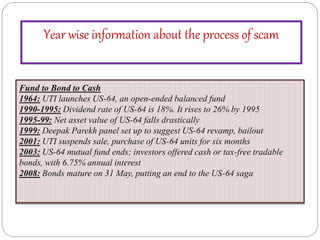

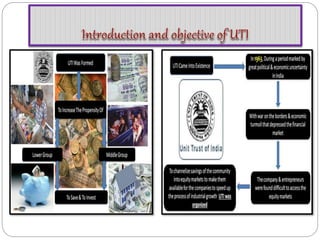

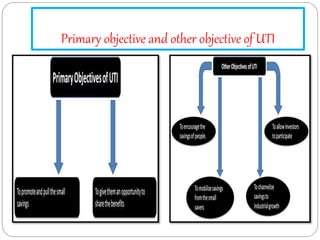

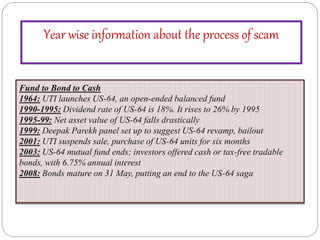

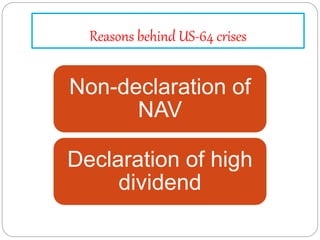

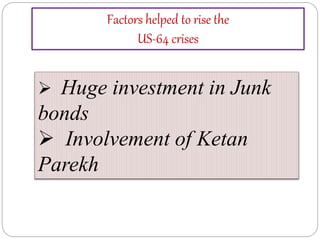

The document summarizes the UTI scam that occurred in India involving the US-64 mutual fund scheme. It provides background on the establishment and growth of US-64 in the 1960s-1990s when its dividend rates rose to 26%. From 1995-1999, the fund's net asset value fell drastically. A panel was formed in 1999 to revamp the fund following the crisis. UTI then suspended trading of US-64 units for six months in 2001 before ending the fund in 2003 and offering investors cash or bonds. The document outlines reasons for the crisis such as non-declaration of net asset values, high dividends, investment in junk bonds, and involvement of Ketan Parekh. It also discusses the impact on investors