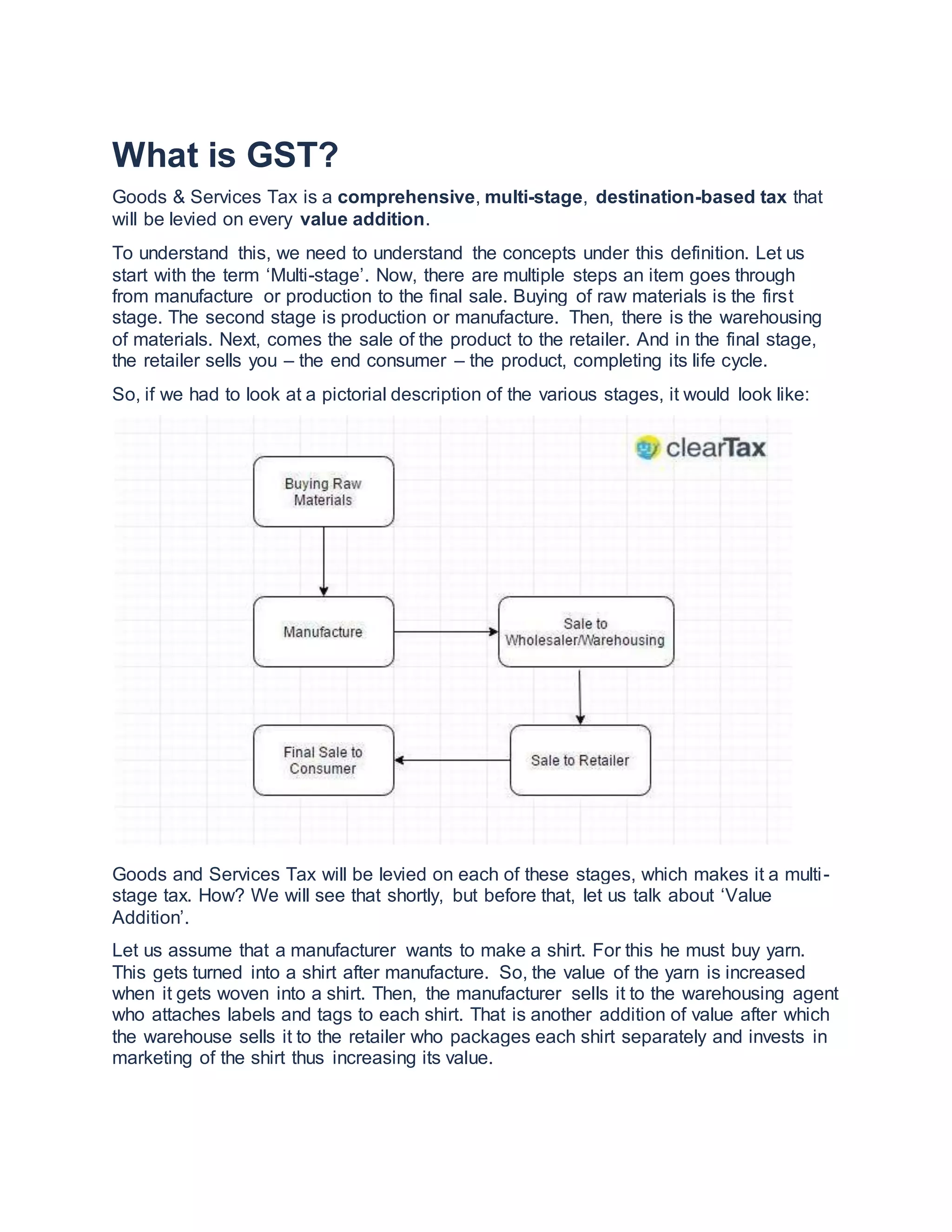

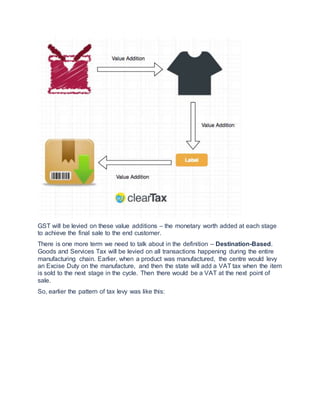

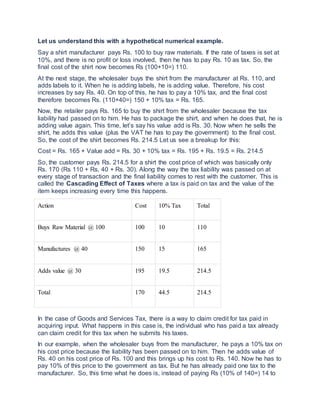

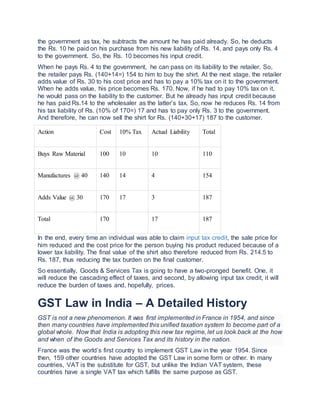

The Goods and Services Tax (GST) aims to streamline India's indirect taxation regime by subsuming multiple taxes into a single tax applicable on goods and services. GST is expected to benefit the Indian economy by creating a seamless nationwide market, improving tax collection, removing tax barriers between states, and integrating the country through a uniform tax rate. It also aims to provide businesses a level playing field and bring India on par with countries with a more structured tax system.