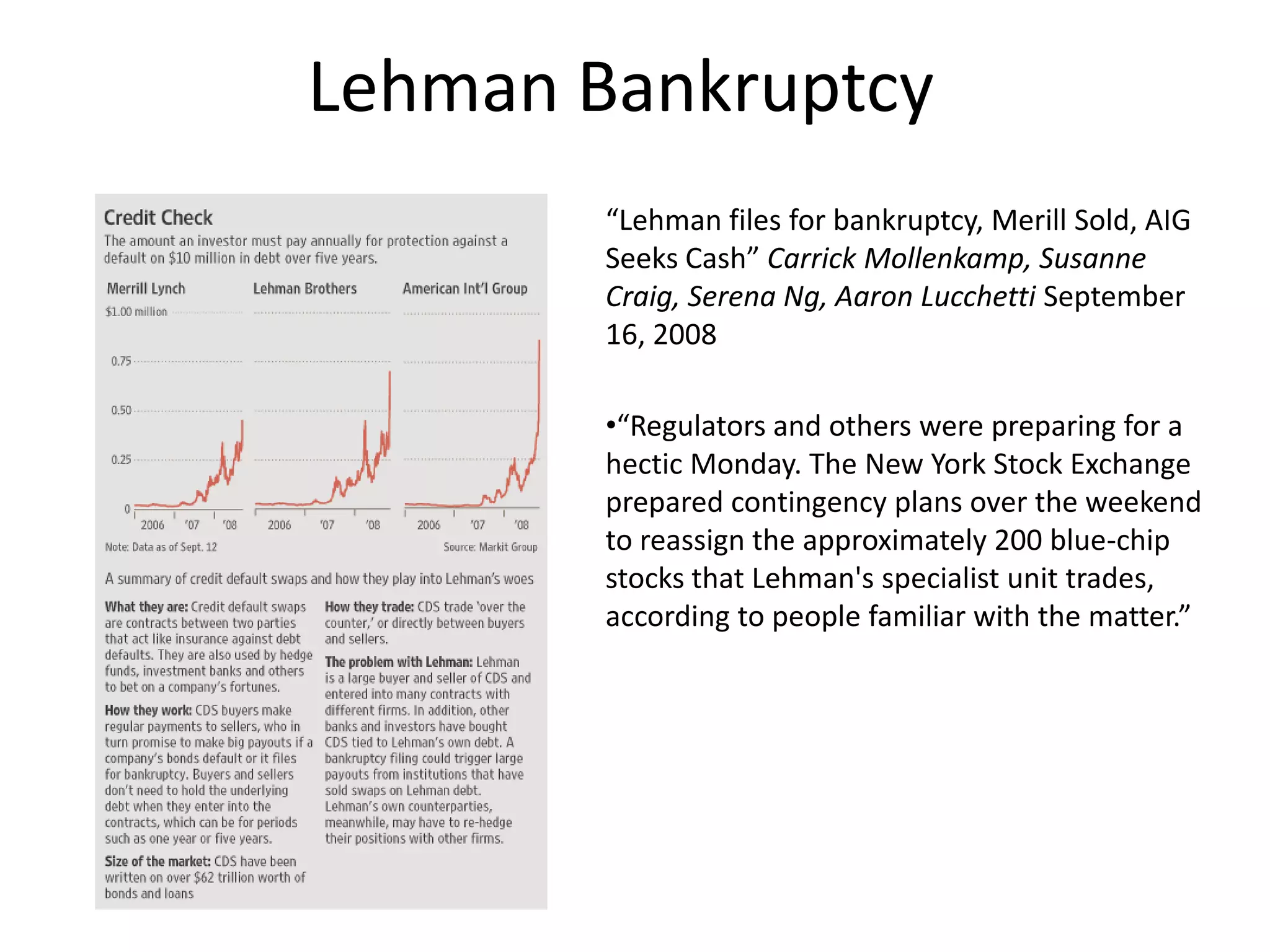

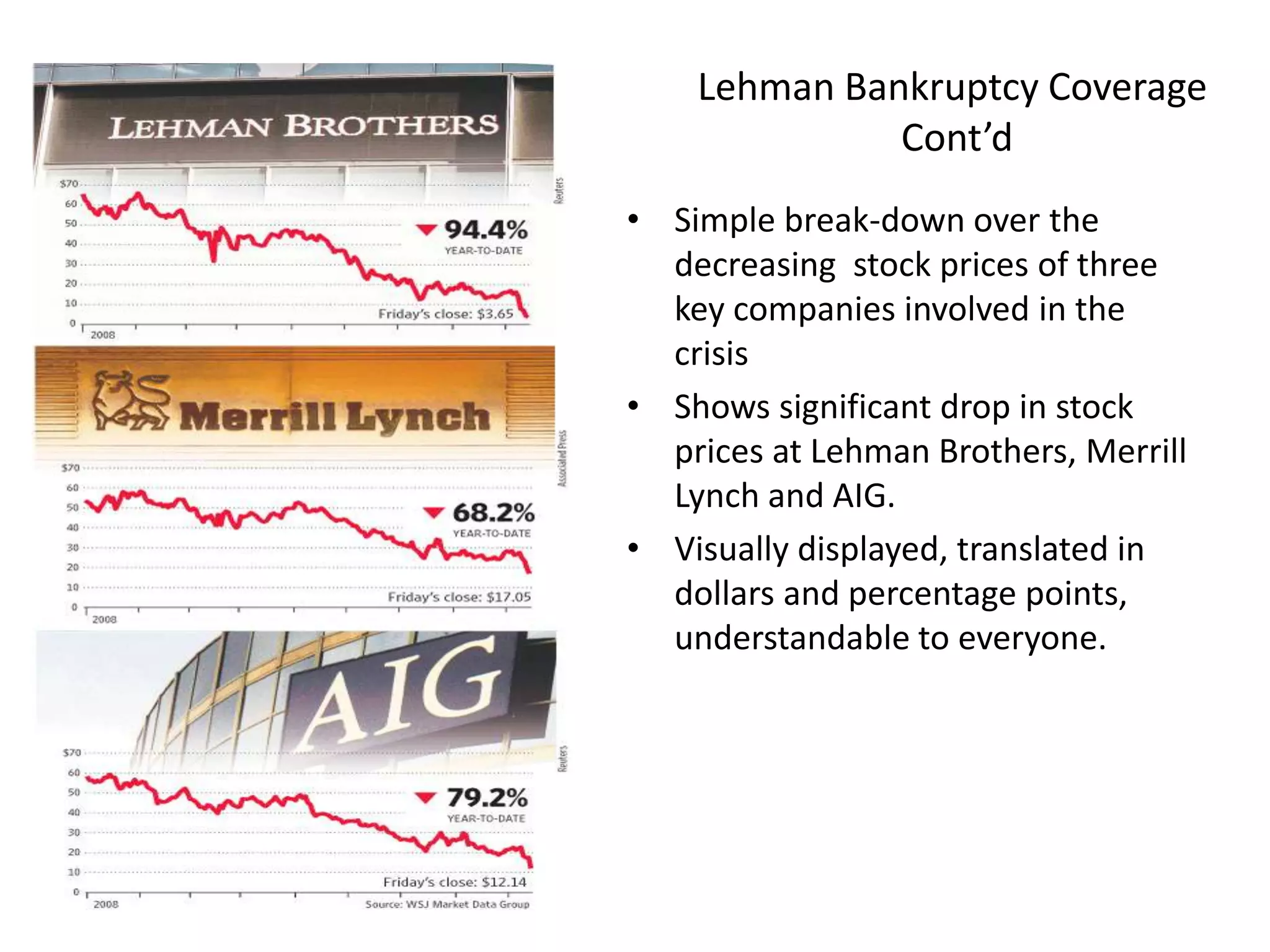

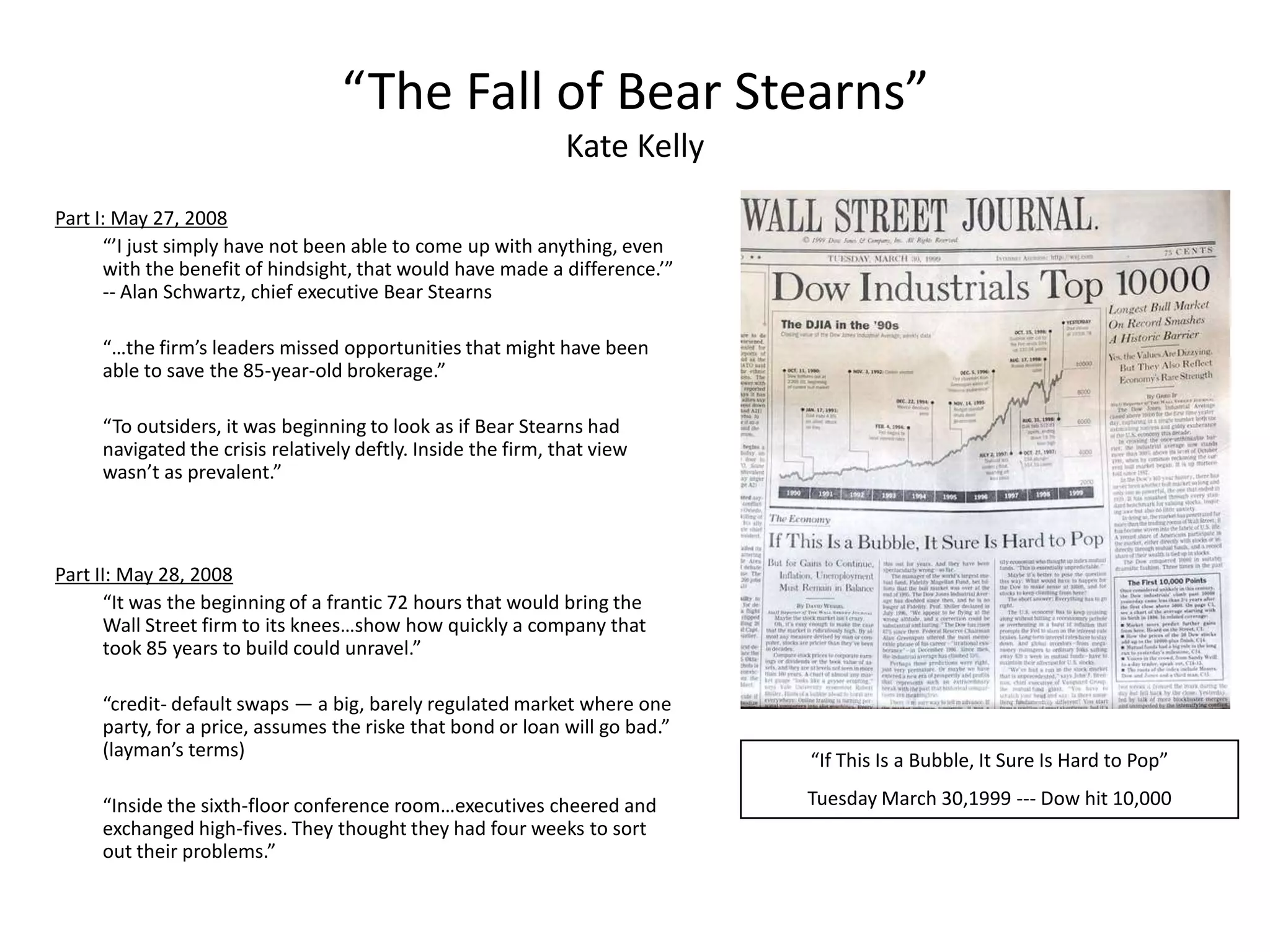

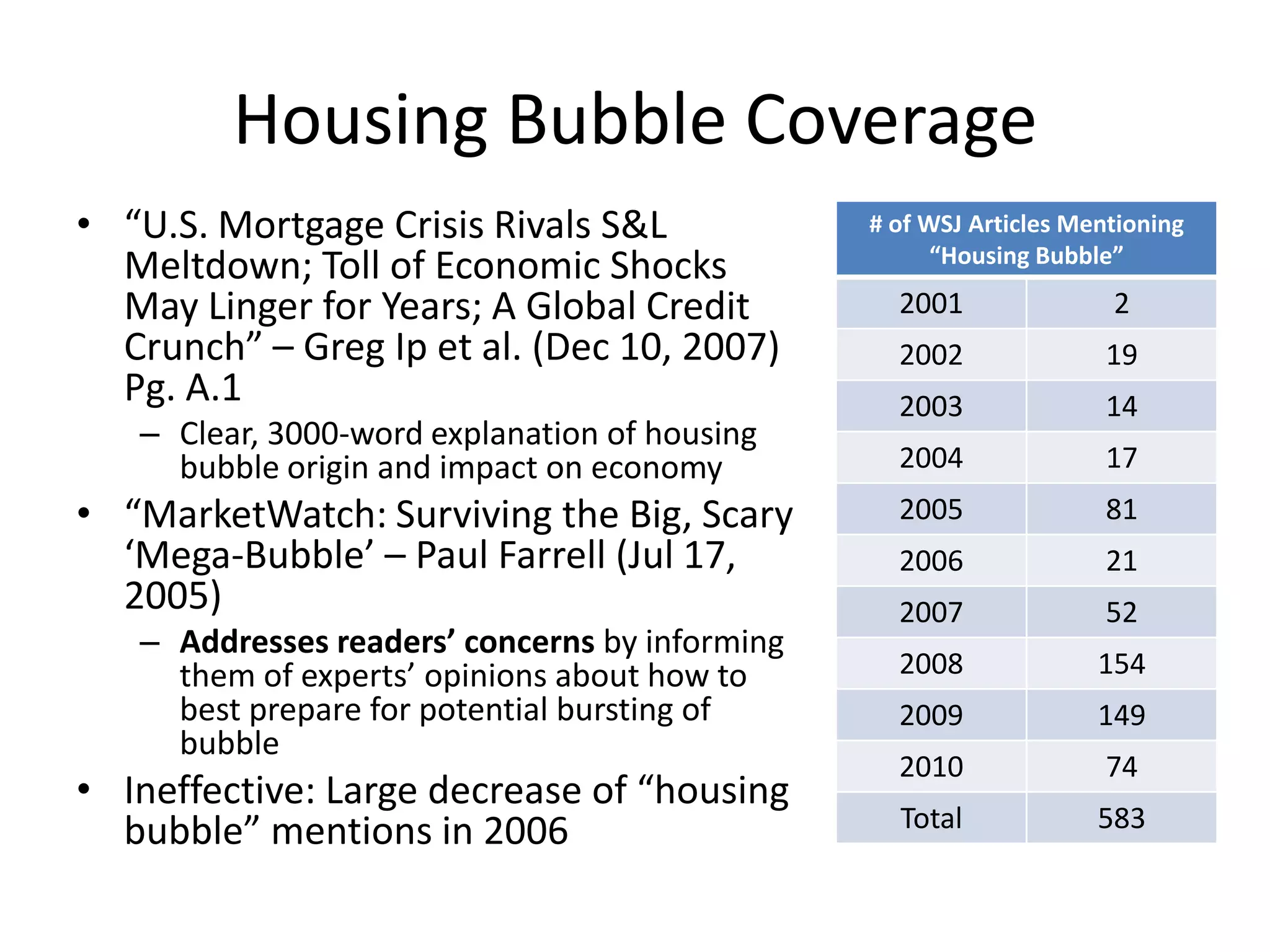

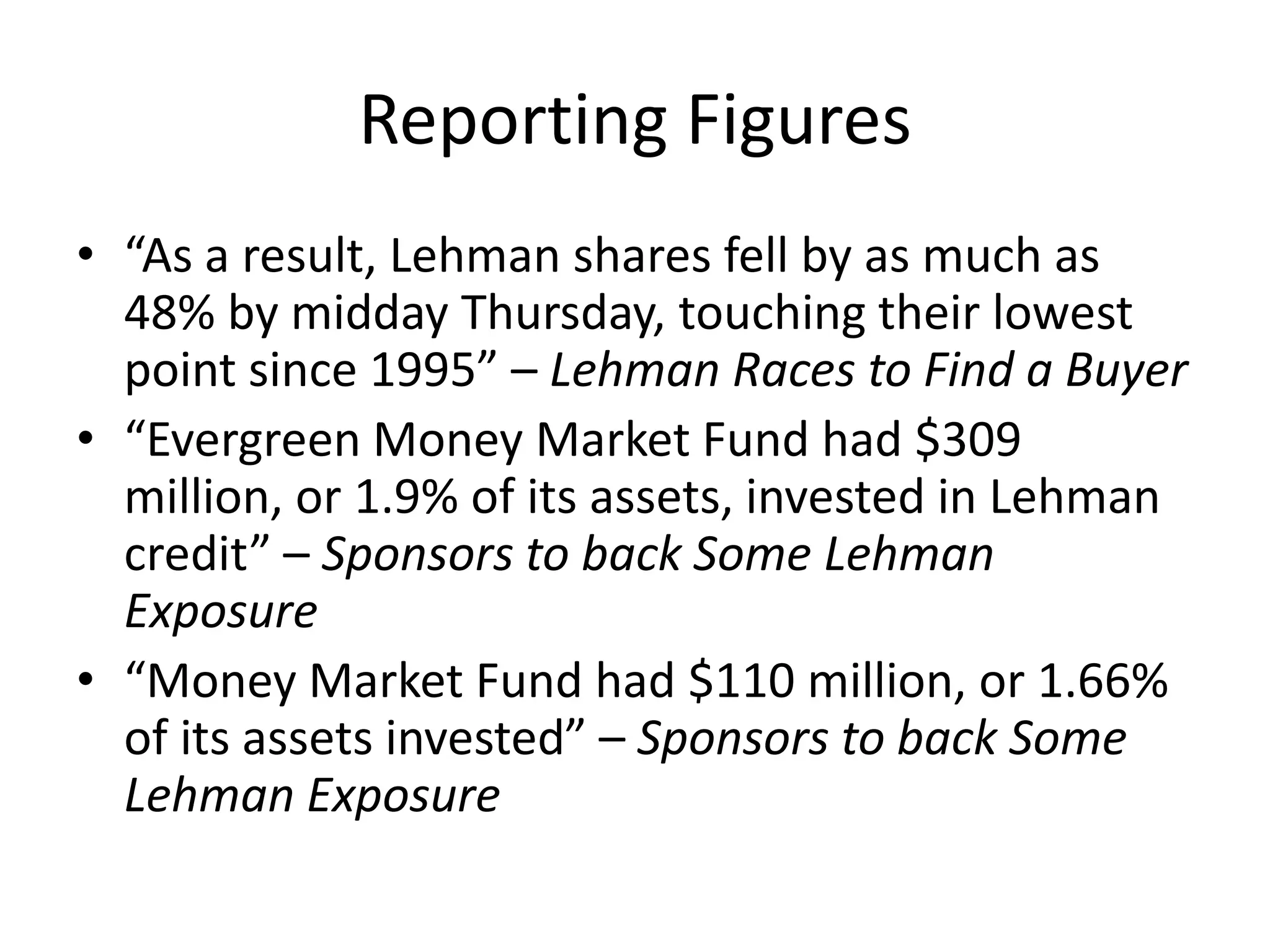

The document provides an overview of The Wall Street Journal's circulation figures for its various regional editions. It then discusses early coverage in 2001-2002 of the emerging housing bubble and concerns about rapidly rising home prices. Several experts are quoted warning about the potential for a collapse in prices. The document also summarizes several WSJ articles covering key events during the unfolding of the financial crisis between 2007-2009, including the collapse of Bear Stearns, Lehman Brothers, and AIG as well as the government bailouts.

![“Prices are heading toward a level ‘a lot farther beyond what people will pay, and I think [they’re] going to fall quite a bit.’”](https://image.slidesharecdn.com/wsjpresentation-100224023254-phpapp01/75/Wsj-Presentation-9-2048.jpg)