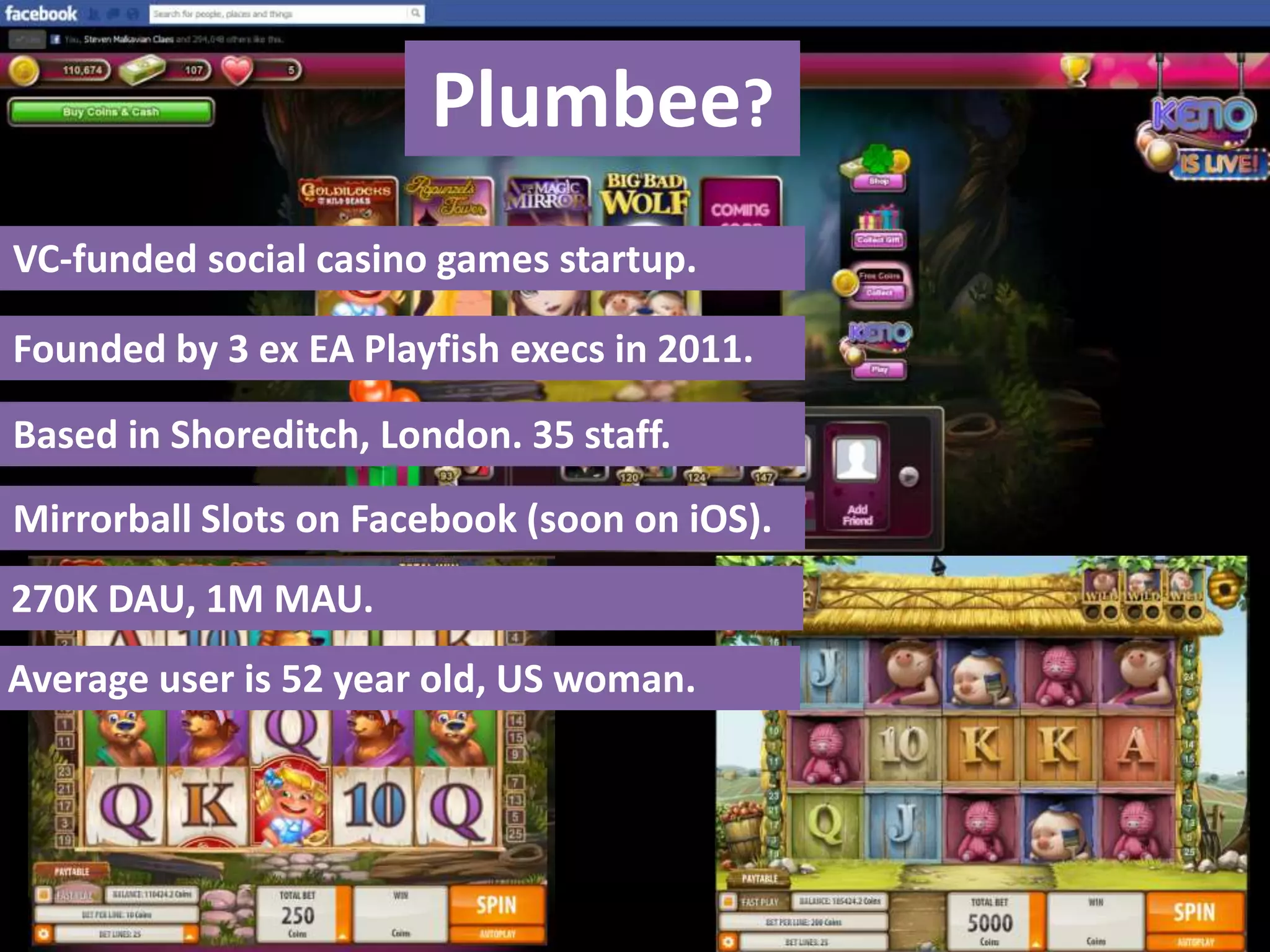

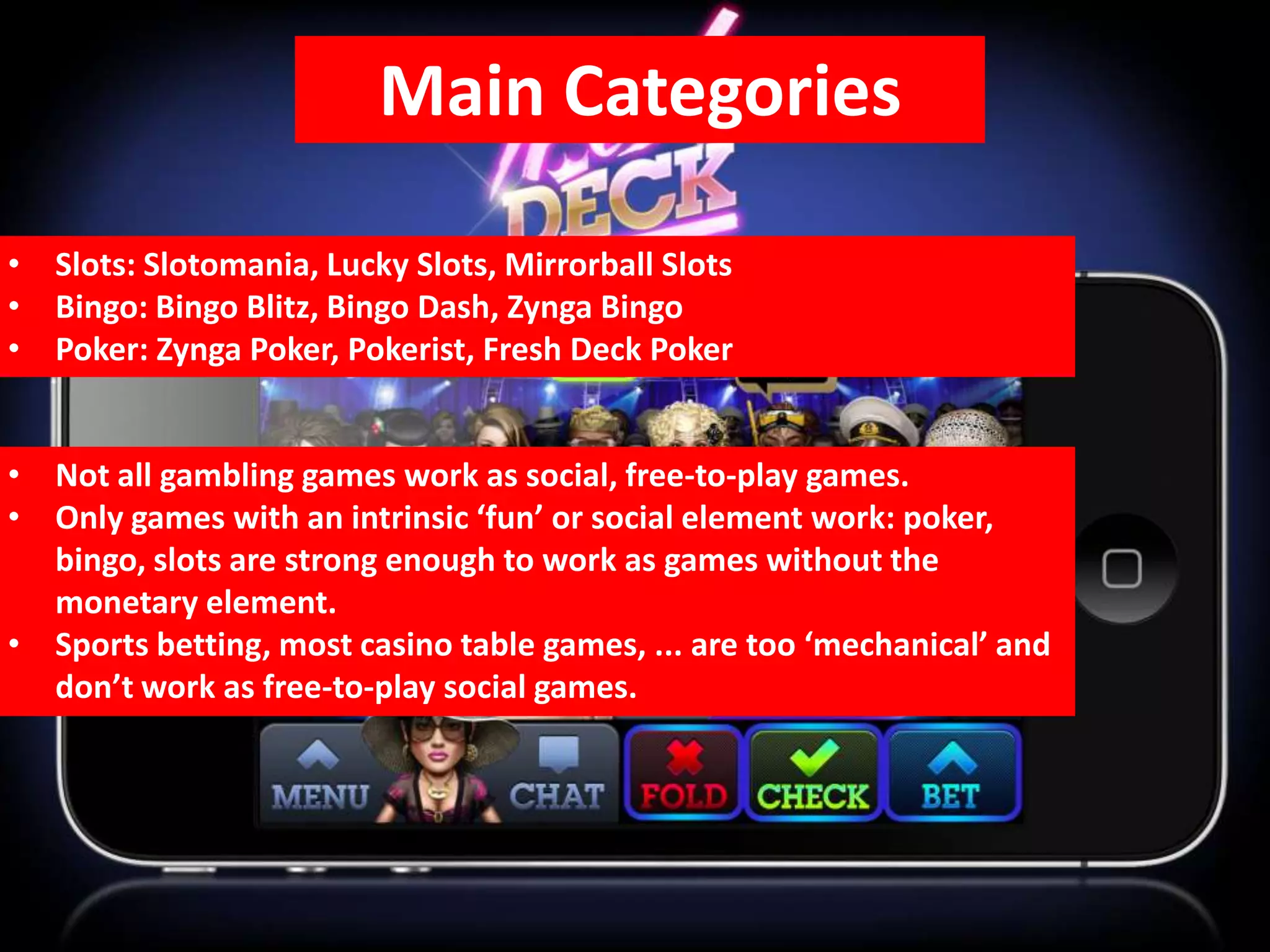

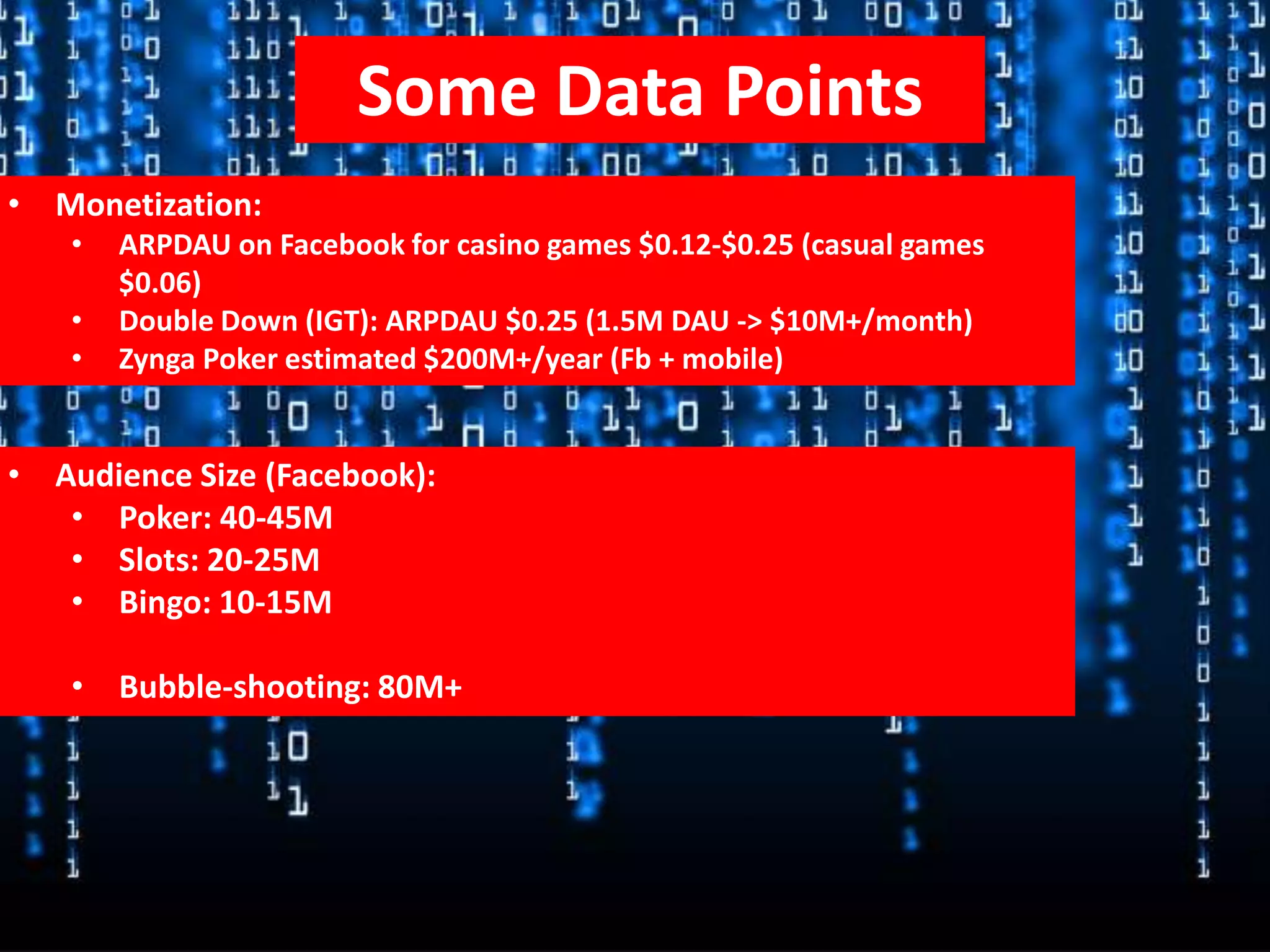

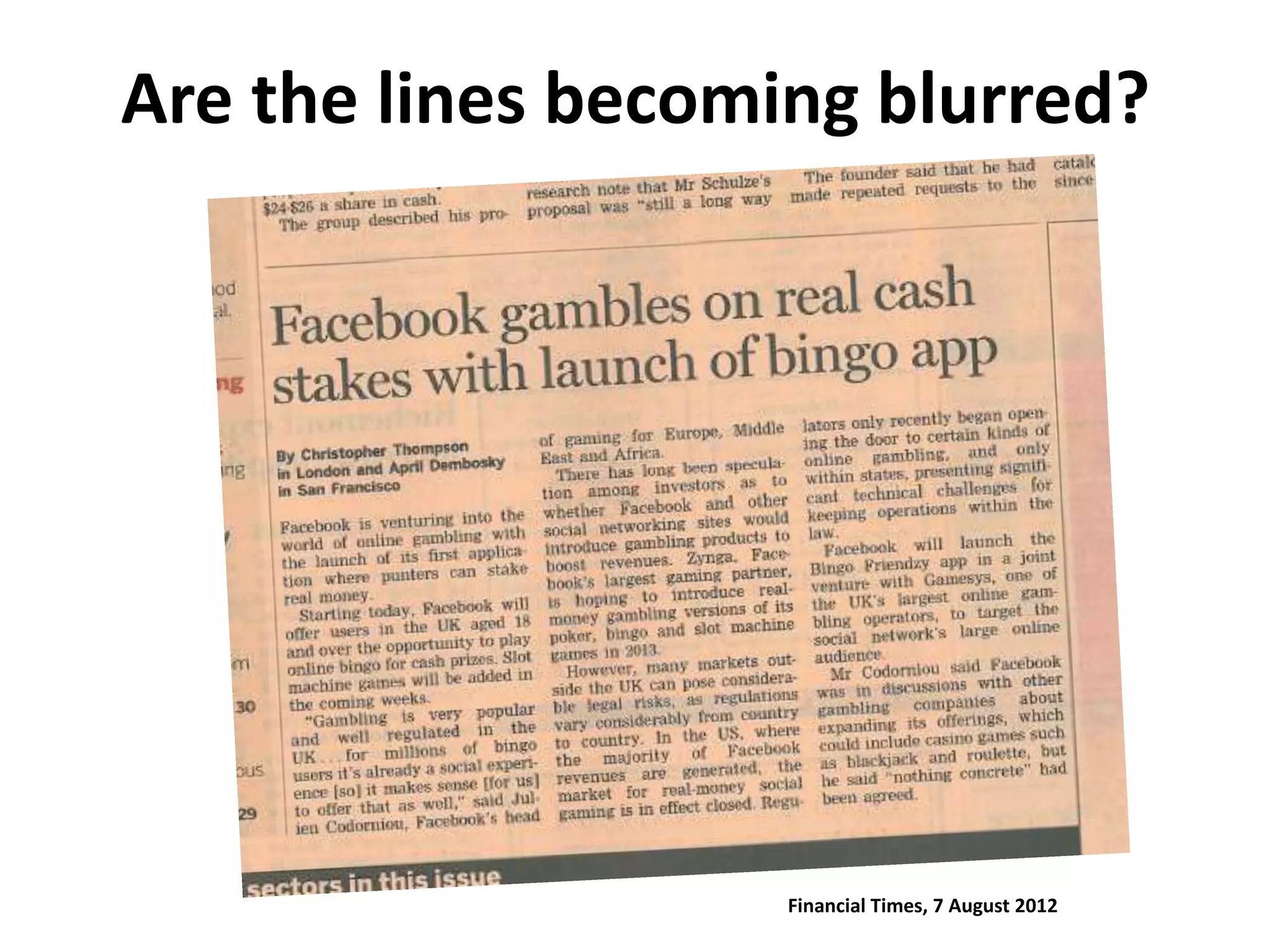

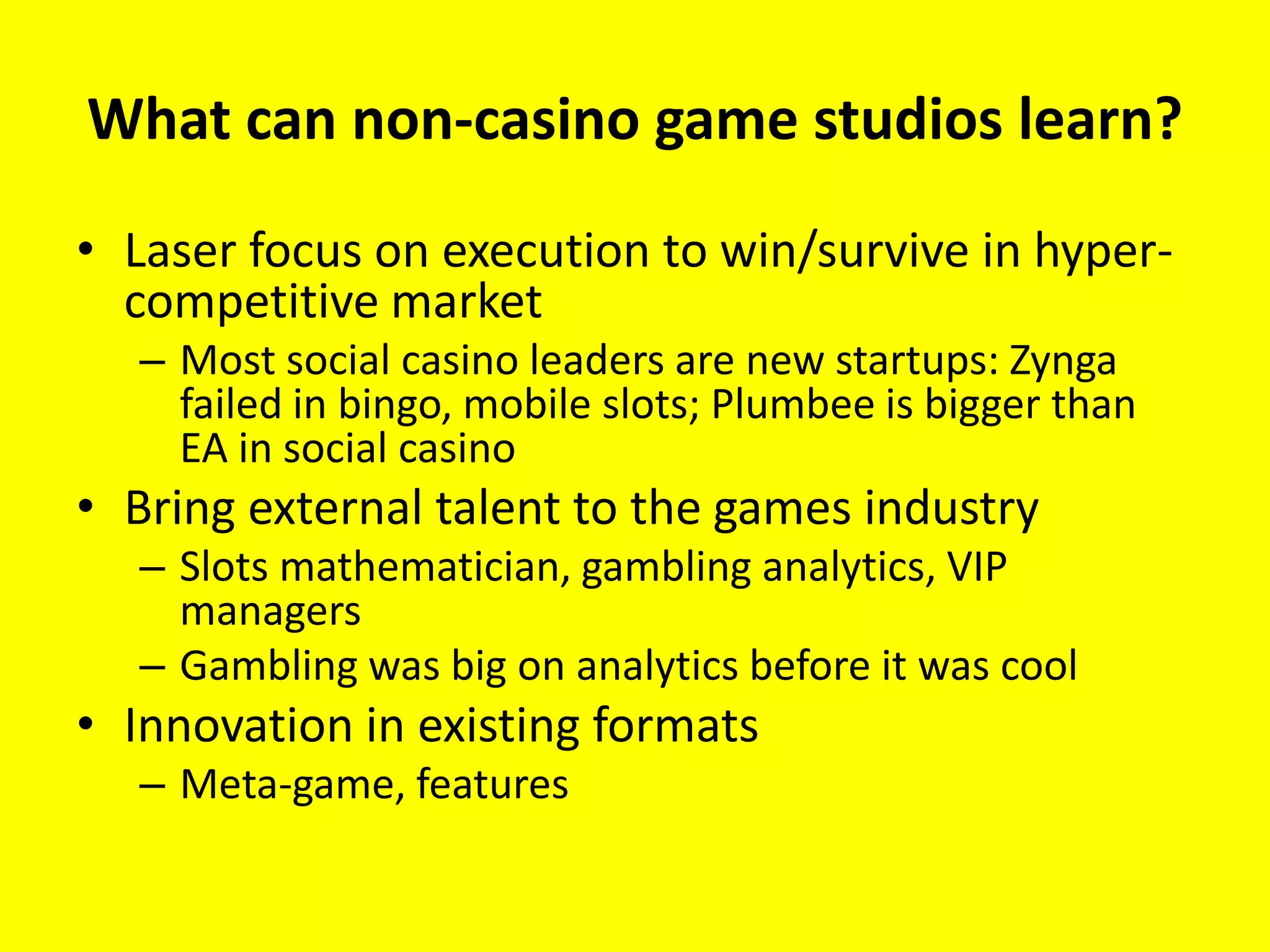

Plumbee is a VC-funded social casino games startup founded in 2011 by former EA Playfish executives and based in London, specializing in free-to-play gaming with significant user engagement. The document discusses the competitive landscape of social casino games, outlining market trends, monetization strategies, and the implications of mergers and acquisitions in the gambling industry. It emphasizes the need for innovation and audience engagement in a crowded space while distinguishing between free-to-play and real-money gambling games.