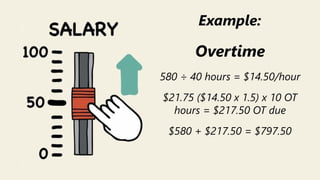

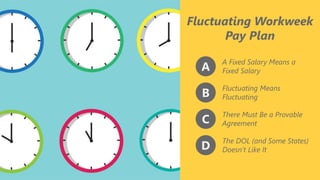

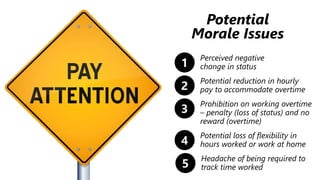

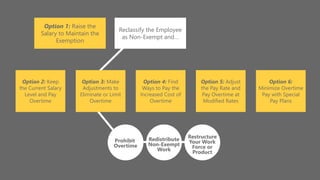

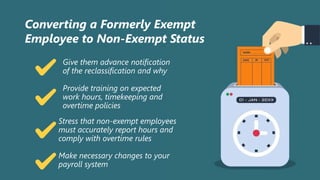

The document covers new overtime rules aimed at increasing eligibility for overtime pay, particularly highlighting changes to salary thresholds and exemption criteria under the Fair Labor Standards Act (FLSA). Effective December 1, 2016, the salary minimum for exemption will rise to $913 per week, with employers facing choices to comply, such as increasing salaries or limiting work hours. The document also discusses various compliance strategies and potential impacts on employee morale and workforce management.

![z

Salary Level

$455/wkcurrently[ ]](https://image.slidesharecdn.com/thenewovertimerules-howwillyoucomply-160708152048/85/The-New-Overtime-Rules-How-Will-You-Comply-17-320.jpg)

![z

Hourly Rate Conversion

FORMULA

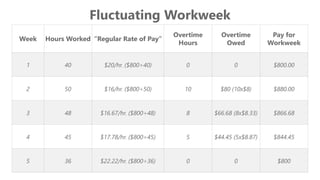

Hourly Rate = Salary ÷

[40+(OT hours x 1.5)]](https://image.slidesharecdn.com/thenewovertimerules-howwillyoucomply-160708152048/85/The-New-Overtime-Rules-How-Will-You-Comply-44-320.jpg)