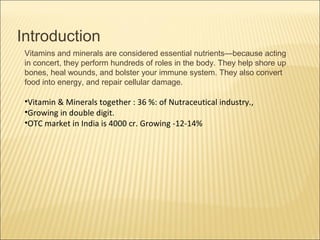

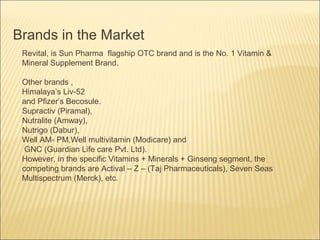

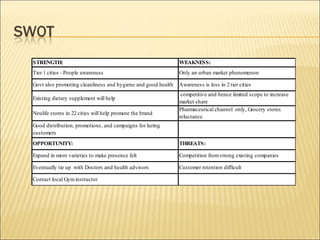

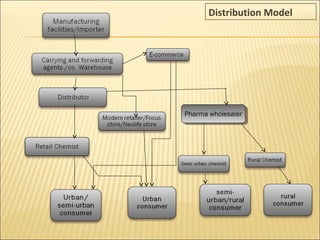

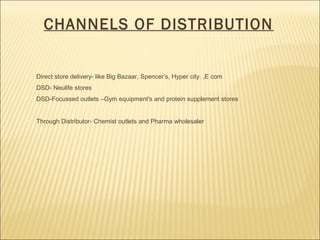

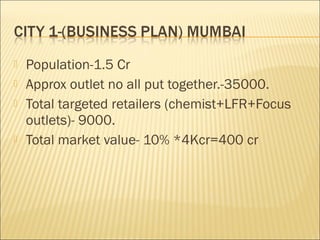

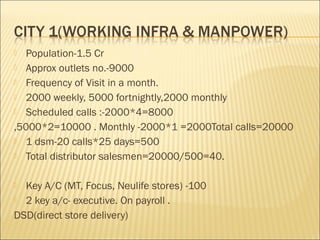

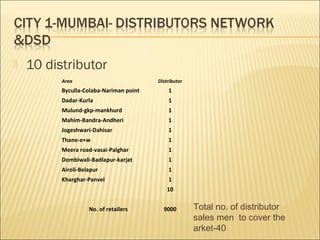

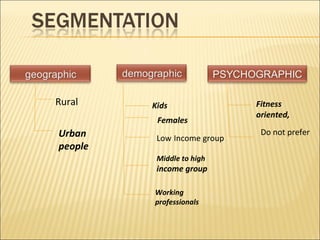

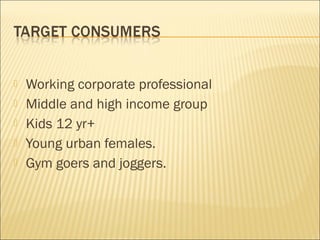

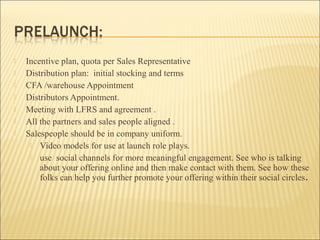

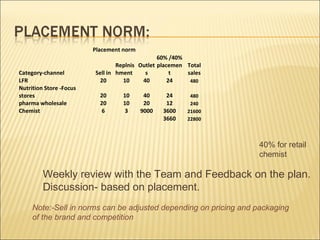

This document discusses the distribution model and launch plan for a new vitamin and mineral supplement brand in India. It outlines key details of the distribution network including 10 distributors covering different regions who will each manage around 40 sales representatives. The document also discusses the target consumer segments and marketing strategies such as in-store merchandising and sampling that will be used during the product launch.