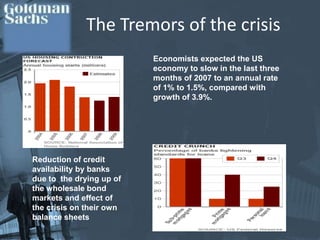

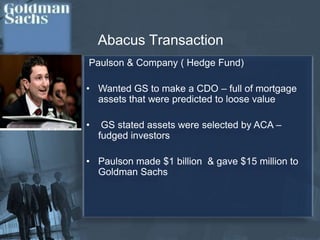

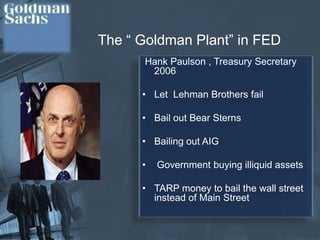

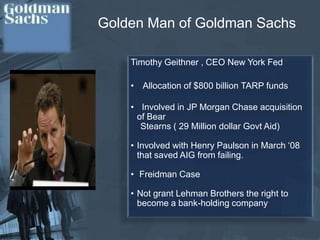

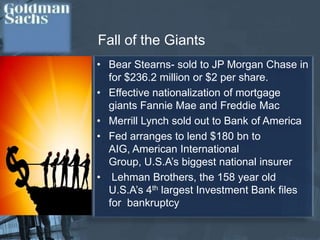

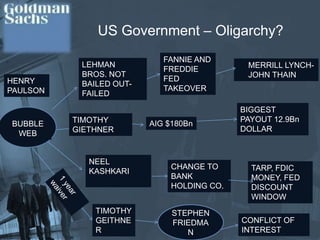

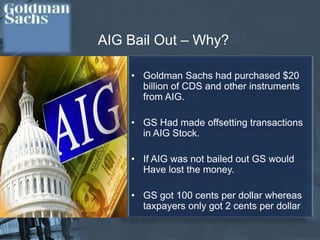

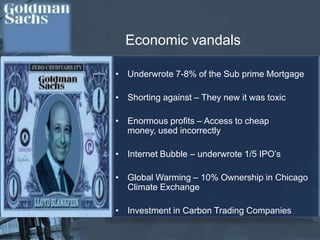

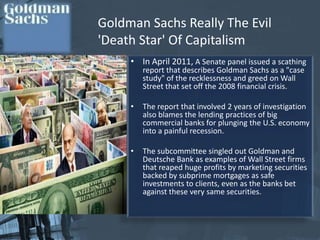

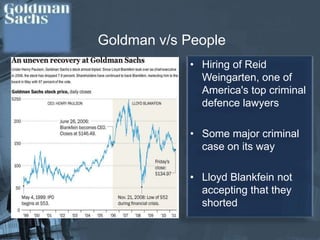

Goldman Sachs is a major investment bank that profited greatly during the financial crisis by shorting the subprime mortgage market while still selling mortgage-backed securities to clients. It faces numerous lawsuits alleging it misled investors and profited from the financial products it created failing. While top executives claim they did not bet against clients, internal emails suggest they were aware of the risks in the products they sold. The bank continues to face legal and reputational challenges over its role in the crisis.