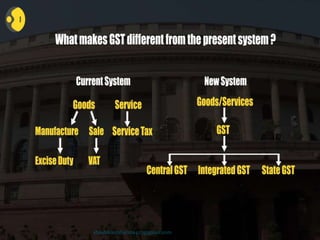

The document discusses key aspects of the Goods and Services Tax (GST) implemented in India in 2017 such as:

1) GST replaced several existing indirect taxes and levies and aims to create a single, unified Indian market.

2) Under GST, taxes are levied on the supply of goods or services based on the place and point of supply.

3) Determining the place and time of supply is important as it dictates whether a supply is intra-state or inter-state and impacts tax rates and collection.

![As per Section 12(2)

of CGST ACT, time of

supply of goods shall

be earlier of

invoice/ payment,

i.e., –

Actual date of issue of invoice by the supplier (INVOICE)

Due date for issue of invoice by the supplier [Section 31]:

- Supply involves movement: Time of removal of goods

for supply

- Other cases: Delivery of goods/ making available to the

recipient or (INVOICE)

Date on which payment is entered in the books of supplier

(PAYMENT)

Date on which payment is credited to the supplier’s bank

a/c (PAYMENT)

Time of Supply of Goods :

shashikantsharma427@gmail.com](https://image.slidesharecdn.com/gstvsvat-171210032246/85/Gst-vs-vat-28-320.jpg)

![Time of supply of services :

As per Section 13(2)

of CGST ACT, time of

supply of services

shall be earlier of

invoice/payment

i.e., –

Actual date of issue of invoice by the supplier

Due date for issue of invoice by the supplier [Section 31*]:

- Before/ after the supply of service, but within 30 days

Date on which payment is entered in the books of supplier

Date on which payment is credited to the supplier’s bank

a/c

*Where payment is received in advance, the Supplier shall issue a receipt voucher,

and NOT a tax invoice shashikantsharma427@gmail.com](https://image.slidesharecdn.com/gstvsvat-171210032246/85/Gst-vs-vat-29-320.jpg)

![ To distribute the credit of input services, the ISD would be required to

follow the manner prescribed by the rules, including:

o Issue of an ISD invoice to each recipient of credit on every distribution.

o Recipients of credit to are those taxable persons to whom it is

attributable, being persons having the same PAN as that of the ISD.

o ISD is located in a State other than that of the recipient of credit :-the

aggregate of Central tax, State tax and Union territory tax, as integrated

tax. [ie.SGST as a IGST not a SGST of other state]

o ISD is located in the same State as that of the recipient:-the Central tax

and State tax (or Union territory tax) should be distributed as the

Central tax and State tax (or Union territory tax), respectively.

o Each type of tax must be distributed through a separate ISD invoice, but

no requirement to issue ISD invoice at an invoice level.

shashikantsharma427@gmail.com](https://image.slidesharecdn.com/gstvsvat-171210032246/85/Gst-vs-vat-78-320.jpg)