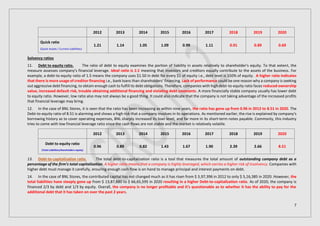

BNL Stores experienced a significant decline in stock and profitability from 2018 to 2020, attributed to increased operational expenses and a shift in business strategy toward supercenter stores and store credit. Key financial ratios show a downward trend in net profit margins, return on assets, and return on equity, indicating challenges in efficiently managing assets and generating profits. The company resorted to substantial long- and short-term debt to support operations, resulting in a high and concerning debt-to-equity ratio of 8.51 by 2020.