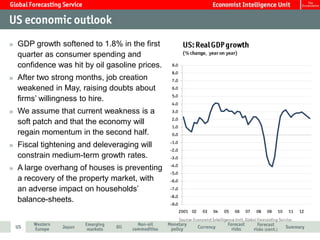

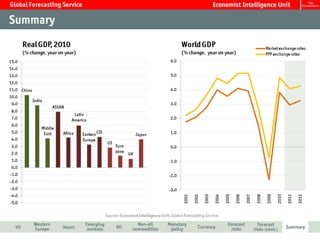

The document provides a global economic forecast for 2011. It notes that GDP growth softened in Q1 due to higher gas prices negatively impacting consumer spending and confidence. While job growth was strong in the first two months of the year, it weakened in May, raising doubts about further hiring. The forecast assumes current economic weakness is a temporary issue and growth will pick up in the second half of the year. Fiscal tightening and household deleveraging will limit medium-term growth.