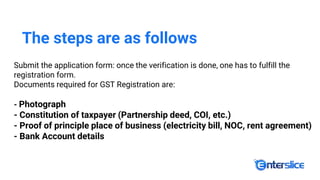

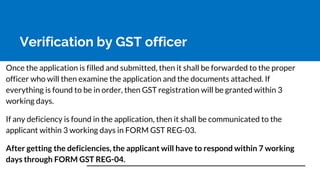

The document outlines the GST registration process in India, including the necessary steps, required documents, and verification procedures by GST officers. It highlights the four-tier GST tax structure and distinguishes between VAT and GST, noting that GST applies to both goods and services. Additionally, it explains the automatic migration from VAT to GST for previously registered businesses.