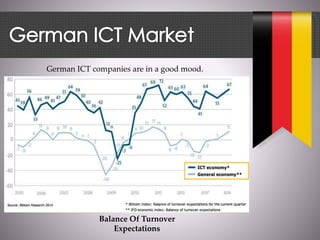

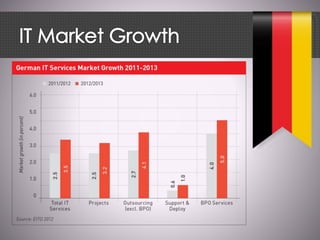

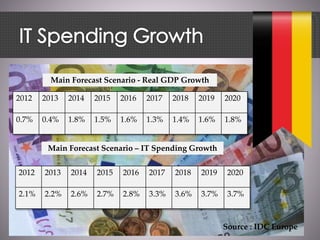

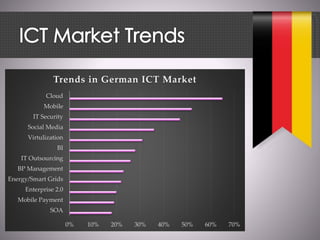

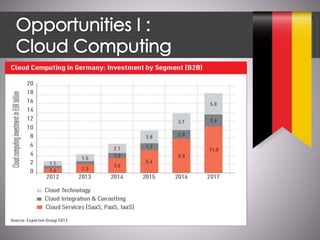

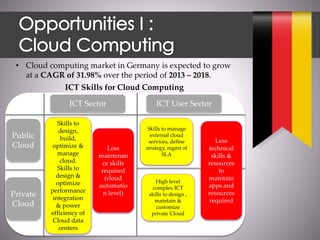

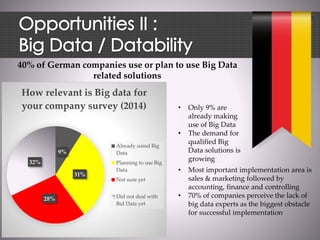

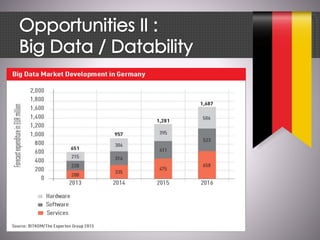

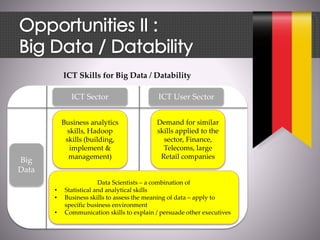

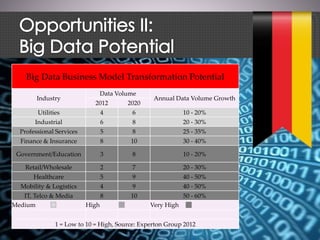

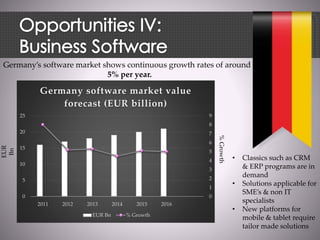

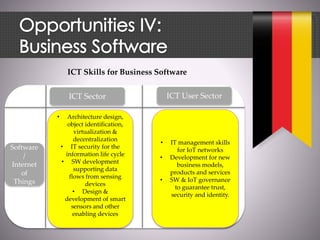

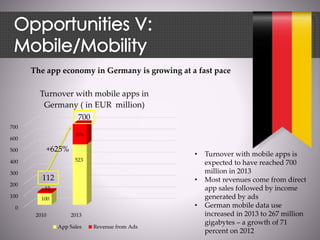

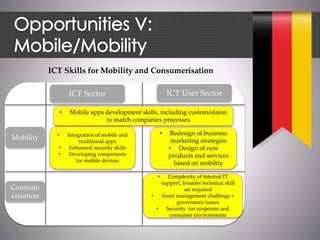

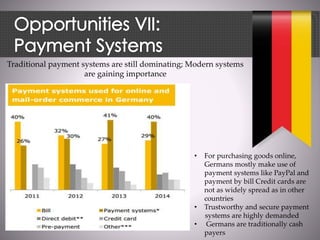

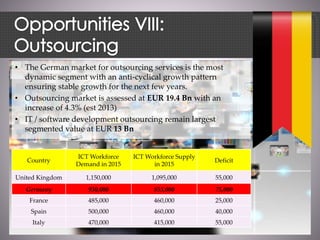

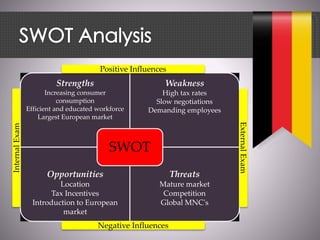

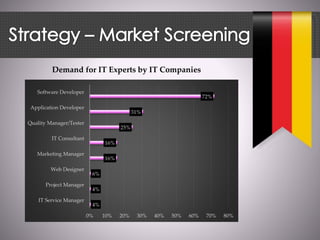

Germany's ICT market shows positive growth due to strong infrastructure and a dynamic SME environment, with significant demand for industry-specific software and cloud services. While the IT spending and employment are on the rise, the country faces a shortage of qualified IT experts, particularly in cloud computing and big data. Companies should concentrate on niche skills and stay adaptable to technological advancements to leverage opportunities in this evolving landscape.