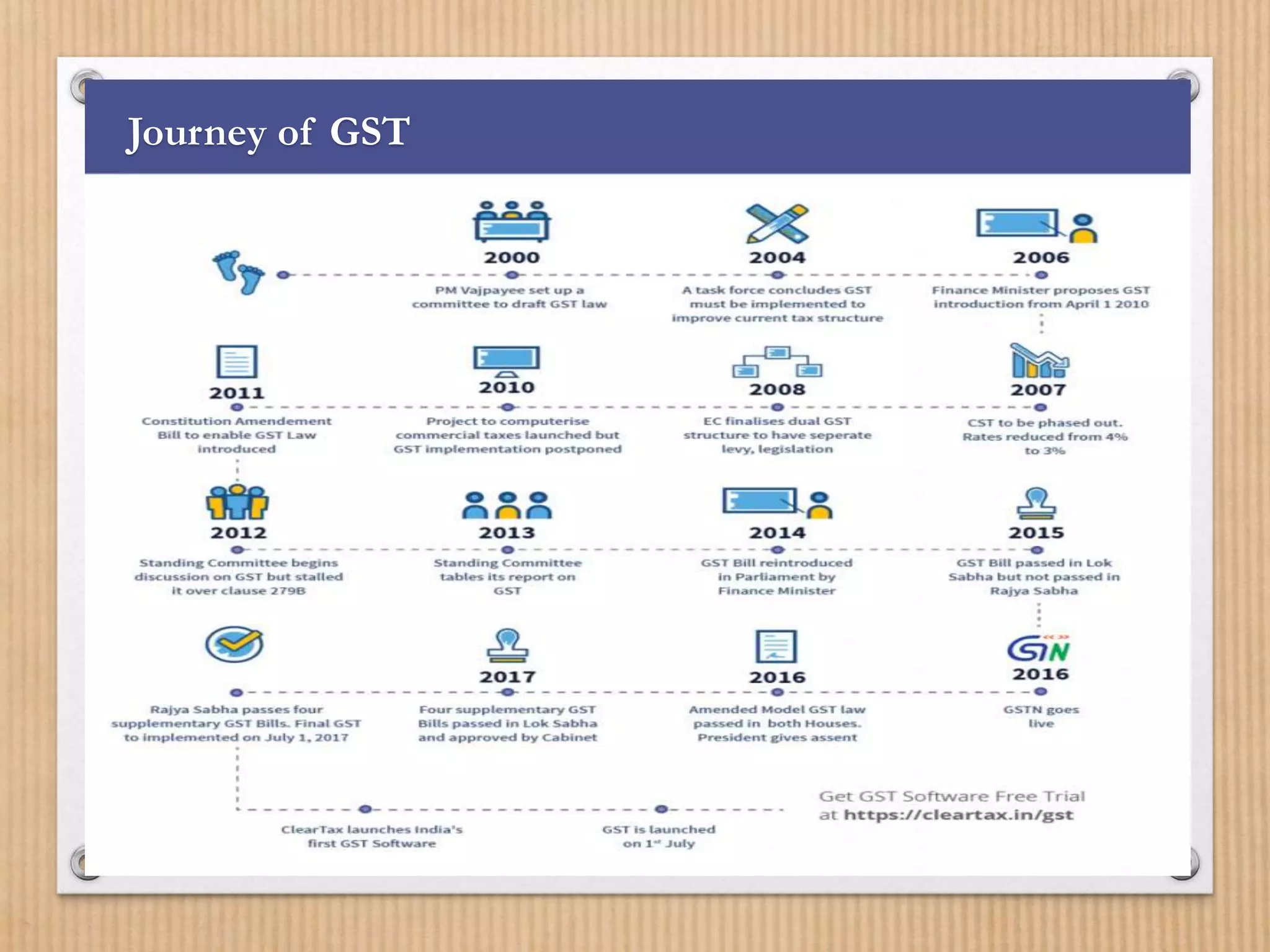

Goods and Service Tax (GST) is an indirect tax in India that replaced multiple indirect taxes, aiming to unify the tax structure across the country. It has a dual framework involving Central GST (CGST), State GST (SGST), and Integrated GST (IGST) with a four-tiered tax structure and offers advantages like eliminating the cascading effect of taxes, while also introducing challenges such as increased compliance costs. GST registration is mandatory for certain businesses based on turnover, and it includes a unique identification number (GSTIN) for each taxpayer.