GST - Basics

•Download as PPTX, PDF•

4 likes•460 views

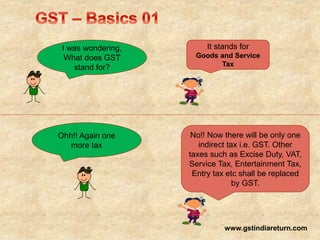

GST stands for Goods and Services Tax, which will replace existing indirect taxes such as VAT, service tax, etc. GST is payable on the supply of goods or services and will be collected by the supplier from the customer. There are three types of GST - CGST, SGST, and IGST. CGST and SGST apply to intrastate supplies while IGST applies to interstate supplies. Registered businesses can claim a tax credit for GST paid on inputs to offset against GST charged on outputs, subject to certain conditions. The threshold for mandatory GST registration is an aggregate turnover of Rs. 20 lakhs annually, except in North Eastern states where it is Rs. 10 lakhs

Report

Share

Report

Share

Recommended

Recommended

More Related Content

What's hot

What's hot (19)

Opportunity in GST for Accountant & Chartered Accountant

Opportunity in GST for Accountant & Chartered Accountant

Goods and service tax concept of cgst, sgst and igst by dr. soheli ghose

Goods and service tax concept of cgst, sgst and igst by dr. soheli ghose

Viewers also liked

Viewers also liked (20)

GST Simplified Series#1: Concept, Scope, Levy & Applicability

GST Simplified Series#1: Concept, Scope, Levy & Applicability

Similar to GST - Basics

Similar to GST - Basics (20)

Recently uploaded

Recently uploaded (20)

Matt Conway - Attorney - A Knowledgeable Professional - Kentucky.pdf

Matt Conway - Attorney - A Knowledgeable Professional - Kentucky.pdf

RMD24 | Debunking the non-endemic revenue myth Marvin Vacquier Droop | First ...

RMD24 | Debunking the non-endemic revenue myth Marvin Vacquier Droop | First ...

Memorandum Of Association Constitution of Company.ppt

Memorandum Of Association Constitution of Company.ppt

India’s Recommended Women Surgeons to Watch in 2024.pdf

India’s Recommended Women Surgeons to Watch in 2024.pdf

Byrd & Chen’s Canadian Tax Principles 2023-2024 Edition 1st edition Volumes I...

Byrd & Chen’s Canadian Tax Principles 2023-2024 Edition 1st edition Volumes I...

The Leading Cyber Security Entrepreneur of India in 2024.pdf

The Leading Cyber Security Entrepreneur of India in 2024.pdf

chapter 10 - excise tax of transfer and business taxation

chapter 10 - excise tax of transfer and business taxation

RMD24 | Retail media: hoe zet je dit in als je geen AH of Unilever bent? Heid...

RMD24 | Retail media: hoe zet je dit in als je geen AH of Unilever bent? Heid...

Meaningful Technology for Humans: How Strategy Helps to Deliver Real Value fo...

Meaningful Technology for Humans: How Strategy Helps to Deliver Real Value fo...

Global Interconnection Group Joint Venture[960] (1).pdf![Global Interconnection Group Joint Venture[960] (1).pdf](data:image/gif;base64,R0lGODlhAQABAIAAAAAAAP///yH5BAEAAAAALAAAAAABAAEAAAIBRAA7)

![Global Interconnection Group Joint Venture[960] (1).pdf](data:image/gif;base64,R0lGODlhAQABAIAAAAAAAP///yH5BAEAAAAALAAAAAABAAEAAAIBRAA7)

Global Interconnection Group Joint Venture[960] (1).pdf

Unleash Data Power with EnFuse Solutions' Comprehensive Data Management Servi...

Unleash Data Power with EnFuse Solutions' Comprehensive Data Management Servi...

Special Purpose Vehicle (Purpose, Formation & examples)

Special Purpose Vehicle (Purpose, Formation & examples)

falcon-invoice-discounting-a-premier-platform-for-investors-in-india

falcon-invoice-discounting-a-premier-platform-for-investors-in-india

Unveiling the Dynamic Gemini_ Personality Traits and Sign Dates.pptx

Unveiling the Dynamic Gemini_ Personality Traits and Sign Dates.pptx

GST - Basics

- 1. www.gstindiareturn.com I was wondering, What does GST stand for? It stands for Goods and Service Tax Ohh!! Again one more tax No!! Now there will be only one indirect tax i.e. GST. Other taxes such as Excise Duty, VAT, Service Tax, Entertainment Tax, Entry tax etc shall be replaced by GST.

- 2. www.gstindiareturn.co m So, when do we need to pay GST??? GST would be applicable on “SUPPLY” of goods or services. Supply includes - Sale, transfer, barter, exchange, license, rental, lease or disposal made for a consideration in the course or furtherance of business

- 3. www.gstindiareturn.co m Who will be liable to pay GST?? GST will be charged by the supplier on the value of goods and services. The supplier will be required to collect the GST from the Customer and pay to the Government. Government Pay GST by Challan Suppli er Charge GST on the Bill Customer

- 4. www.gstindiareturn.co m But I heard that there are three taxes and not one?? Is there only one GST??? You are partially correct. There is only one GST. However, there are three types of GST – Central GST (CGST), State GST (SGST) and Integrated GST (IGST). GST Intrastate Supply (within the state) CGST SGST Interstate Supply (outside the state) IGST

- 5. www.gstindiareturn.co m Ohh!! So there are 3 types of GST. But I am not sure how will it work. Ok!! I will explain you with a simple example. Example – A : Intrastate Supply (Supply within the state) Supply of Goods/Services Rs. 100 CGST @10% Rs. 10* SGST @ 10% Rs. 10* Example – B : Interstate Supply (Supply outside the state) Supply of Goods/Services Rs. 100 IGST @ 20% Rs. 20* . *rates are taken for example

- 6. www.gstindiareturn.co m At what rate GST will be levied?? There are broadly 4 rates of GST – 5%, 12%, 18% and 28% • Rate for Common Use Items5% • Standard Rate for goods and services12% & 18% • Rate for Luxury Items28%

- 7. www.gstindiareturn.co m Hmm!!! Can we take the credit of the tax paid on inputs and utilize the same for payment of output GST?? Yes, a registered person can take the credit of the tax paid on inputs purchased by it and further, it can utilize the credit for the payment of output GST. I will explain it with a simple example. Example – B has purchased the goods from A and paid GST of Rs. 20. B will take the credit of Rs. 20. When B will sell the goods further, he will charge Rs. 28 from its customer but remit Rs. 8 (Rs.28 minus Rs.20) to Govt. by utilizing input tax credit of Rs. 20. A - Seller • Cost of Goods Rs.100 • CGST @10% Rs. 10 • SGST @ 10% Rs. 10 B - Purchaser • Cost of Goods Rs 120 • Profit Rs. 20 • CGST @10% Rs. 14 • SGST @ 10% Rs. 14 • Input Tax Credit (Rs.

- 8. www.gstindiareturn.co m So, This means GST paid on inputs can be utilized for payment of output GST, without any restrictions?? No, There are conditions for utilization of GST. As I told you earlier, there are three types of GST. So there are certain restrictions on utilization of credit, which is explained in the below chart. IGST IGST CGST SGST CGST CGST IGST SGST SGST IGST > • First with > • Then With > • Then With Order of Utilization

- 9. www.gstindiareturn.co m But what is the threshold limit for registration in GST?? For those with an aggregate turnover below Rs.20 lakhs annually will be exempted from GST. Where as for the north-eastern States, the exemption threshold is Rs.10 lakhs Aggrega te Turnove r 20 Lakhs Mandator y Registrati on in GST

- 10. www.gstindiareturn.co m THANK YOU For any suggestions or queries please feel free to mail us at gstindiareturn@gmail.com