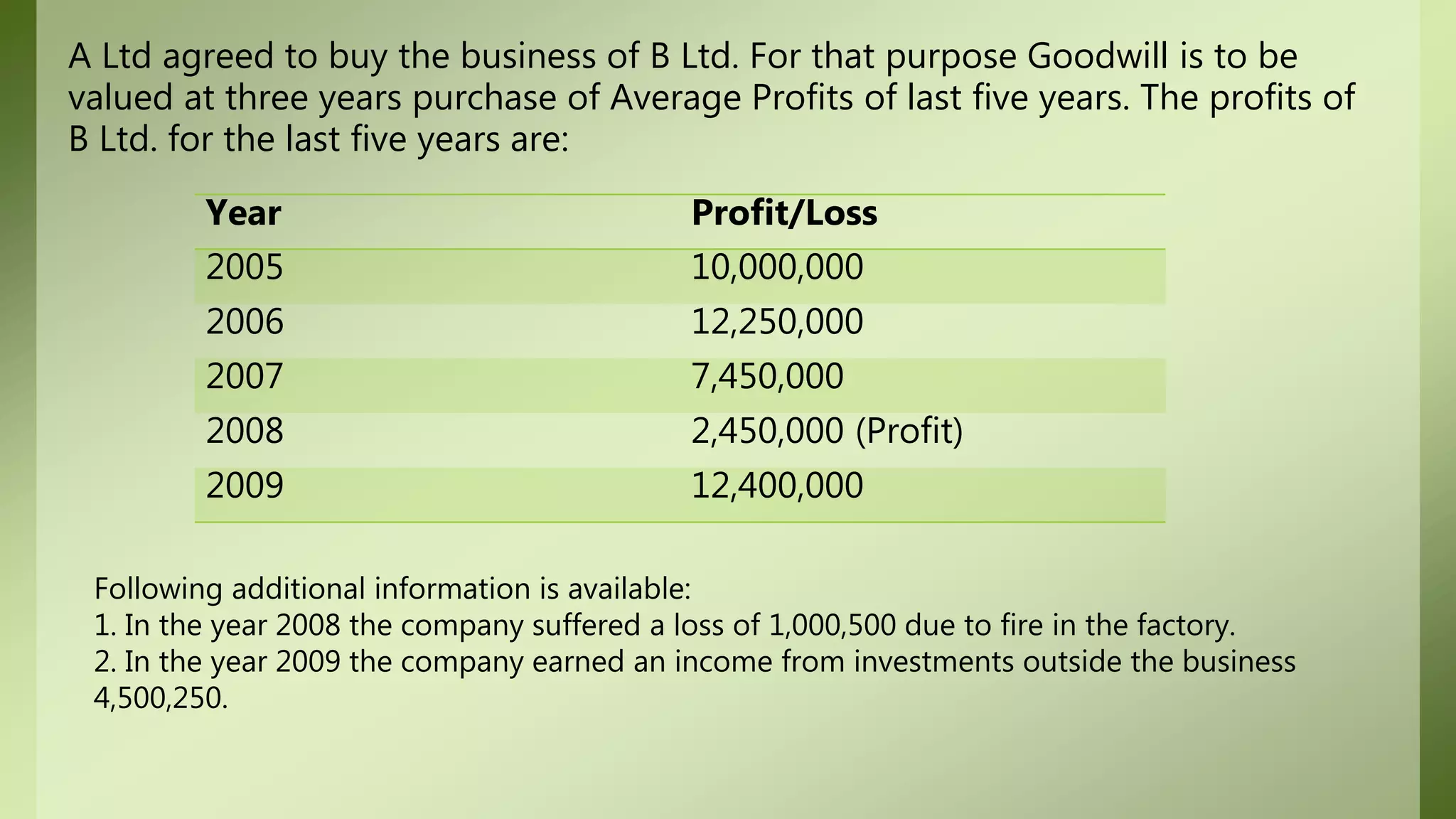

The document covers various methods for valuing goodwill in business, including average profit, super profit, and capitalization methods. It provides detailed explanations and examples, including calculations for specific companies' profits over several years, showing how to determine goodwill based on those profits. Additionally, it discusses the implications of super profits and their sustainability in the business market.