1) The CEO of Ghana Export Promotion Authority urged Ghanaians to embrace import substitution to improve Ghana's trade imbalance, as the country historically runs trade deficits due to heavy import dependence.

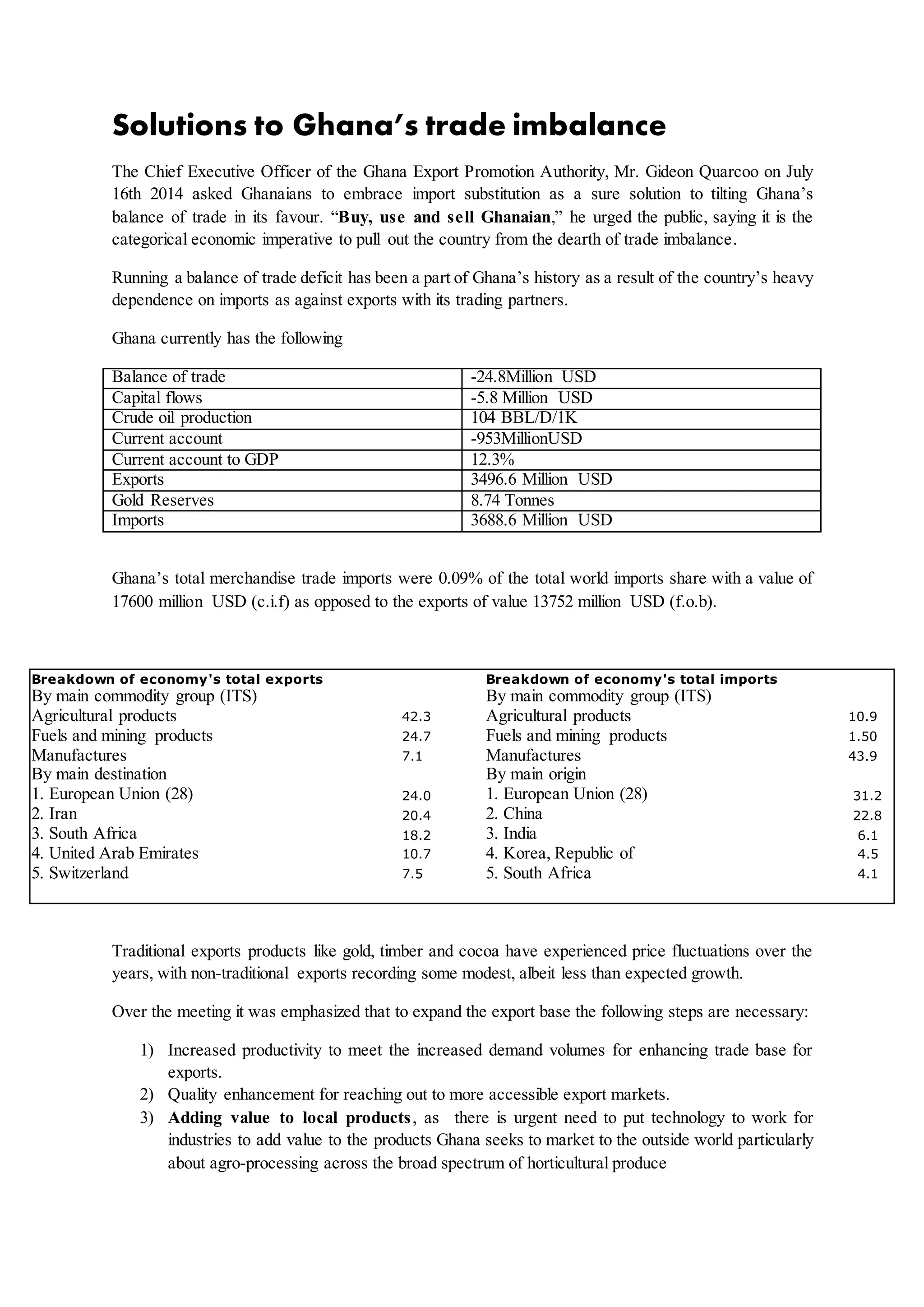

2) Ghana currently has trade and current account deficits according to reported statistics. Its top exports are agricultural and fuel/mining products to European nations, while top imports are manufactures from China, India, and other Asian nations.

3) To expand exports, Ghana needs to increase productivity, improve quality, add value to local products, and develop non-traditional sectors like media and business outsourcing. However, currency devaluation may not improve the trade balance in the short-term due to supply and demand rigidities