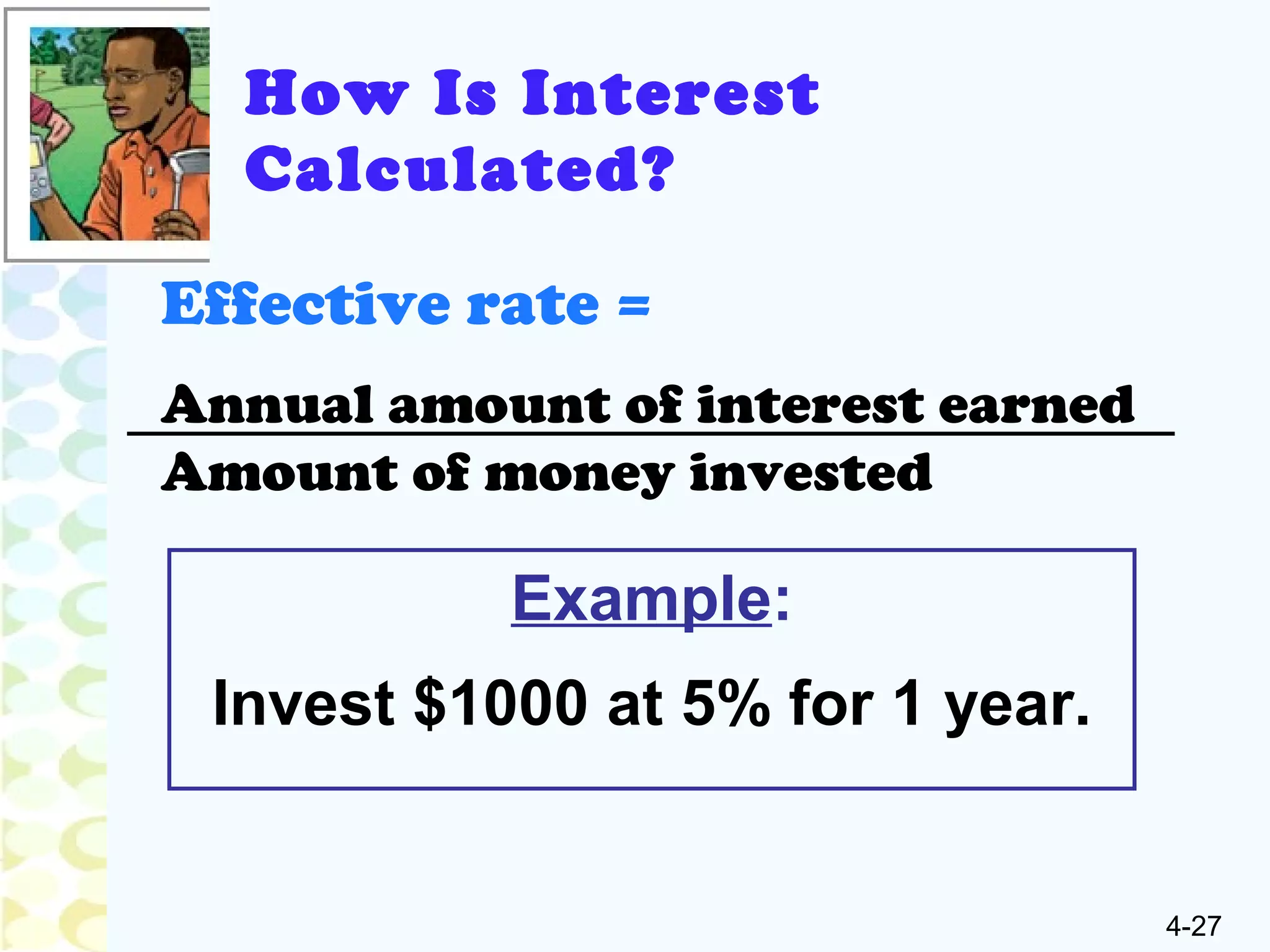

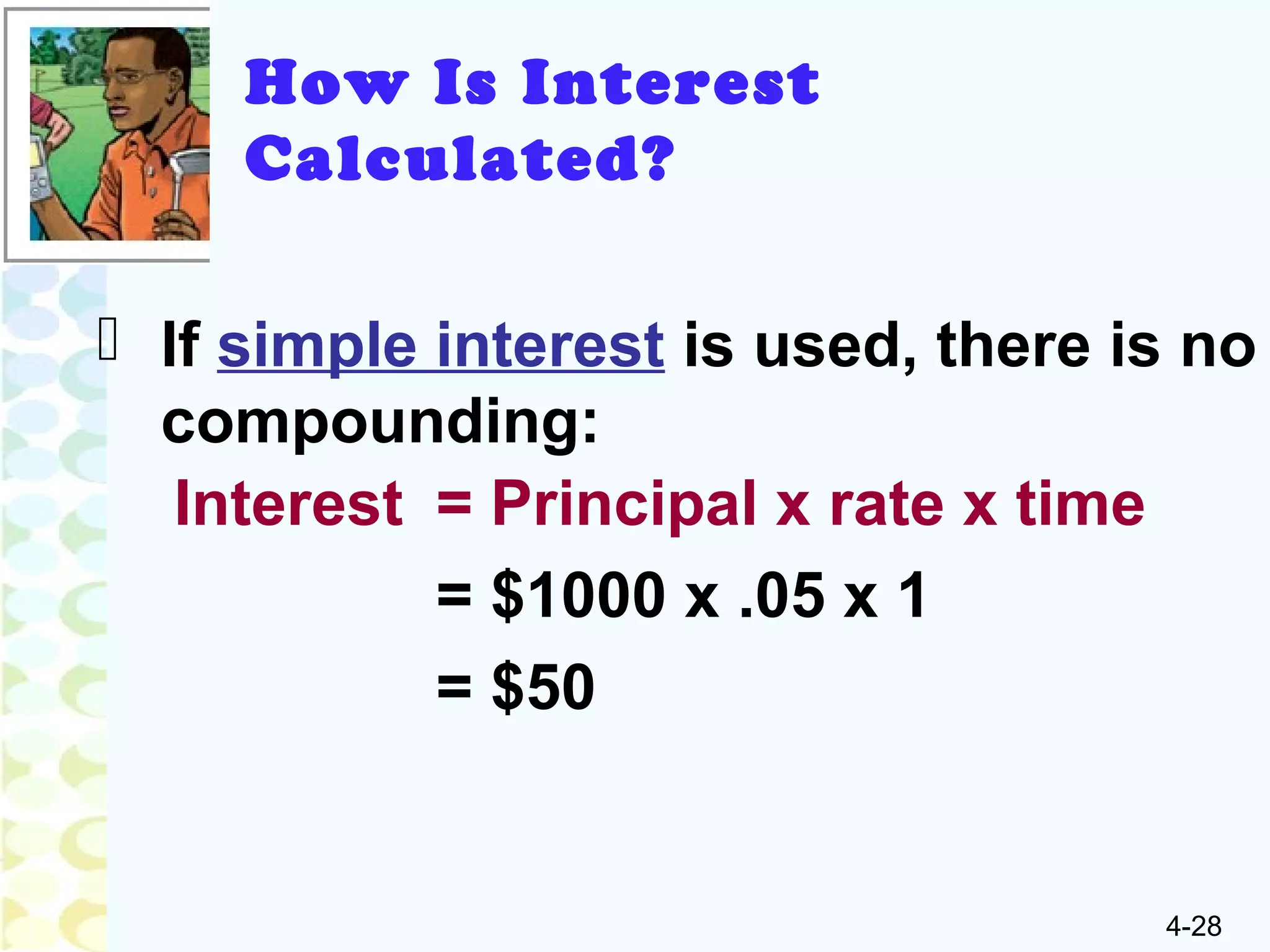

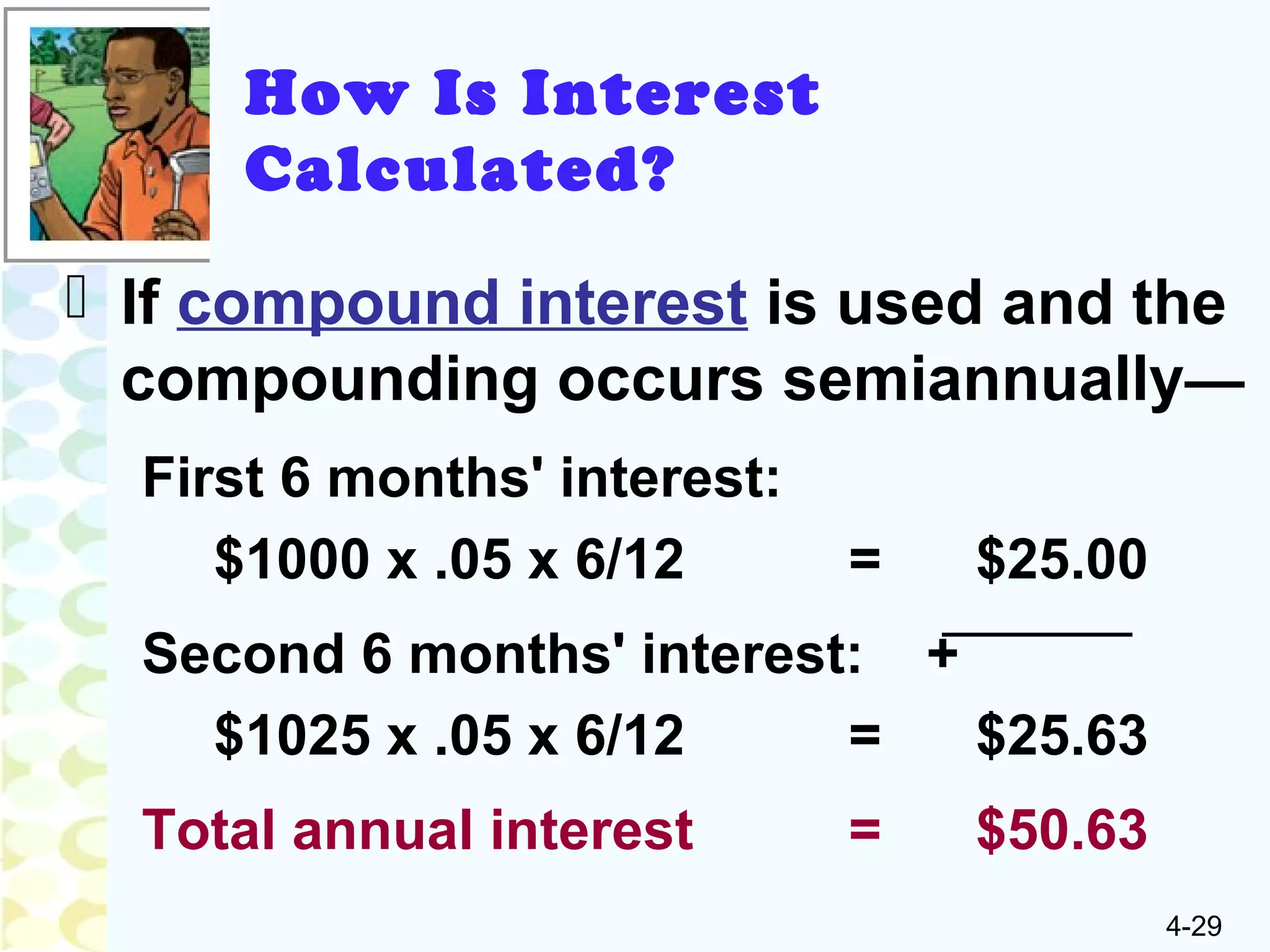

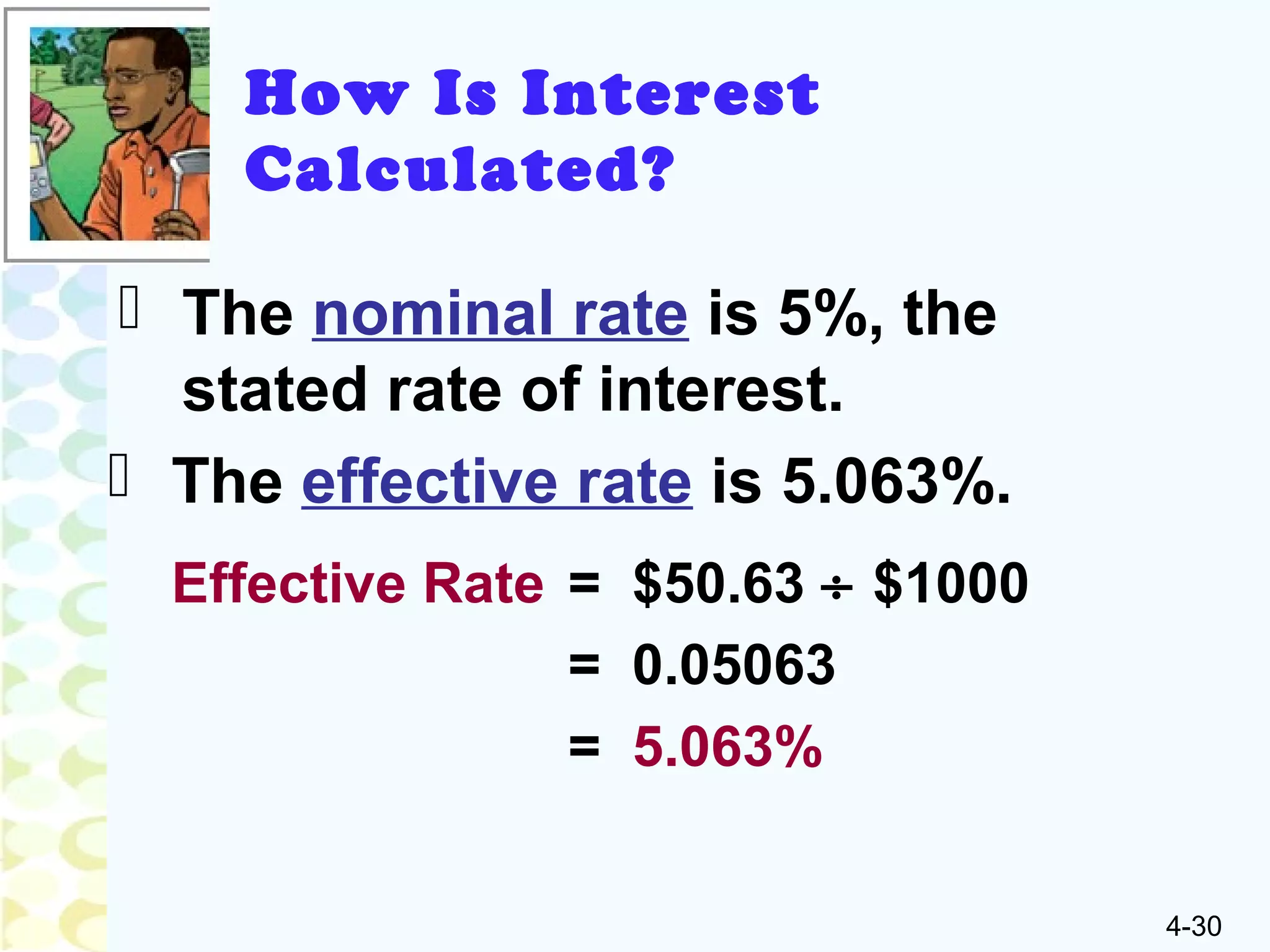

This document discusses cash management and savings options. It begins by defining cash management and listing examples of liquid assets. It then outlines the various types of financial institutions like banks, credit unions, and internet banks. The document also discusses cash management products like checking and savings accounts, money market funds, and electronic banking services. Finally, it covers ways to establish a savings program and the variety of savings vehicles available, such as CDs, Treasury bills, and savings bonds.