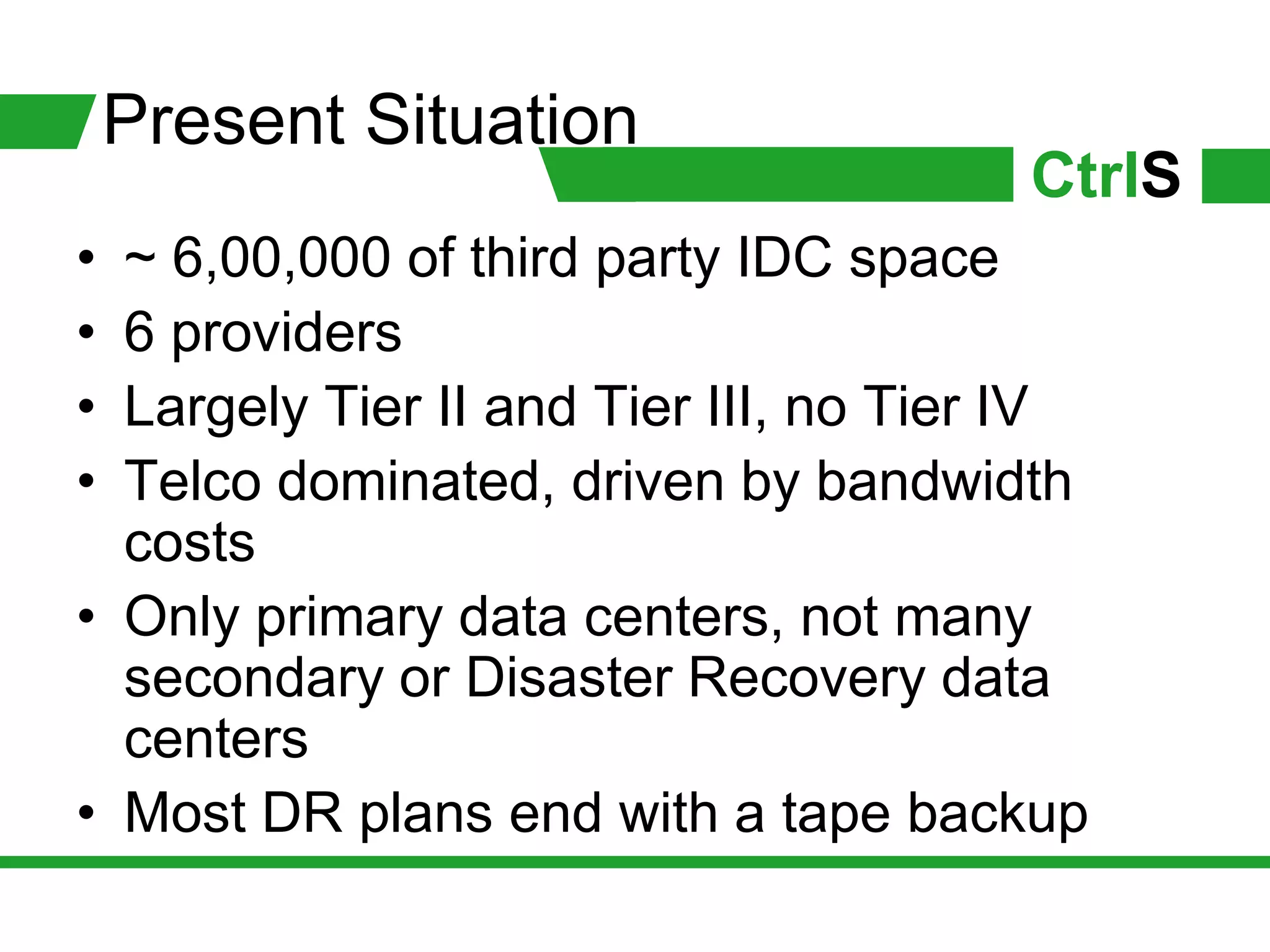

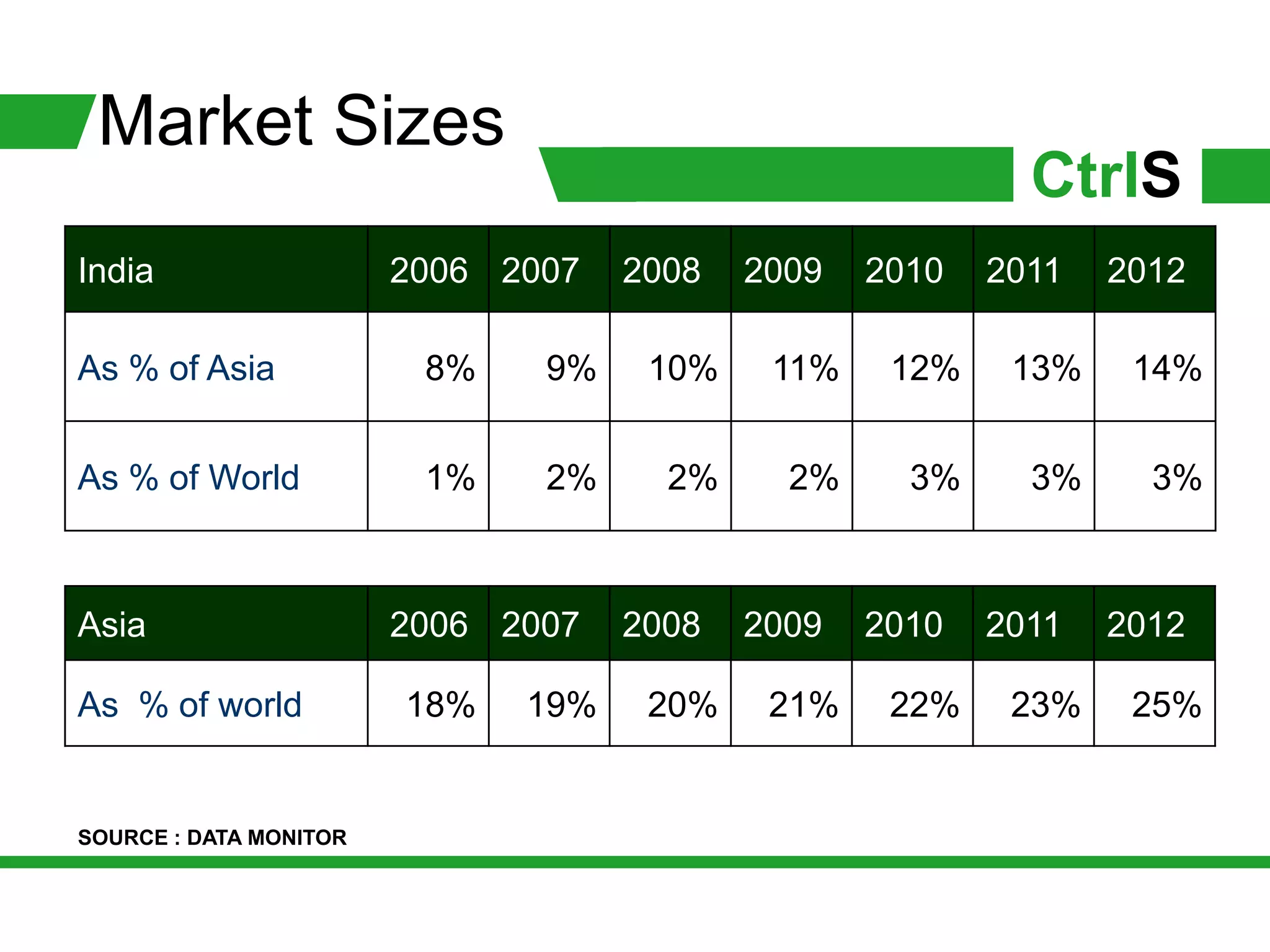

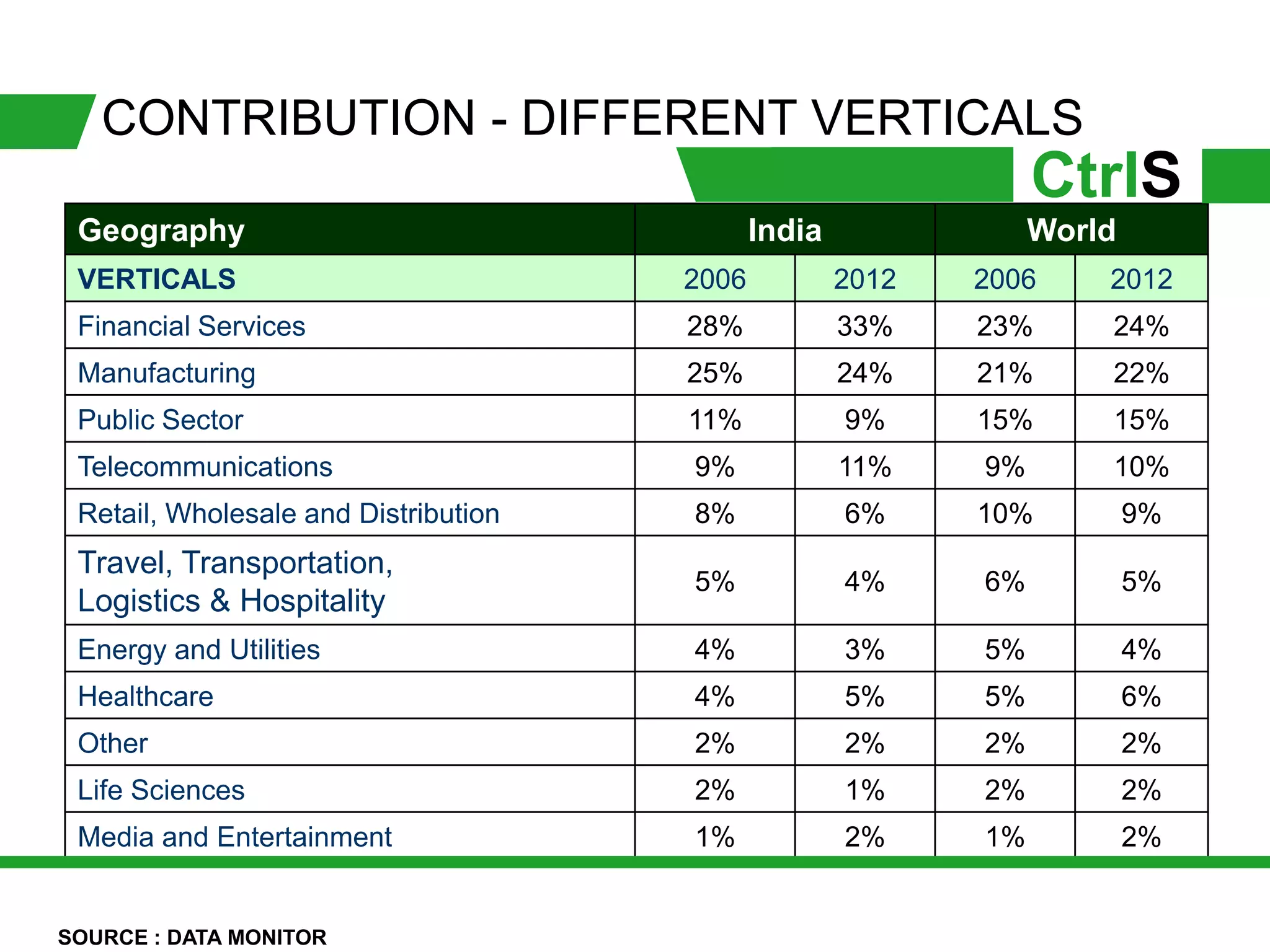

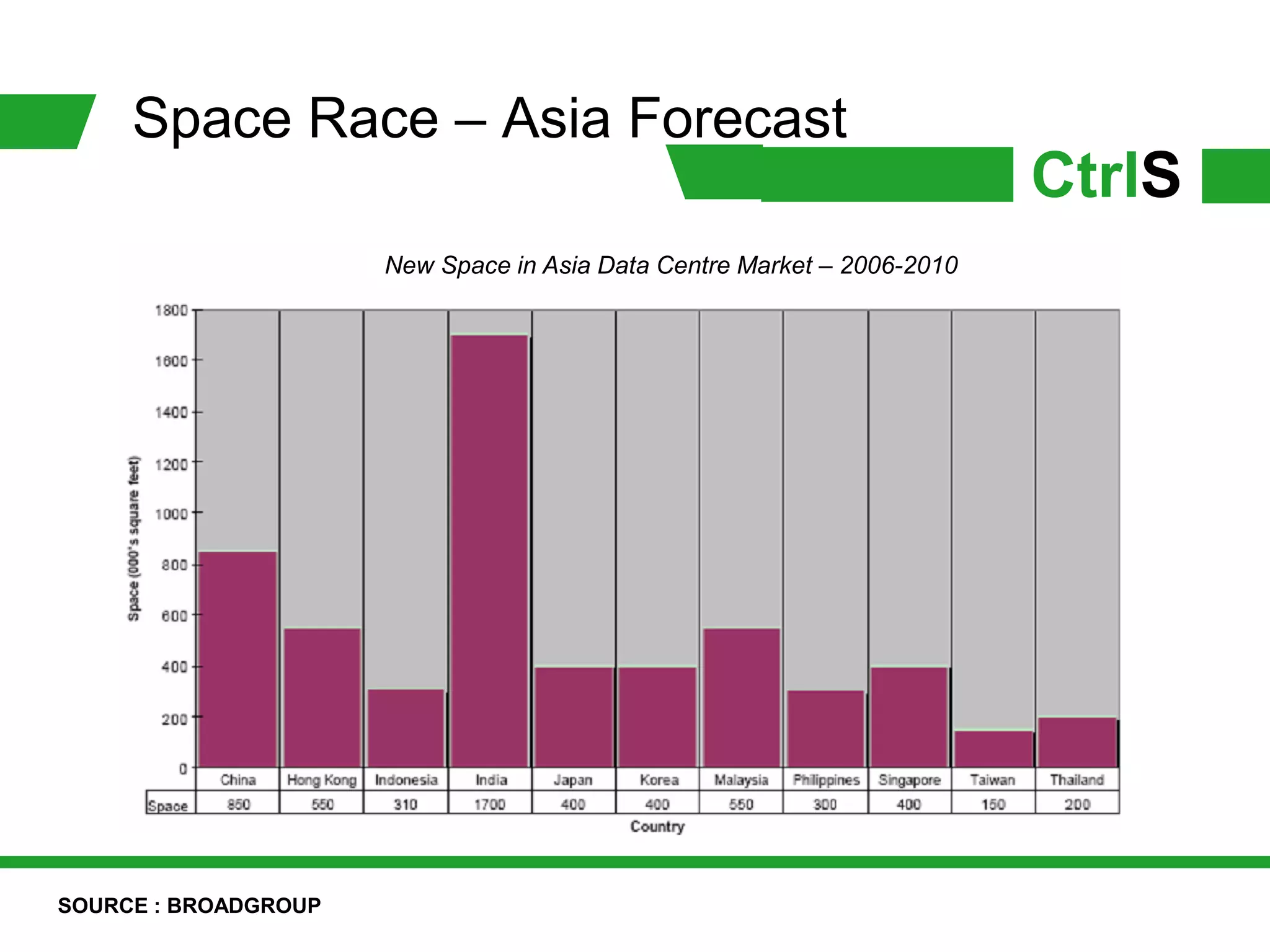

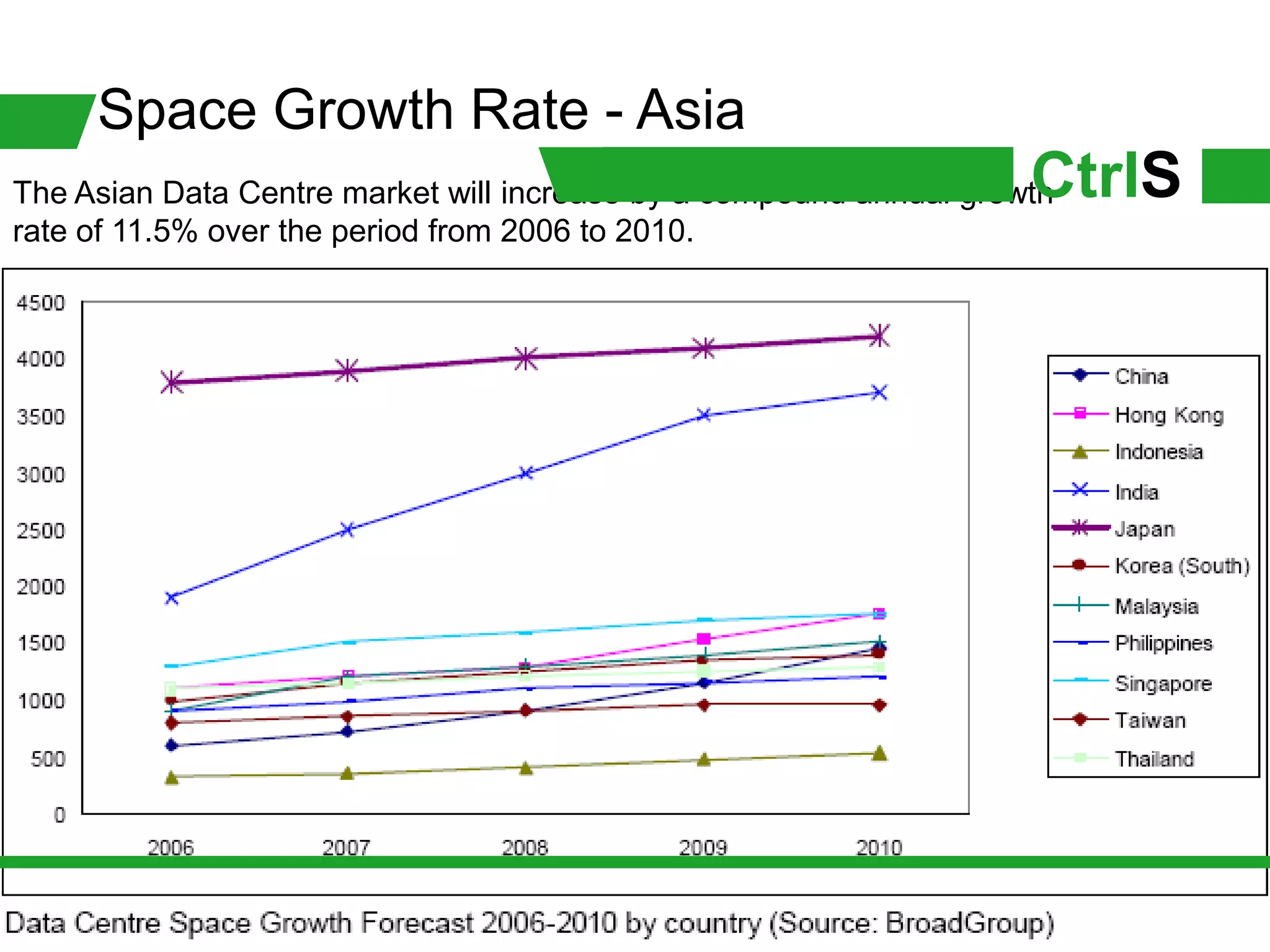

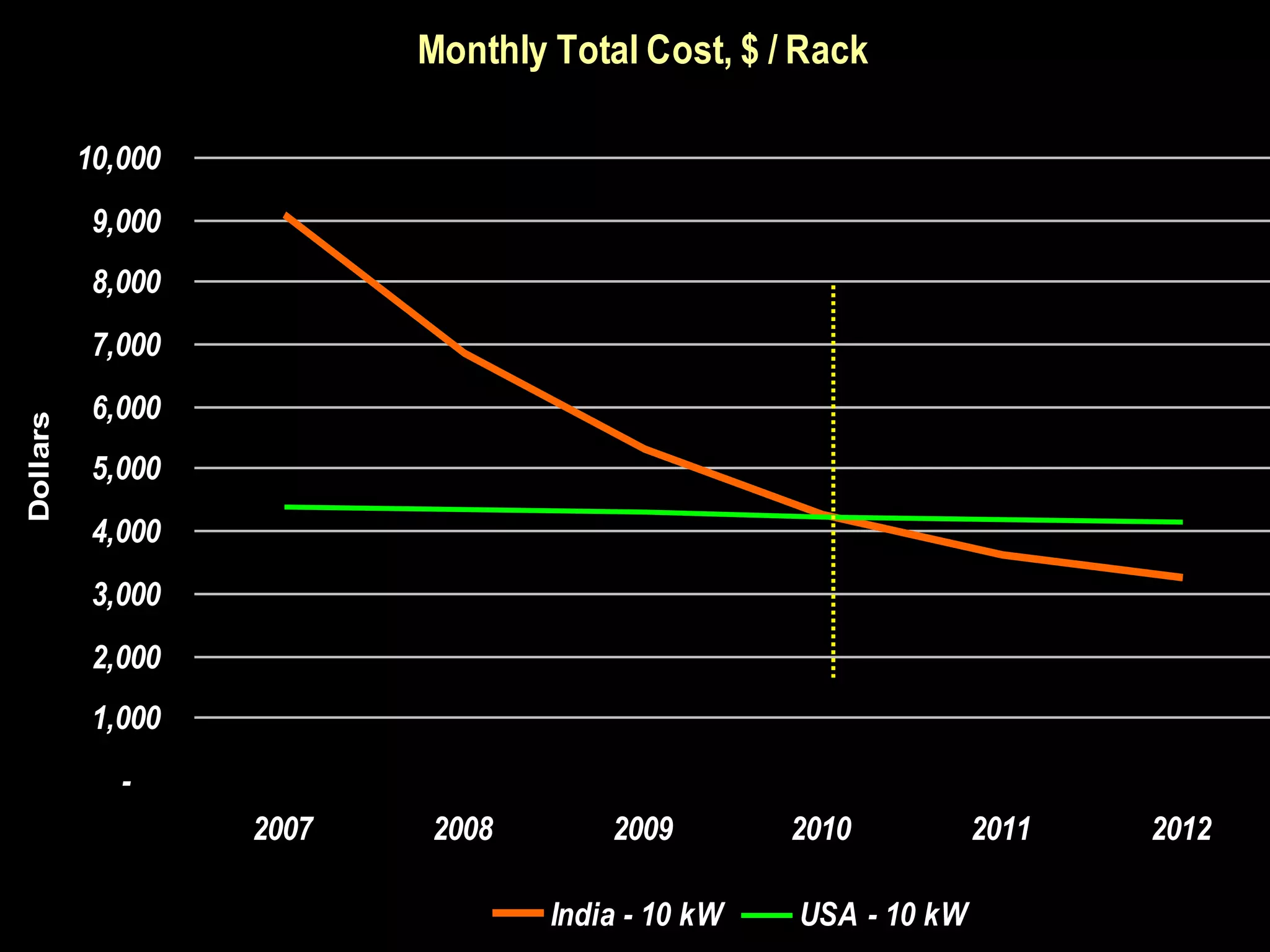

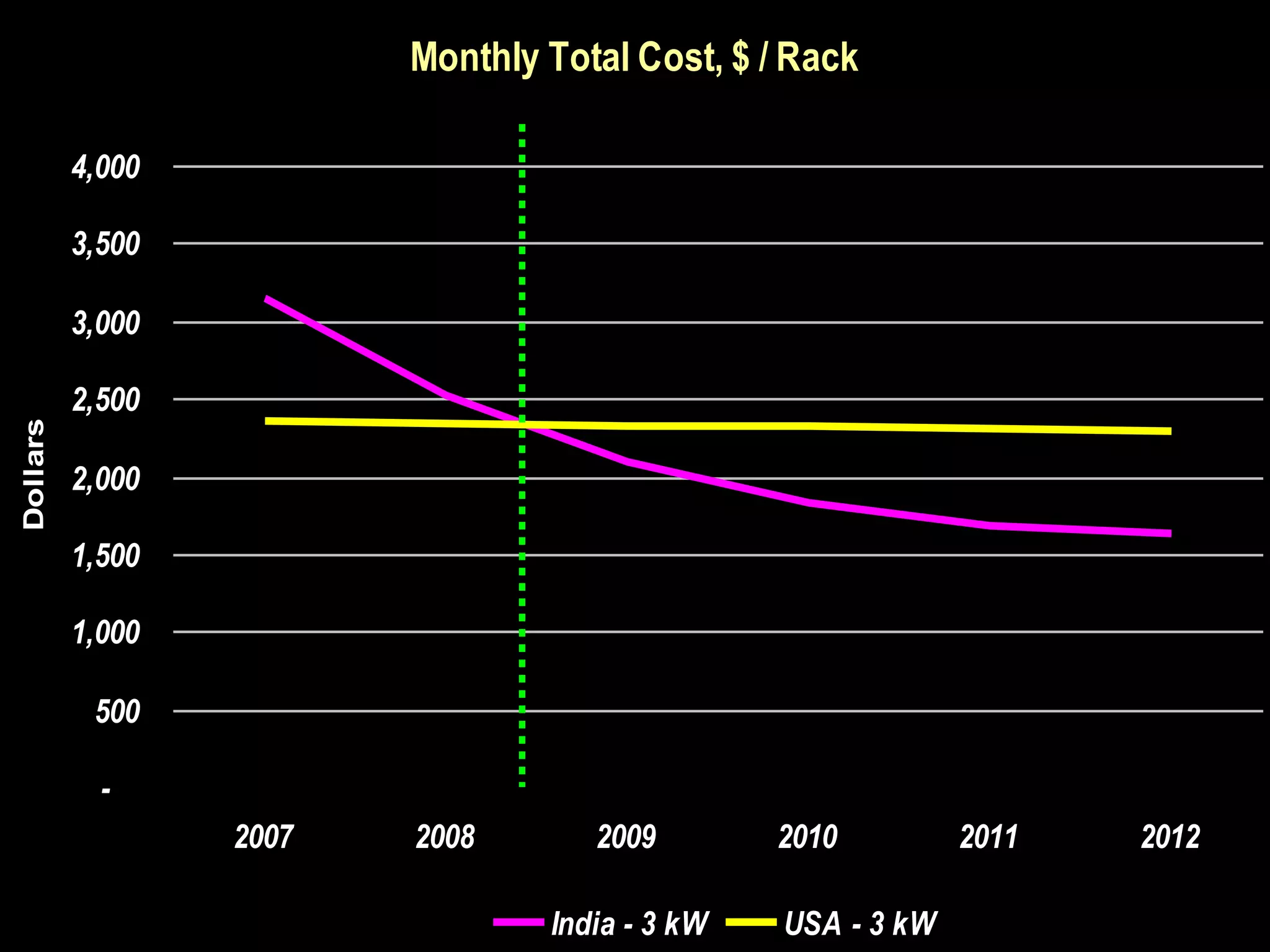

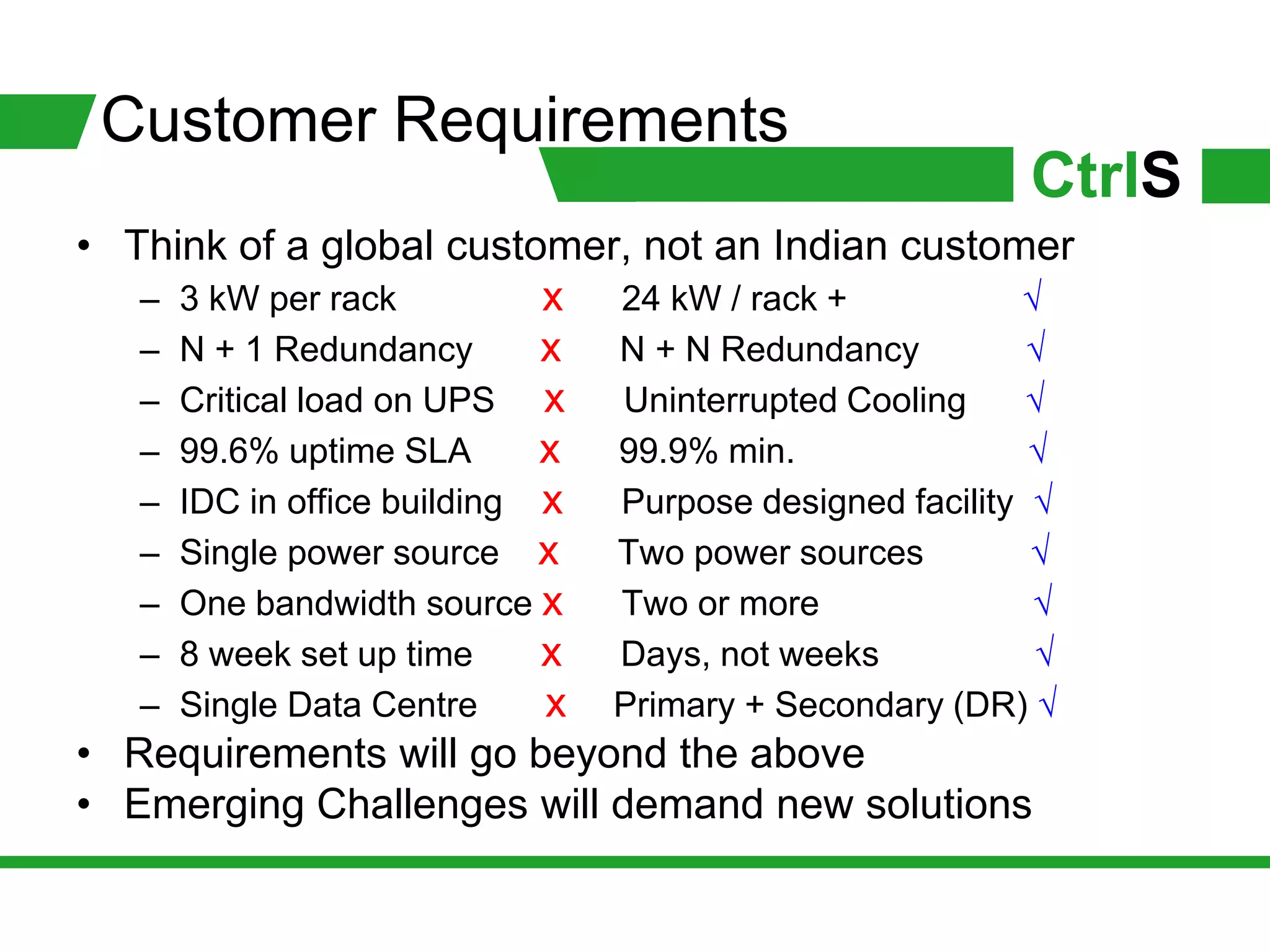

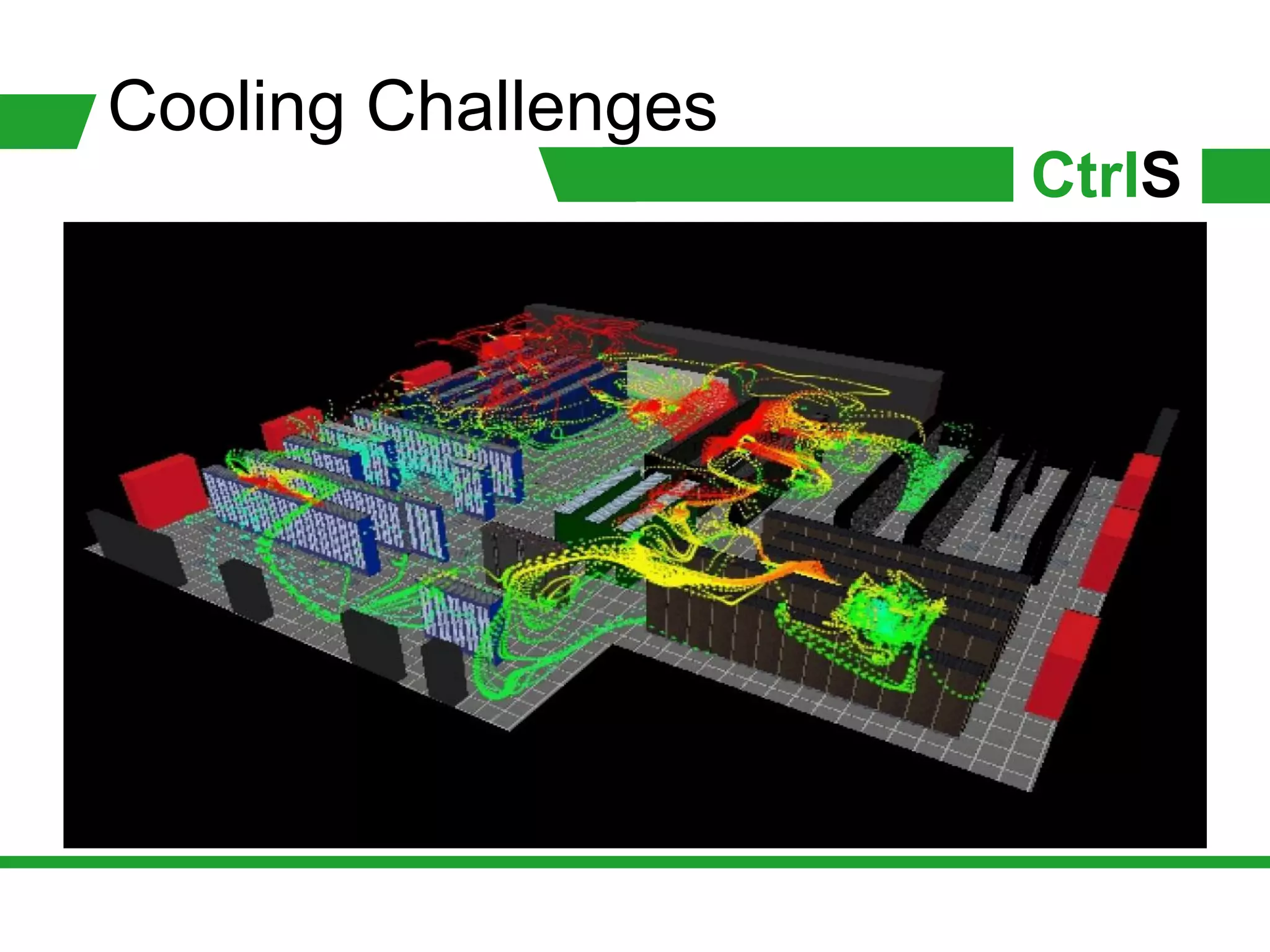

The document analyzes the future of data centers in India, highlighting current market conditions, growth forecasts, and customer demands. It indicates that India is poised to become a leading data center market, driven by decreasing bandwidth costs and increasing power density needs. The report emphasizes crucial requirements for infrastructure improvement and challenges, such as the necessity for dual power sources and robust disaster recovery plans, while projecting that Indian cities like Hyderabad and Bangalore will emerge as key disaster recovery hubs.