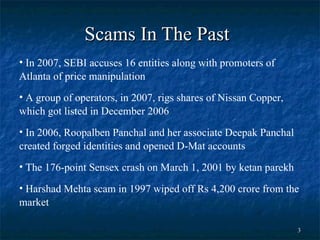

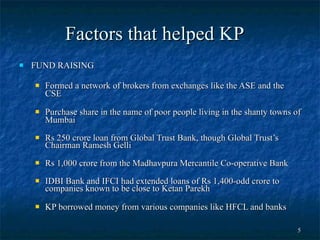

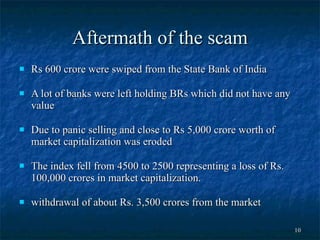

The document summarizes several stock market scams that have occurred in India, including the Ketan Parekh scam of 2001 and the Harshad Mehta scam of 1992. The Ketan Parekh scam involved diverting over Rs. 3500 crores from banks to finance stock market operations through price manipulation. Ketan Parekh raised funds through various methods and then used the shares as collateral to obtain more loans, causing losses when share prices fell. The Harshad Mehta scam in 1992 rigged prices of several stocks and siphoned Rs. 4,000 crores from the banking system through fake transactions, eroding over Rs. 5,000 crores from the stock market. Both scams shook investor confidence