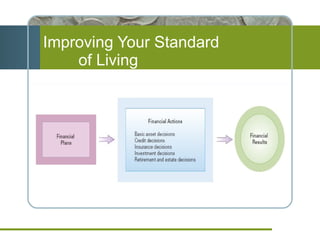

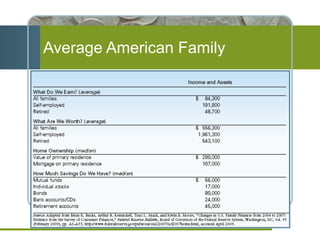

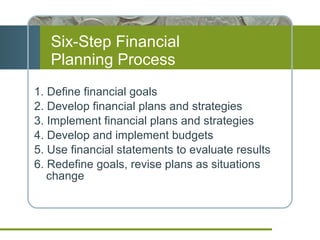

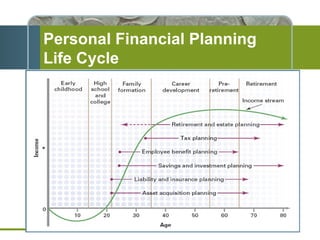

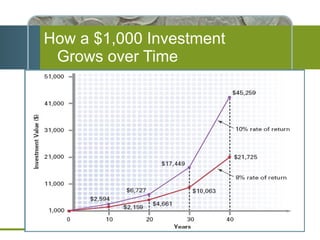

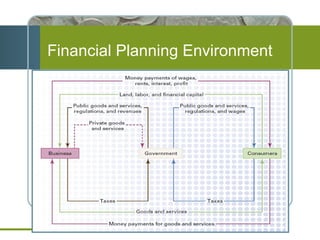

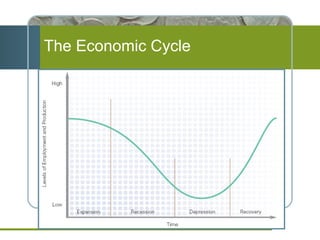

The document outlines the six-step financial planning process which includes defining goals, developing plans and strategies, implementing plans, developing budgets, evaluating results, and redefining goals. It discusses how financial planning helps maintain standards of living, accumulate wealth, and control spending. Financial goals should be specific, realistic, involve others, and have target dates. Professional financial planners can help develop asset acquisition, savings, insurance, employee benefits, tax, and retirement plans. Financial planning takes place in a dynamic economic environment influenced by government, business, consumers, and economic cycles.