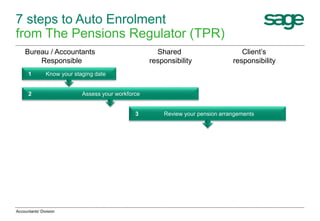

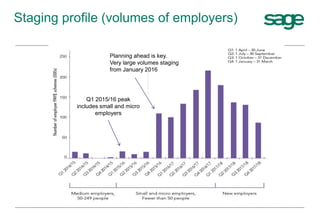

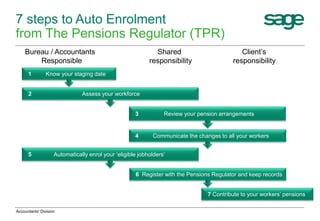

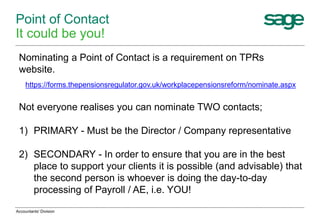

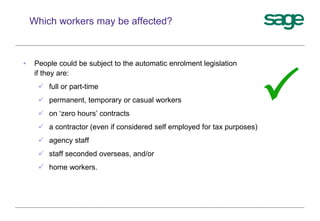

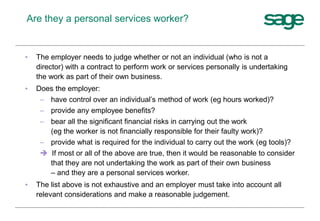

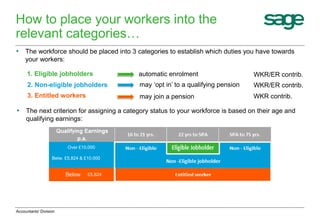

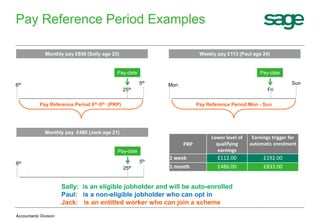

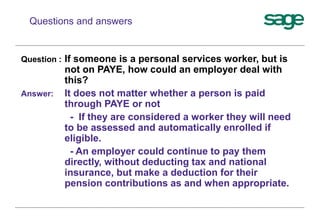

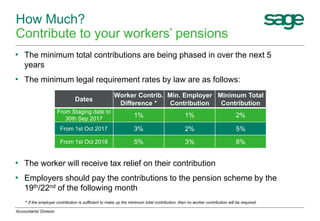

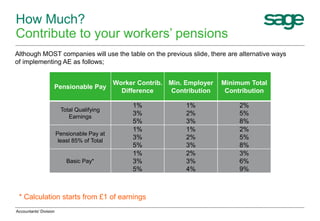

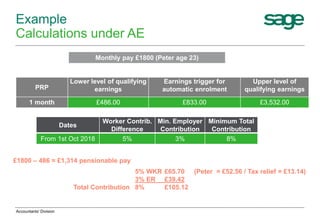

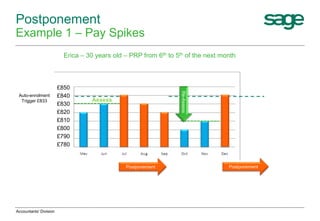

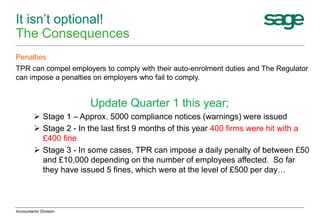

This document provides guidance for accountants and their clients on preparing for auto enrolment workplace pension reforms. It outlines the seven steps employers must take, including knowing their staging date, assessing their workforce, reviewing existing pension arrangements, communicating changes, automatically enrolling eligible workers, registering with the Pensions Regulator, and contributing to workers' pensions. It also discusses key considerations like minimum contribution rates, categorizing workers, dealing with personal services contractors, using postponements, opt outs and refunds, and the consequences of non-compliance, which can include fines. The presentation aims to help accountants support their clients in meeting their new auto enrolment duties.