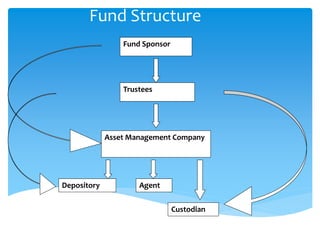

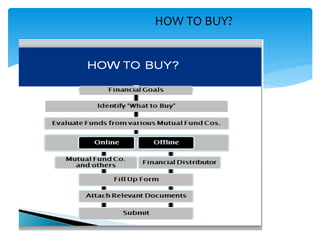

Mutual funds pool money from investors to invest in stocks, bonds, and other securities. The document provides an overview of mutual funds in India, including their history and regulation. It describes how mutual funds work, the different types of funds, and advantages like professional management and risk diversification and disadvantages like lengthy procedures. The key entities involved in mutual funds are fund sponsors, asset management companies, trustees, depositories, custodians, and agents.