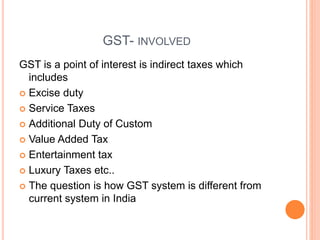

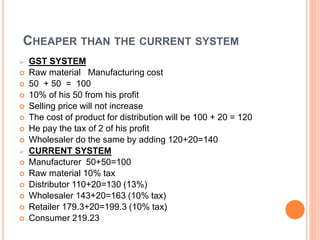

Goods and Services Tax (GST) is intended to simplify India's tax system by combining several indirect taxes into a single tax applicable to both goods and services. GST will replace taxes such as VAT, excise duty, and service tax and is made up of CGST, SGST, and IGST depending on whether a good or service is sold within a state or between states. GST is expected to make India's economy more efficient by reducing the overall tax burden through elimination of cascading of taxes.

![GOODS AND SERVICE TAXES

Dr. Harishchandra S B

MBA, M.Phil, PhD

Dept of Management Studies [MBA], APPA Institute of

Engineering & Technology, Kalaburagi, Karnataka-

India

harish.bramhaver@gmail.com 09945678951](https://image.slidesharecdn.com/gstpresentation2-170621110935/85/GST-presentation-2-320.jpg)