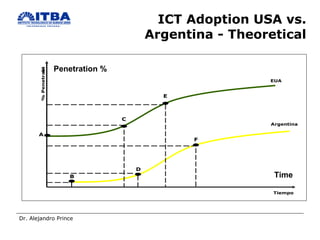

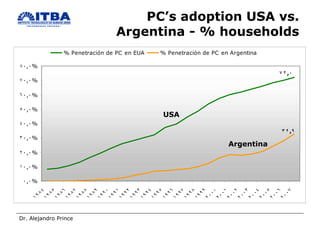

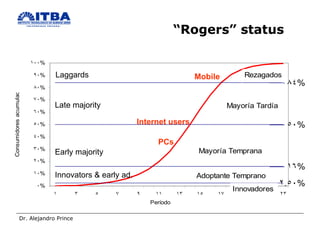

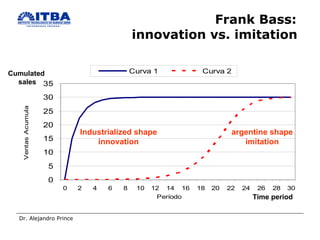

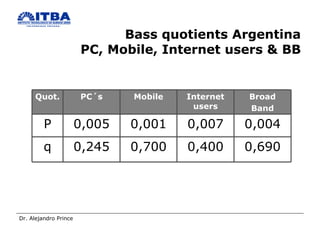

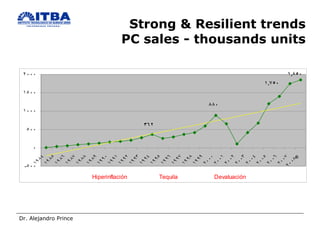

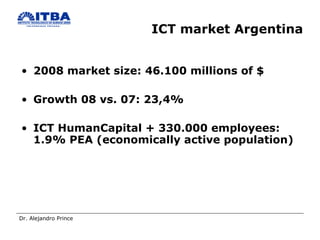

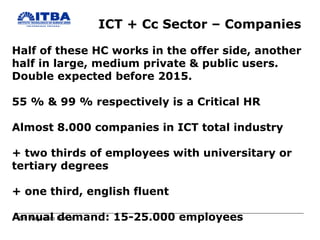

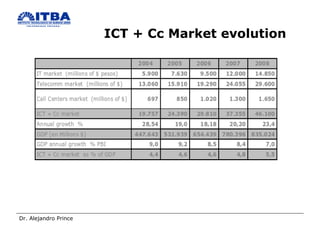

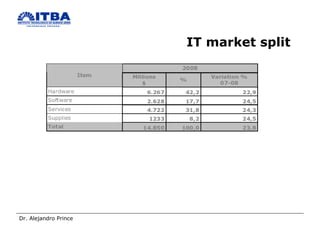

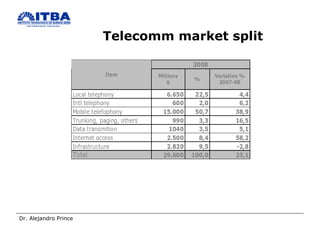

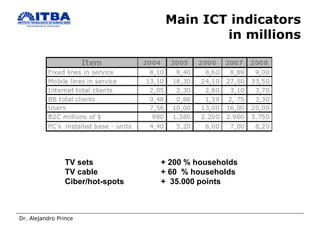

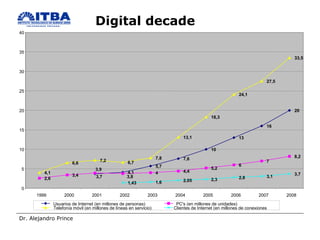

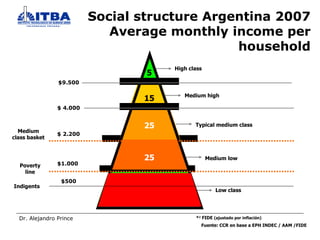

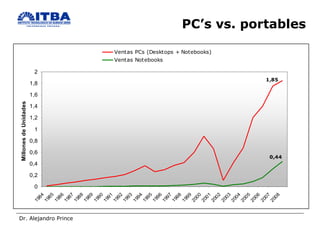

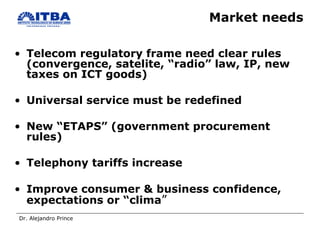

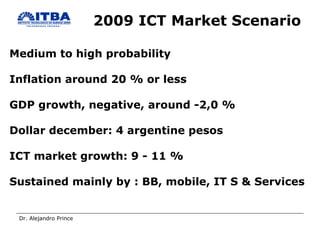

The document summarizes key aspects of Argentina's information and communications technology (ICT) market and industry. It finds that the ICT market in Argentina grew 23.4% in 2008 to $46.1 billion, with over 330,000 people employed in the ICT sector. Adoption of technologies like personal computers, the internet, and mobile phones has followed an "imitation" model compared to more "innovative" patterns seen in industrialized nations. The document also outlines trends in the ICT sector, opportunities for international involvement, and provides a forecast for 2009 anticipating 9-11% growth in the ICT market despite an economic downturn.

![Alejandro Prince [email_address] President of Prince & Cooke www.princecooke.com Vicepresident Fundación Gestión y Desarrollo www.fgd.org.ar Professor at UBA, UTN, UDESA, FASTA, Fundación Libertad, UP, y otras Universidades. International lecturer, Author of several papers and books on Information Society & Economy Licencee on Marketing, Ph.D on Political Science and Ph.D Candidate on Economics. www.linkedin.com/in/alxprince www.facebook.com/alejandro.prince](https://image.slidesharecdn.com/seminariocoreaargentinasep2009-100128174203-phpapp01/85/Seminario-CoreaArgentina-Sep09-27-320.jpg)