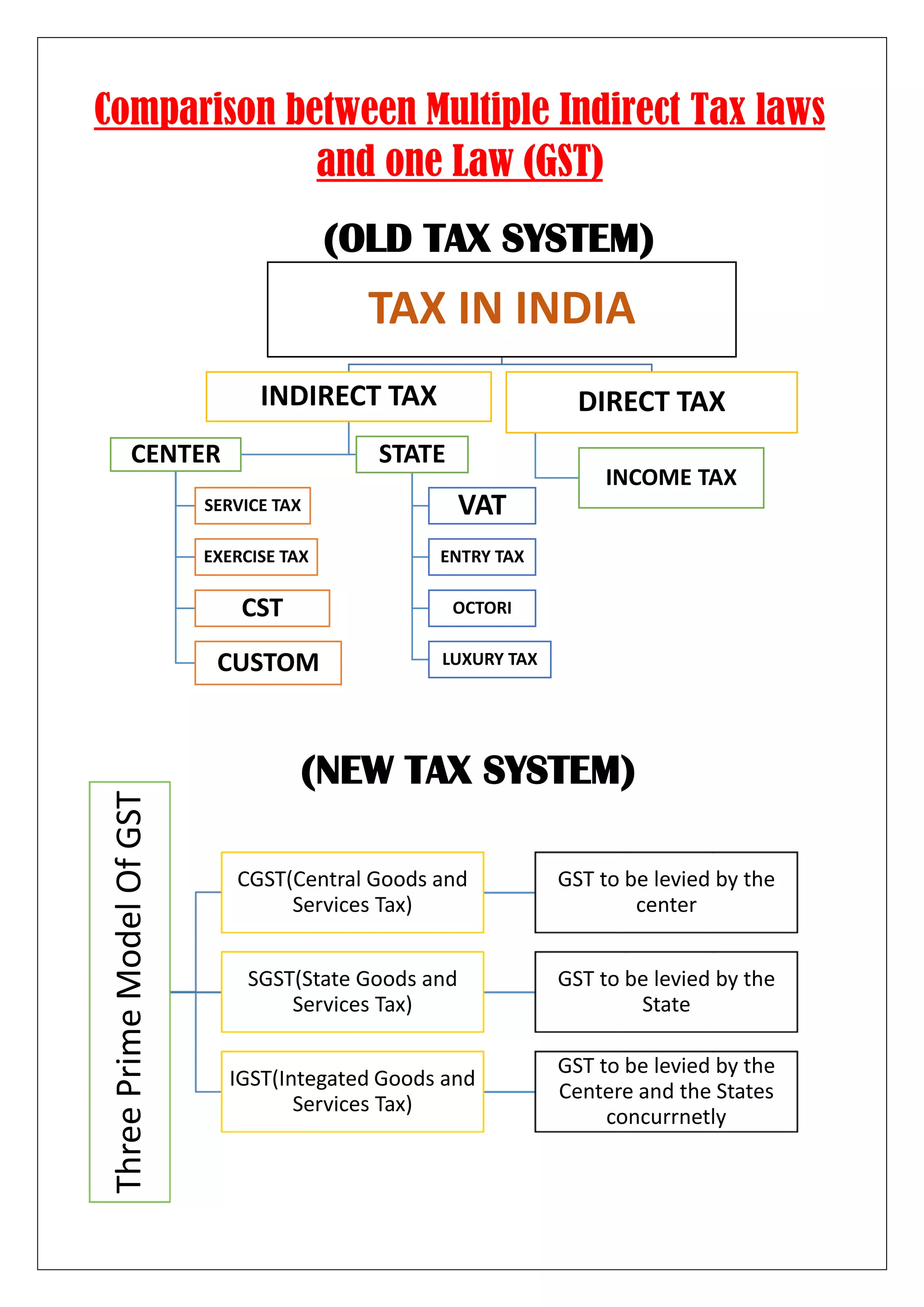

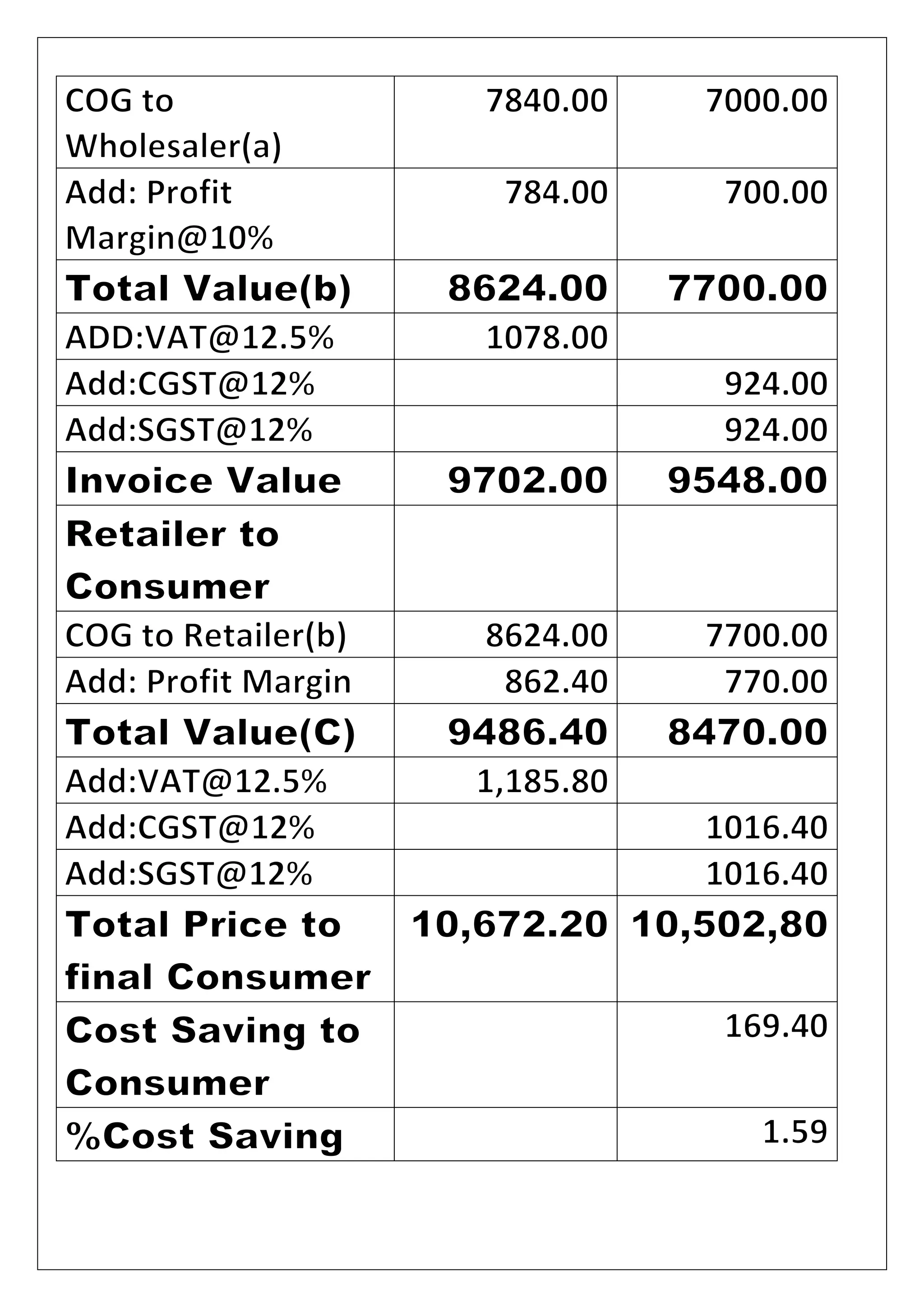

The introduction of GST in India would significantly reform indirect taxation by amalgamating numerous central and state taxes into a single tax, reducing cascading taxes and creating a common national market. It would lower the overall tax burden on goods from 25-30% currently. GST would also make Indian goods and services more competitive domestically and internationally, and is estimated to spur economic growth. Administering GST may be easier due its transparent structure with each taxpayer assigned a common 15-digit identification number.