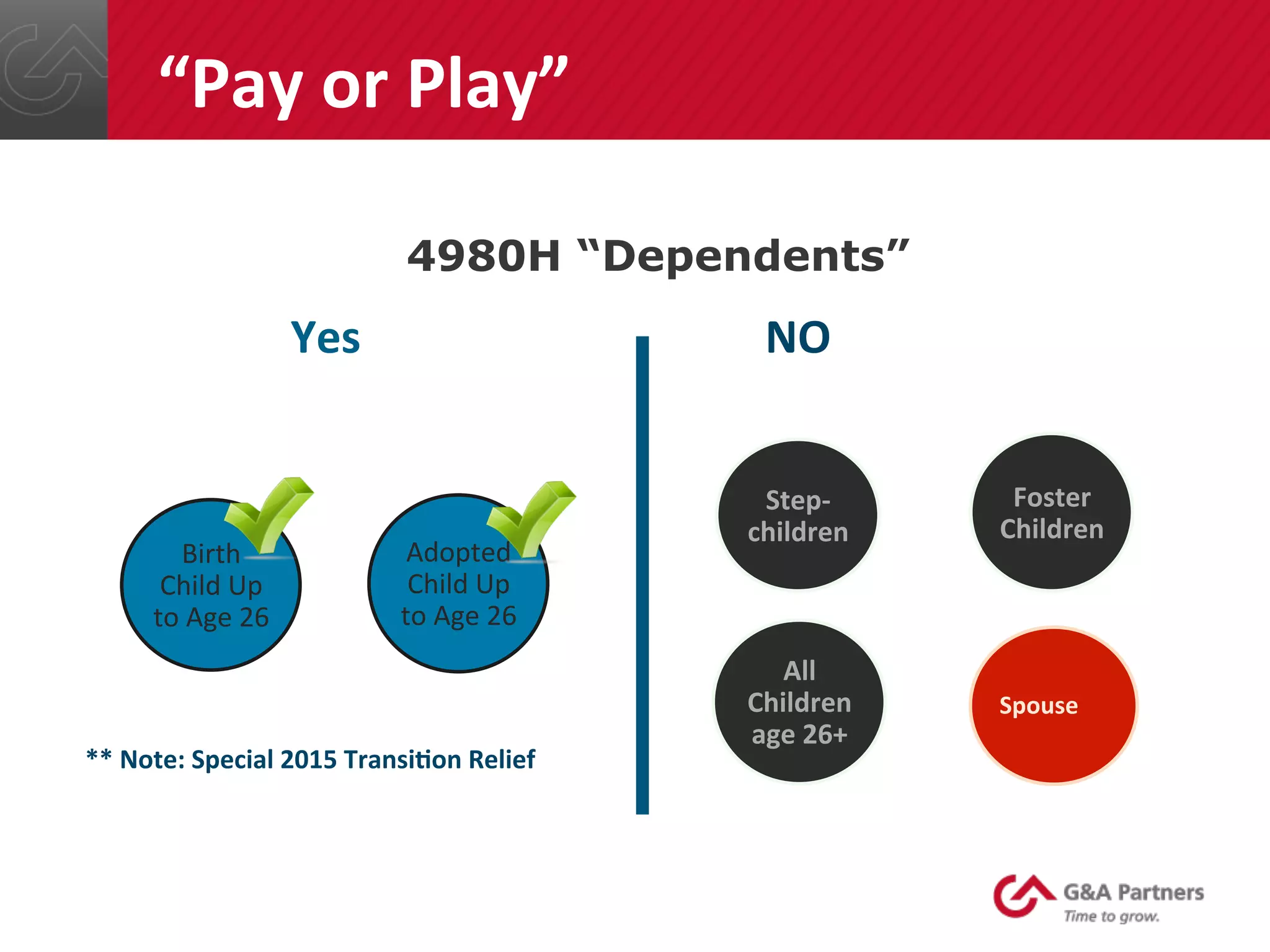

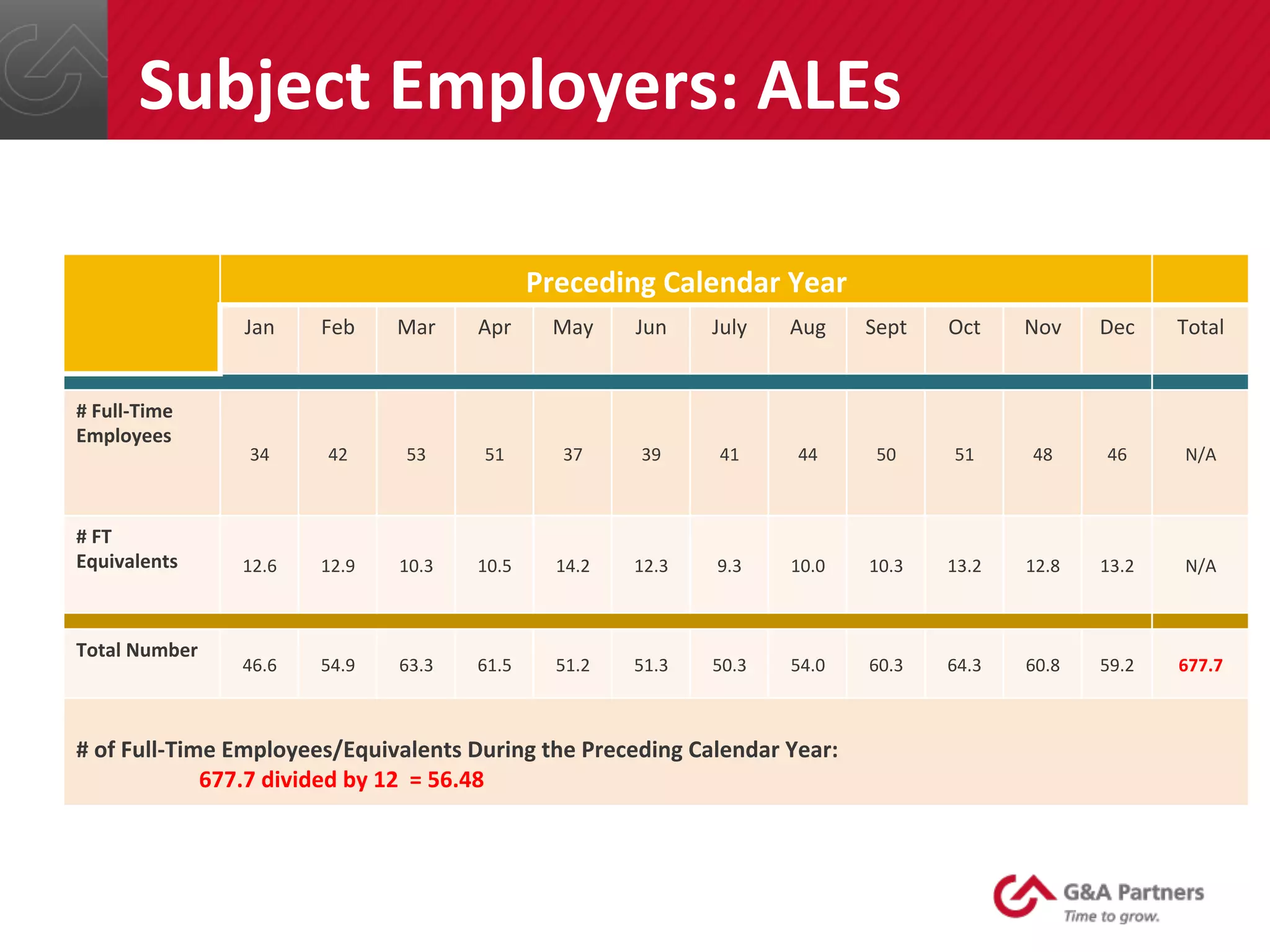

The document discusses how the Affordable Care Act, or ACA, will affect employers in 2014 and 2015. It covers the status of the individual mandate, details of the employer mandate including the "pay or play" provisions, and how to determine if an employer is an applicable large employer subject to the mandate. It provides an overview of key deadlines and guidelines for employers to determine their responsibilities and penalties under the ACA.