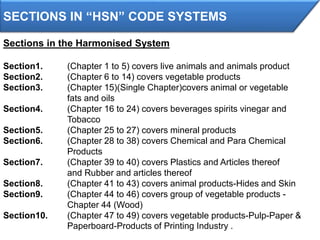

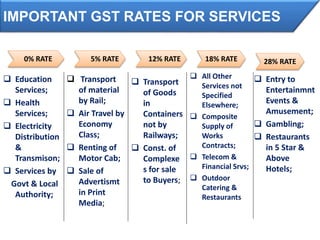

The document provides a comprehensive overview of the Goods and Services Tax (GST) in India, outlining its definitions, frameworks, and various components such as the GST council, tax rates, and codes (HSN and SAC) for goods and services. It highlights the implications of GST for businesses, including aspects of registration, input tax credit, and assessment. The document emphasizes the need for accurate classification of goods and services under the new tax regime to ensure compliance and facilitate seamless credit.