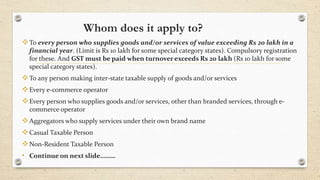

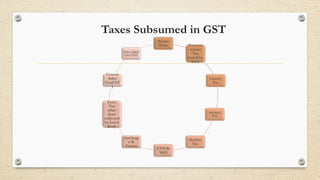

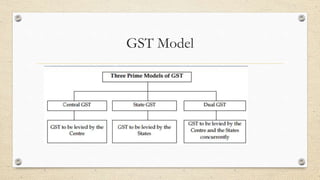

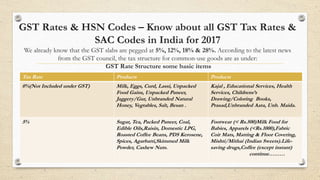

GST is a new indirect tax that will replace multiple taxes into a single tax. It will be levied as CGST, SGST, and IGST depending on whether a good or service is intra-state or inter-state. Many existing taxes such as VAT, excise, customs, etc. will be subsumed into GST. Taxpayers will be able to claim input tax credit which allows for tax cascading benefits. Certain items like petroleum products and alcohol are exempted from GST. The GST rates are proposed to be 5%, 12%, 18%, and 28% with some items falling into each slab.