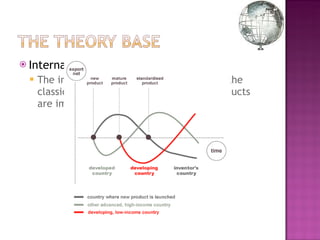

The document discusses international business (IB) as a field that examines cross-border business activities influenced by government policies. It highlights the lack of a unified theoretical approach, the role of governments in shaping business negotiations, and various strategies employed by firms to navigate different regulatory environments. Additionally, it emphasizes the importance of understanding conflicting rules and cultural differences in IB, proposing a multilevel perspective on the international business process.