This document summarizes the potential for green hydrogen production and financing of green hydrogen projects globally. Key points include:

- Green hydrogen production costs are falling rapidly due to declines in renewable energy and electrolyzer costs. Several countries and regions have set targets for hydrogen below $2/kg by 2030.

- Over 60 large-scale green hydrogen projects have been proposed globally, requiring $84 billion in investment. By February 2021, over 200 projects were under consideration, totaling over $300 billion in planned investments.

- Early commercial green hydrogen projects are starting up in Europe and other regions, co-located with renewable energy and existing industrial facilities to promote blending and offtake.

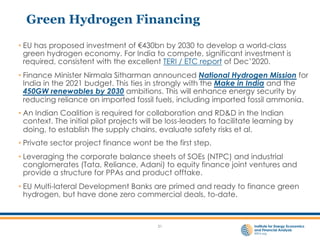

- Financing green hydrogen projects